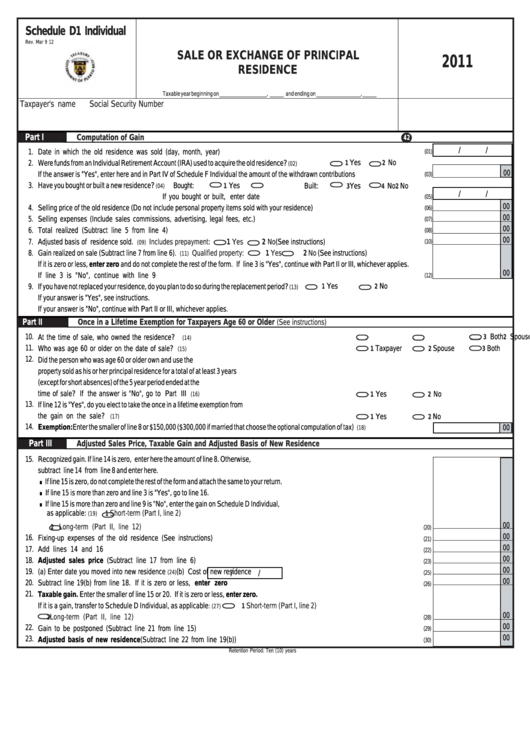

Schedule D1 Individual - Sale Or Exchange Of Principal Residence - 2011

ADVERTISEMENT

Schedule D1 Individual

Rev. Mar 9 12

SALE OR EXCHANGE OF PRINCIPAL

2011

RESIDENCE

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Computation of Gain

42

1.

Date in which the old residence was sold (day, month, year) ................................................................................................................

/

/

(01)

Yes

No

2.

Were funds from an Individual Retirement Account (IRA) used to acquire the old residence?

................

1

2

(02)

00

If the answer is "Yes", enter here and in Part IV of Schedule F Individual the amount of the withdrawn contributions ....................................

(03)

3.

Have you bought or built a new residence?

Bought:

Yes

No

Built:

Yes

No

1

2

3

4

(04)

/

/

If you bought or built, enter date ....................................................................................

(05)

00

4.

Selling price of the old residence (Do not include personal property items sold with your residence) .............................................................

(06)

00

5.

Selling expenses (Include sales commissions, advertising, legal fees, etc.) .............................................................................................

(07)

00

6.

Total realized (Subtract line 5 from line 4) .............................................................................................................................................

(08)

00

7.

Adjusted basis of residence sold.

Includes prepayment:

1 Yes

2 No

(See instructions) ....................................................

(10)

(09)

8.

Gain realized on sale (Subtract line 7 from line 6).

Qualified property:

1 Yes

2 No

(See instructions)

(11)

If it is zero or less, enter zero and do not complete the rest of the form. If line 3 is "Yes", continue with Part II or III, whichever applies.

00

If line 3 is "No", continue with line 9 .............................................................................................................................................

(12)

Yes

No

9.

If you have not replaced your residence, do you plan to do so during the replacement period?

1

2

(13)

If your answer is "Yes", see instructions.

If your answer is "No", continue with Part II or III, whichever applies.

Part II

Once in a Lifetime Exemption for Taxpayers Age 60 or Older

(See instructions)

10.

Taxpayer

Spouse

Both

At the time of sale, who owned the residence? .........................................................................................

1

2

3

(14)

11.

Taxpayer

Spouse

Both

Who was age 60 or older on the date of sale? ...........................................................................................

1

2

3

(15)

12.

Did the person who was age 60 or older own and use the

property sold as his or her principal residence for a total of at least 3 years

(except for short absences) of the 5 year period ended at the

time of sale? If the answer is "No", go to Part III ..................................................................................

Yes

No

(16)

1

2

13.

If line 12 is "Yes", do you elect to take the once in a lifetime exemption from

the gain on the sale? .................................................................................................................... .........

Yes

No

(17)

1

2

14.

Exemption: Enter the smaller of line 8 or $150,000 ($300,000 if married that choose the optional computation of tax) ....................................

00

(18)

Part III

Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Residence

15.

Recognized gain. If line 14 is zero, enter here the amount of line 8. Otherwise,

.

subtract line 14 from line 8 and enter here.

.

If line 15 is zero, do not complete the rest of the form and attach the same to your return.

.

If line 15 is more than zero and line 3 is "Yes", go to line 16.

If line 15 is more than zero and line 9 is "No", enter the gain on Schedule D Individual,

as applicable:

Short-term (Part I, line 2)

1

(19)

......

00

Long-term (Part II, line 12)

..............................................................................................................................................

2

(20)

00

16.

Fixing-up expenses of the old residence (See instructions) ...................................................................................................................

(21)

00

17.

Add lines 14 and 16 ........................................................................................................................................................................

(22)

00

18.

Adjusted sales price (Subtract line 17 from line 6) .............................................................................................................................

(23)

00

19.

(a) Enter date you moved into new residence

................

(b) Cost of new residence ..................................

(24)

(25)

/

/

00

20.

Subtract line 19(b) from line 18. If it is zero or less, enter zero ...........................................................................................................

(26)

21.

Taxable gain. Enter the smaller of line 15 or 20. If it is zero or less, enter zero.

If it is a gain, transfer to Schedule D Individual, as applicable

Short-term (Part I, line 2)

:

1

(27)

00

Long-term (Part II, line 12) ...................................................................................................................................................

2

(28)

00

22.

Gain to be postponed (Subtract line 21 from line 15) .............................................................................................................................

(29)

00

23.

Adjusted basis of new residence (Subtract line 22 from line 19(b)) .....................................................................................................

(30)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1