City Income Tax Return For Individuals Page 2

ADVERTISEMENT

Primary

Name(s) as shown on Page 1

Social Security Number

-I

Non-Wage Income

C

Column O

Column P

Column S

Column Q

Column R

O

OTHER INCOME FROM FEDERAL

CITY

TOTAL OTHER INCOME (OR LOSS)

INCOME (OR LOSS) FROM FEDERAL

RENTAL INCOME (OR LOSS) FROM

D

PARTNERSHIP K-1 - ATTACHED

IF GREATER THAN ZERO, CARRY TO PAGE 1,

FEDERAL SCHEDULE E OR

SCHEDULE C AND/OR F - ATTACHED

E

SCHEDULE Y - ATTACHED

COLUMN C.

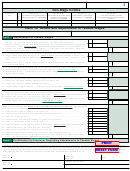

Claim for Refund and Adjustments to Taxable Wages

Reason for Adjustment (Explain fully)

Resident Address for this period

Adjustments to Taxable Wages

Part 1

1. If you are claiming employee expenses from Federal Form 2106, enter your total wages from that

1

job here. Do not include wages included on Lines 14 or 23 below. See instructions.........................

2. Employee business expenses from Federal Form 2106. Do not include 2106 expenses reported on

2

Lines 15 or 24 below. Attach a copy of the 2106 and Federal Schedule A. See instructions..........

3. Subtract Line 2 from 1. If less than zero, enter zero. List this figure in Part A of Page 1 along with

3

any other taxable wages you or your spouse earned.................................................................................................................

4. If you were under the age of 18 for all or part of the year, enter your total wages for the year.........

4

5. Wages earned while under the age of 18. Attach a copy of your birth certificate, a copy of your

driver’s license or a notarized statement from either parent stating your birthday. Enter date of birth

5

here: _________________________..................................................................................................

6. Subtract Line 5 from 4. List this figure in Part A of Page 1 along with any other taxable wages you

6

or your spouse earned..................................................................................................................................................................

7

7. If city tax was improperly withheld from your wages, enter your total wages from that employer ....

8. Income upon which tax was improperly withheld by employer.

Complete Part 2

below................

8

9. Subtract Line 8 from 7. List this figure in Part A of Page 1 along with any other taxable wages you

or your spouse earned ..................................................................................................................................................................

9

10

10. If city tax was improperly withheld from your wages, enter your total wages from that employer ....

11. Income from short-term disability withheld by employer after 7/1/07 ...................................................

11

12. Income from long-term disability withheld by employer .........................................................................

12

13. Subtract Lines 11 and 12 from 10. List this figure in Part A of Page 1.

Complete Part 2

below..............................................

13

14. If you were a nonresident railroad employee or nonresident over-the-road truck driver assigned

14

duties only within Ohio, enter your total railroad or driving wages here...............................................

15. Enter the amount of 2106 expenses related to this income. Attach a copy of the 2106 & Fed Sch A

15

16. Subtract Line 15 from 14. If less than zero, enter zero........................................................................

16

17. Multiply the amount of Line 16 by 10% (.10). List this figure in Part A of Page 1 along with any other

taxable wages you or your spouse earned.

Complete Part 2

below.......................................................................................

17

If you were a nonresident employee who worked part of the year outside the city for which your employer withheld city tax

complete Lines 18 through 28. Attach a list of the dates and locations worked out. See instructions.

18. Enter the total number of vacation days taken during the entire year...................................................

18

19. Enter the total number of holidays for the entire year...........................................................................

19

20. Enter the total number of sick leave days taken during the entire year.................................................

20

21. Add Lines 18 through 20.......................................................................................................................

21

22. Subtract line 21 from 260 (total workdays in a year) (see instructions) ..............................................

22

23

23. Enter your total wages for this job for the year.....................................................................................

24

24. Enter the amount of 2106 expenses related to this income. Attach a copy of the 2106 & Fed Sch A

25

25. Subtract Line 24 from 23. If less than zero, enter zero........................................................................

26

26. Divide Line 25 by the number of days shown on Line 22.....................................................................

27

27. Enter the number of days worked in the city (Line 22 less total days worked out)..............................

28. Multiply Line 26 by Line 27. List this figure in Part A of Page 1 along with any other taxable wages

28

you or your spouse earned.

Complete Part 2

below................................................................................................................

Certification by Employer Regarding Adjustments to Taxable Wages

Part 2

PRINT

Employer certification is required to claim adjustments on Lines 7 through 28 above. Your request for refund will not be considered valid without a

completed employer certification. A separate certification is required for each job for which you are claiming adjustments on Lines 7 through 28 above.

I/We certify that the employee referenced on this form was employed by the undersigned during the year referenced on this tax return; that the employee was

RESET FORM

either not working inside the corporate limits of the city or city tax was improperly withheld; that no portion of the tax withheld has been or will be refunded

to the employee; and that no adjustment has been or will be made in remitting taxes withheld to the city.

Name of

Employer’s

Date

Employer

(

)

Phone No.

Official’s Name Printed

Official’s

Signature

Title

Rev. 10/12/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3