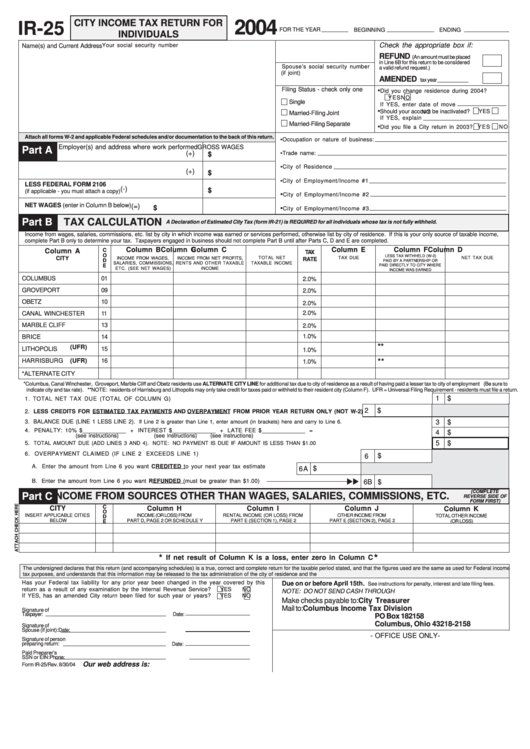

CITY INCOME TAX RETURN FOR

2004

IR-25

FOR THE YEAR

BEGINNING

ENDING

INDIVIDUALS

Check the appropriate box if:

Your social security number

Name(s) and Current Address

REFUND

(An amount must be placed

in Line 6B for this return to be considered

Spouse’s social security number

a valid refund request.)

(if joint)

AMENDED

tax year

Filing Status - check only one

•

Did you change residence during 2004?

YES

N O

Single

If YES, enter date of move

•

Should your account be inactivated?

YES

N O

Married-Filing Joint

If YES, explain

Married-Filing Separate

•

Did you file a City return in 2003?

YES

N O

Attach all forms W-2 and applicable Federal schedules and/or documentation to the back of this return.

•Occupation or nature of business:

Employer(s) and address where work performed

GROSS WAGES

Part A

(+)

•Trade name:

$

•City of Residence

(+)

$

•City of Employment/Income #1

LESS FEDERAL FORM 2106

(-)

$

(if applicable - you must attach a copy)

•

City of Employment/Income #2

NET WAGES (enter in Column B below)

(=)

$

•

City of Employment/Income #3

Part B

TAX CALCULATION

A Declaration of Estimated City Tax (form IR-21) is REQUIRED for all individuals whose tax is not fully withheld.

Income from wages, salaries, commissions, etc. list by city in which income was earned or services performed, otherwise list by city of residence. If this is your only source of taxable income,

complete Part B only to determine your tax. Taxpayers engaged in business should not complete Part B until after Parts C, D and E are completed.

Column B

Column C

Column D

Column E

Column F

Column G

Column A

C

TAX

O

LESS TAX WITHHELD (W-2)

CITY

INCOME FROM WAGES,

INCOME FROM NET PROFITS,

TOTAL NET

TAX DUE

NET TAX DUE

RATE

D

PAID BY A PARTNERSHIP OR

TAXABLE INCOME

SALARIES, COMMISSIONS,

RENTS AND OTHER TAXABLE

E

PAID DIRECTLY TO CITY WHERE

ETC. (SEE NET WAGES)

INCOME

INCOME WAS EARNED

COLUMBUS

01

2.0%

GROVEPORT

09

2.0%

OBETZ

10

2.0%

2.0%

CANAL WINCHESTER

11

MARBLE CLIFF

13

2.0%

1.0%

BRICE

14

**

(UFR)

LITHOPOLIS

15

1.0%

HARRISBURG

(UFR)

16

**

1.0%

*ALTERNATE CITY

*Columbus, Canal Winchester, Groveport, Marble Cliff and Obetz residents use ALTERNATE CITY LINE for additional tax due to city of residence as a result of having paid a lesser tax to city of employment (Be sure to

indicate city and tax rate). **NOTE: residents of Harrisburg and Lithopolis may only take credit for taxes paid or withheld to their resident city (Column F). UFR = Universal Filing Requirement - residents must file a return.

1

$

1. TOTAL NET TAX DUE (TOTAL OF COLUMN G)........................................................................................................................................

2

$

2. LESS CREDITS FOR ESTIMATED TAX PAYMENTS AND OVERPAYMENT FROM PRIOR YEAR RETURN ONLY (NOT W-2)

3

$

3. BALANCE DUE (LINE 1 LESS LINE 2).

If Line 2 is greater than Line 1, enter amount (in brackets) here and carry to Line 6.

...................................................

4. PENALTY: 10% $_____________ + INTEREST $_____________ + LATE FEE $_____________ = ...........................................................

4

$

(see instructions)

(see instructions)

(see instructions)

5

$

5.

TOTAL AMOUNT DUE (ADD LINES 3 AND 4). NOTE: NO PAYMENT IS DUE IF AMOUNT IS LESS THAN $1.00

....................................................................

6. OVERPAYMENT CLAIMED (IF LINE 2 EXCEEDS LINE 1) .................................................................................

$

6

A. Enter the amount from Line 6 you want CREDITED to your next year tax estimate..............

$

6A

B. Enter the amount from Line 6 you want REFUNDED (must be greater than $1.00)

6B

$

(COMPLETE

Part C

INCOME FROM SOURCES OTHER THAN WAGES, SALARIES, COMMISSIONS, ETC.

REVERSE SIDE OF

FORM FIRST)

C

CITY

Column H

Column I

Column J

B

Column K

O

INSERT APPLICABLE CITIES

INCOME (OR LOSS) FROM

RENTAL INCOME (OR LOSS) FROM

OTHER INCOME FROM

TOTAL OTHER INCOME

D

BELOW

PART D, PAGE 2 OR SCHEDULE Y

PART E (SECTION 1), PAGE 2

PART E (SECTION 2), PAGE 2

E

(OR LOSS)

If net result of Column K is a loss, enter zero in Column C

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated, and that the figures used are the same as used for Federal income

tax purposes, and understands that this information may be released to the tax administration of the city of residence and the I.R.S.

Has your Federal tax liability for any prior year been changed in the year covered by this

Due on or before April 15th.

See instructions for penalty, interest and late filing fees.

return as a result of any examination by the Internal Revenue Service?

YES

NO

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL.

If YES, has an amended City return been filed for such year or years?

YES

NO

Make checks payable to:

City Treasurer

Mail to:

Columbus Income Tax Division

Signature of

Date:

Taxpayer:

PO Box 182158

Columbus, Ohio 43218-2158

Signature of

Spouse (if joint):

Date:

- OFFICE USE ONLY-

Signature of person

preparing return:

Date:

Paid Preparer’s

SSN or EIN:

Phone:

Our web address is:

Form IR-25/Rev. 8/30/04

1

1 2

2 3

3