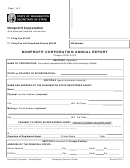

Supplemental Solicitation Report - Washington Secretary Of State Page 2

ADVERTISEMENT

3. The total dollar value of gross receipts:

= $

"Gross receipts" include, but are not limited to, contributions, gross

revenue from special events, sales of inventory, goods or services

(including tickets to events), and all other revenue from solicitations,

regardless of custody of funds.

Amounts collected on behalf of the charitable organization by a

commercial fundraiser or commercial coventurer must be included on

(line 1 + line 2 = line 3)

line 3.

4. The total gross dollar value of expenditures used directly

$

for charitable program services:

Payments to affiliates may be included if costs involved are not

connected with the administrative or fundraising functions of the

reporting organization.

5. The total gross dollar value of expenditures used for

+ $

administrative and fundraising:

"Administrative and fund-raising costs" include, but are not limited to,

the following expenses if not directly related to program services:

salaries, wages, compensation, legal, accounting, occupancy, equipment

costs, printing and publications, telephone, postage, supplies, travel,

meetings, fees for services, and cost of goods or inventory sold that are

not directly related to program services.

Amounts paid to or retained by a commercial fundraiser or fundraising

counsel must be included on line 5.

6. The total dollar value of program service, administrative

= $

and fundraising expenditures:

Enter on line 6 the sum of the expenditures reported on lines 4 and 5.

This includes, but is not limited to, amounts paid to or retained by a

commercial fundraiser or fundraising counsel, amounts expended for

charitable program services, administrative expenses, fees for services,

(line 4 + line 5 = line 6)

and fundraising costs incurred by the charitable organization.

7. Beginning assets (gross):

$

8. Ending assets (gross):

$

CHARITY S COMMENTS REGARDING SOLICITATION REPORT (OPTIONAL)

Attach additional information or provide an explanation, if any, which the organization believes would be of assistance in

understanding the financial information provided in Solicitation Report or IRS tax return, or to provide context for reported

information. Be sure to clearly label attachment as Solicitation Comments .

SECTION 2 - SIGNATURE (Required)

By signing this report, the applicant: ( a ) certifies that the information contained in the application and in the attachments is

accurate and true to the best of the applicant s knowledge; ( b ) irrevocably appoints the Secretary of State to receive process (notice

of lawsuits) in non-criminal cases against the applicant, and under the conditions set out in RCW 19.09.305; and ( c ) certifies that

neither the organization nor any of its officers, directors, and principals has been convicted of a crime involving charitable

solicitations, nor been subject to permanent injunction or administrative order under the Washington Consumer Protection Act

(Chapter 19.86 RCW) in the past ten years.

_______________________________

_____________________________

_______________________

________________

Signature of applicant

Printed name

Title

Date

This form may be signed by the President, Treasurer or a comparable officer or, in the absence of officers, person responsible for the organization.

NOTE: Expedited Mail Service is available for registration documents requiring 48-hour turnaround. To utilize Expedited Mail

Service, please enclose $20 per registration document (in addition to regular fees), check ( ) the box on page one of this document,

and write the word EXPEDITE in bold letters on the outside of the envelope. Your request will be processed and mailed within

TWO business days of receipt by the Charities Program.

Charity Supplemental Solicitation Report/Rev 10/07

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2