Business Tax Return - City Of Forest Park - 2006 Page 2

ADVERTISEMENT

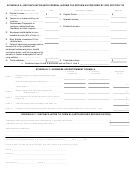

SCHEDULE X—RECONCILIATION WITH FEDERAL INCOME TAX RETURN AS PROVIDED BY ORC SECTION 718

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

A. Capital Losses

(Sec 1221 or 1231

$

H. Capital Gains……………………………………..

$

included)……………………………………..

B. Taxes on or measured by net

I.

Interest income …………………………………..

Income……………………………..

C. Guaranteed Payments to

J. Dividend income ………………………………….

partners, retired partners,

members or other owners……….

D. Expenses attributable to non-

taxable income (5% of Line I.)….

………………………………………………………….

E. Real Estate Investment Trust

distributions……………………….

…………………………………………………………..

F. Federal deducted amounts paid or

accrued to or for qualified self-

employed retirement plans, health

………………………………………………………….

insurance plans, and life insurance for

owners or owner-employees of non-C

corp entities. ………………………..

G. Total additions……………………..

$

K. Total deductions………………………………….

$

L. Combine Lines G and K and enter net on Part A, Line 2 ________________________

SCHEDULE Y—BUSINESS APPORTIONMENT FORMULA

a. Located

b. Located in

Percentage

Everywhere

Forest Park

(b / a)

Original average cost of real and tangible personal

STEP 1.

property…………………………………………………………..

Gross annual rentals paid multiplied by 8………………….…

%

TOTAL STEP 1…………………………………………………..

Wages, salaries, and other compensation paid

STEP 2.

%

*See Schedule Y-1…………………………………..

Gross receipts from sales made and/or work or services

STEP 3.

%

performed…………………………………………………………

STEP 4.

Total percentages (Add percentages from Steps 1-3)

%

STEP 5.

Average percentage (Divide total percentage (Step 4) by number of percentages used—Carry to Part A, Line 4)

%

*SCHEDULE Y-1 RECONCILIATION TO FORM W-3 (WITHHOLDING RECONCILIATION)

Total wages allocated to Forest Park (from Federal Return or apportionment formula)……………………………………………………

$

Total wages shown on Form W-3 (Withholding Reconciliation)………………………………………………………………………………

$

Please explain any difference:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Are there any employees leased in the year covered by this return? ______YES ______ NO

If YES, please provide the name, address and FID number of the leasing company.

Name:__________________________________________________

Address: ________________________________________________

________________________________________________

FID Number:__________________ Phone #____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3