2006 Business Privilege Tax - Ez - City Of Philadelphia

ADVERTISEMENT

City Account Number

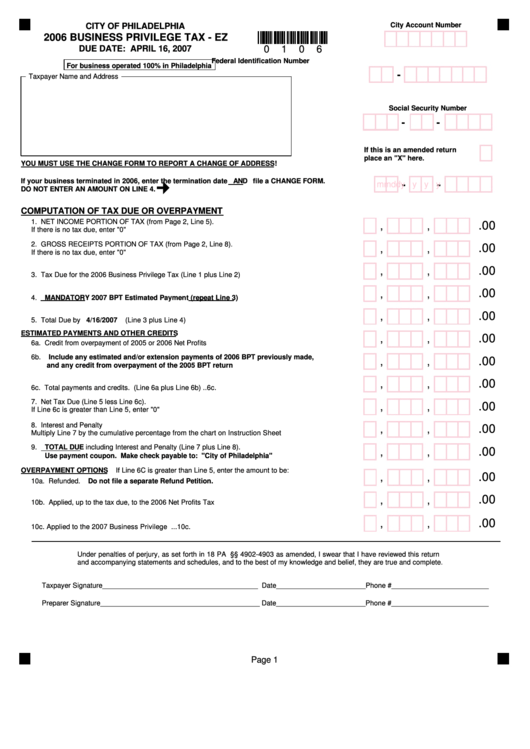

CITY OF PHILADELPHIA

2006 BUSINESS PRIVILEGE TAX - EZ

DUE DATE: APRIL 16, 2007

0

1

0

6

Federal Identification Number

For business operated 100% in Philadelphia

-

Taxpayer Name and Address

Social Security Number

-

-

If this is an amended return

place an "X" here.

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS!

If your business terminated in 2006, enter the termination date AND file a CHANGE FORM.

-

-

m m

d d

y y y y

DO NOT ENTER AN AMOUNT ON LINE 4.

COMPUTATION OF TAX DUE OR OVERPAYMENT

1. NET INCOME PORTION OF TAX (from Page 2, Line 5).

.00

,

,

If there is no tax due, enter "0".............................................................................................................1.

2. GROSS RECEIPTS PORTION OF TAX (from Page 2, Line 8).

.00

,

,

If there is no tax due, enter "0".............................................................................................................2.

.00

,

,

3. Tax Due for the 2006 Business Privilege Tax (Line 1 plus Line 2)........................................................3.

.00

,

,

4. MANDATORY 2007 BPT Estimated Payment (repeat Line 3)...........................................................4.

.00

,

,

5. Total Due by 4/16/2007 (Line 3 plus Line 4)........................................................................................5.

ESTIMATED PAYMENTS AND OTHER CREDITS

.00

,

,

6a. Credit from overpayment of 2005 or 2006 Net Profits Tax................................................................6a.

6b. Include any estimated and/or extension payments of 2006 BPT previously made,

.00

,

,

and any credit from overpayment of the 2005 BPT return............................................................6b.

.00

,

,

6c. Total payments and credits. (Line 6a plus Line 6b).........................................................................6c.

7. Net Tax Due (Line 5 less Line 6c).

.00

,

,

If Line 6c is greater than Line 5, enter "0"............................................................................................7.

8. Interest and Penalty

.00

,

,

Multiply Line 7 by the cumulative percentage from the chart on Instruction Sheet II.............................8.

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

.00

,

,

Use payment coupon. Make check payable to: "City of Philadelphia".........................................9.

OVERPAYMENT OPTIONS If Line 6C is greater than Line 5, enter the amount to be:

.00

,

,

10a. Refunded. Do not file a separate Refund Petition....................................................................10a.

.00

,

,

10b. Applied, up to the tax due, to the 2006 Net Profits Tax Return.....................................................10b.

.00

,

,

10c. Applied to the 2007 Business Privilege Tax...................................................................................10c.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2