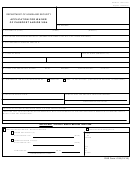

Section B. History and Business Status

Please check the appropriate answer for each question below. If any of the questions require a "Yes" answer, provide an explanation on a separate sheet.

Yes No

Yes No

1.

Is the applicant the subject of any assessments, or contingent

4.

Have any mortgage insurance companies, secondary

liabilities not disclosed in its financial statements?

marketing agencies or warehouse lenders, or broker/

dealers denied the applicant approval in the three

2.

Has the applicant or any of its principals, officers,

previous fiscal years being reported? Provide the date

individuals serving on the Board of Directors, or

and reasons for each denial.

individuals acting as authorized signatories, ever

been, or are any presently suspended, terminated,

5.

Has the applicant been subject to any past or present

debarred, sanctioned, fined, convicted, denied approval,

action by HUD, VA, Fannie Mae, Freddie Mac, or other

or refused a license by any Federal, State, or local

government-related entity to indemnify the entity

government agency, or a government-related entity,

against loss?

where the action is related to the responsibilities that are

6.

Is the applicant currently subject to regulatory or super-

commensurate with those of the financial services industry?

visory action by any regulatory agency? Regulatory

3.

Is the applicant or any of it principals, officers, individu-

actions include, but are not limited to, supervisory

als serving on it's Board of Directors, individuals acting

agreements, cease and desist orders, notices of deter-

as authorized signatories, or employees currently in-

mination, memorandum of understanding, unresolved

volved in a proceeding or subject to an investigation

audits, and investigations.

Supervisory actions in-

that could result, or has resulted, in suspension, fine, or

clude, but are not limited to, the appointment of a

disbarment by a Federal, State, or local government

trustee, conservator, or managing agent.

agency, conviction in a criminal matter, bankruptcy or

7.

Has the applicant or any owner, principal, or managing

denial of fidelity insurance or mortgagee’s errors and

executive been involved, through ownership or other-

omissions insurance coverage?

wise, with a previously defaulted Ginnie Mae issuer(s)?

Section C: FHA Title I and Title II only

1. Premium Address Check if same as:

Geographic

Mailing

5. Lender/Mortgagee Type

6. Institution Type

Attention (Use a title, not an individual's name)

Government

Federal

State

Street Address /P.O. Box

Local

Supervised *

Credit Union

City

State

Zip Code

(not Loan Correspondent)

Bank

Savings Bank

2. Payee Address Must be completed for all FHA applications

Savings and Loan

Attention (Use a title, not an individual's name)

Non-supervised

Insurance Company

(not Loan Correspondent)

Mortgage Co./Finance Co.

Street Address /P.O. Box

Loan Correspondent

Mortgage Co./Finance Co.

(Supervised/Non-supervised)

Supervised Loan Corr.*

City

State

Zip Code

Investing Mortgagee

For-Profit

Not-for-Profit

3. CHUMS Address Check if same as:

Geographic

Mailing

Premium

Payee

Reserved

Attention (Use a title, not an individual's name)

Service Provider

Service Provider

Street Address /P.O. Box

Servicing Agent

5. Lender/Mortgagee

6. Institution Type

City

State

Zip Code

Type Code (HUD use)

(HUD use)

4. Endorsement Address Check if same as:

Geographic

Mailing

Premium

Payee

CHUMS

Attention (Use a title, not an individual's name)

* 7. Examined and Supervised

7. Examined and

Supervised Code

Federal Reserve System

(HUD use)

Street Address /P.O. Box

Federal Deposit Insurance Corp.

Office of Thrift Supervision

City

State

Zip Code

National Credit Union Admin.

Other (specify)

11. Fiscal Year End (month)

10. Origination/Service

8. Sponsor Home Office Lender/Mortgagee ID

(HUD use)

(10 digits)

12. Financial Statement Date (HUD use)

Title I Property Improvement

9. Applicant Taxpayer Identifying Number

Manufactured Housing

13a. Title I Home Office Lender ID,

(9 digits)

if prior approval (10 digits)

Title II 1-4 Family Mortgages

Multifamily Mortgages

13b. Title II Home Office Mortgagee ID,

if prior approval (10 digits)

Previous editions are obsolete.

form HUD-11701 (07/2003)

Replaces HUD-92001, 92001-D and LD

ref Handbooks 5500.3, Rev. 1 and 4060.1

Page 2 of 3

1

1 2

2 3

3 4

4 5

5