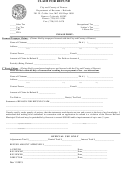

Form Rv-F1402101 - Unlicensed Exporter Claim For Refund - Tennessee Department Of Revenue Page 2

ADVERTISEMENT

Schedule A - Purchases of Tennessee Tax Paid Gallons - Unlicensed Exporter Claim for Refund (Attach to PET 380)

Exporter Name:

FEIN:

Account Number:

Month of (MM-YY):

Tennessee Department of Revenue

Product Type (Circle One)

65 GASOLINE

142 KEROSENE

M O D E

122 BLENDING COMPONENTS (TRANSMIX)

160 UNDYED DIESEL

J TRUCK

123 ALCOHOL

226 DIESEL (HIGH SULFUR DYED)

R RAIL

124 GASOHOL

227 DIESEL (LOW SULFUR DYED)

B BARGE

125 AVIATION GASOLINE

____ OTHER (SEE ITA PRODUCT CODE LIST)

PL PIPELINE

130 JET FUEL

B A BOOK ADJUSTMENT

ST STOCK TRANSFER

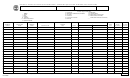

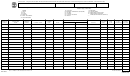

POINT OF

TERMINAL

PURCHASED

SHIPPING

CARRIER

SHIP

SALES

TAX PAID

CODE #

FROM

PAPER

CARRIER NAME

FEIN

MODE

ORIGIN

DESTINATION

DATE

DOCUMENT #

GALLONS

Schedule Instructions - Use this schedule to provide detailed information to support Line 1 of the return. A separate schedule is required for each product type.

Total Gallons

RV-F1402001

INTERNET (4-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3