Form 480.30(Ii)le - Income Tax Return For Exempt Businesses Under The Puerto Rico Incentives Programs Special Acts

ADVERTISEMENT

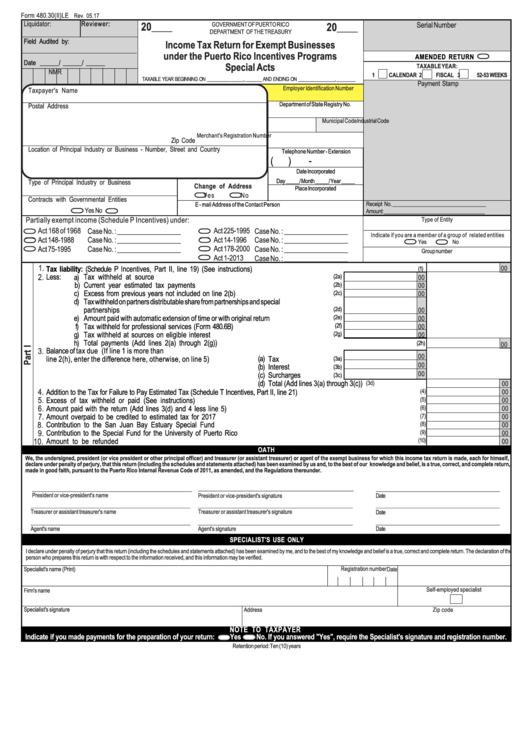

Form 480.30(II)LE

Rev. 05.17

Liquidator:

Reviewer:

20____

20____

Serial Number

GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field Audited by:

Income Tax Return for Exempt Businesses

under the Puerto Rico Incentives Programs

AMENDED RETURN

Date ______/ ______/ ______

Special Acts

TAXABLE YEAR:

R

M

N

1

CALENDAR 2

FISCAL 3

52-53 WEEKS

TAXABLE YEAR BEGINNING ON ________________, _______ AND ENDING ON ________________, ________

Payment Stamp

Employer Identification Number

Taxpayer's Name

Department of State Registry No.

Postal Address

Industrial Code

Municipal Code

Merchant's Registration Number

Zip Code

Location of Principal Industry or Business - Number, Street and Country

Telephone Number - Extension

(

)

-

Date Incorporated

Day _____/ Month _____/ Year _____

Type of Principal Industry or Business

Change of Address

Place Incorporated

Yes

No

Contracts with Governmental Entities

Receipt No. ___________________________________

E - mail Address of the Contact Person

Yes

No

Amount: ______________________________________

Partially exempt income (Schedule P Incentives) under:

Type of Entity

Act 225-1995

Act 168 of 1968

Case No. : __________________

Case No. : __________________

Indicate if you are a member of a group of related entities

Act 14-1996

Act 148-1988

Case No. : __________________

Case No. : __________________

Yes

No

Act 178-2000

Act 75-1995

Case No. : __________________

Case No. : __________________

Group number

Act 1-2013

Case No. : __________________

1.

Tax liability: (Schedule P Incentives, Part II, line 19) (See instructions) .........................................................................................

00

(1)

2.

Less:

a)

Tax withheld at source ..............................................................................................

(2a)

00

b)

Current year estimated tax payments .........................................................................

(2b)

00

c)

Excess from previous years not included on line 2(b) ...................................................

(2c)

00

d)

Tax withheld on partners distributable share from partnerships and special

partnerships ............................................................................................................

(2d)

00

e)

Amount paid with automatic extension of time or with original return .................................

(2e)

00

Tax withheld for professional services (Form 480.6B) ................................................

f)

(2f)

00

g)

Tax withheld at sources on eligible interest ................................................................

(2g)

00

h)

Total payments (Add lines 2(a) through 2(g)) ............................................................................................................

(2h)

00

3.

Balance of tax due (If line 1 is more than

00

(a)

Tax .........................

line 2(h), enter the difference here, otherwise, on line 5) ......................

(3a)

00

(b)

Interest .....................

(3b)

00

(c)

Surcharges ...............

(3c)

(d)

Total (Add lines 3(a) through 3(c)) ...........................

(3d)

00

4.

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Incentives, Part II, line 21) ....................................................................

(4)

00

5.

Excess of tax withheld or paid (See instructions) ........................................................................................................................

(5)

00

6.

Amount paid with the return (Add lines 3(d) and 4 less line 5) .......................................................................................................

(6)

00

7.

Amount overpaid to be credited to estimated tax for 2017 .............................................................................................................

(7)

00

8.

Contribution to the San Juan Bay Estuary Special Fund ..............................................................................................................

(8)

00

9.

Contribution to the Special Fund for the University of Puerto Rico ..................................................................................................

(9)

00

10.

Amount to be refunded ............................................................................................................................................................

(10)

00

OATH

We, the undersigned, president (or vice president or other principal officer) and treasurer (or assistant treasurer) or agent of the exempt business for which this income tax return is made, each for himself,

declare under penalty of perjury, that this return (including the schedules and statements attached) has been examined by us and, to the best of our knowledge and belief, is a true, correct, and complete return,

made in good faith, pursuant to the Puerto Rico Internal Revenue Code of 2011, as amended, and the Regulations thereunder.

_____________________________________________________________

___________________________________________________________

________________________________________________

President or vice-president's name

President or vice-president's signature

Date

___________________________________________________________

_________________________________________________________

________________________________________________

Treasurer or assistant treasurer's name

Treasurer or assistant treasurer's signature

Date

___________________________________________________________

_________________________________________________________

________________________________________________

Agent's name

Agent's signature

Date

SPECIALIST'S USE ONLY

I declare under penalty of perjury that this return (including the schedules and statements attached) has been examined by me, and to the best of my knowledge and belief is a true, correct and complete return. The declaration of the

person who prepares this return is with respect to the information received, and this information may be verified.

Specialist's name (Print)

Registration number

Date

20

Self-employed specialist

Firm's name

Specialist's signature

Zip code

Address

NOTE TO TAXPAYER

Indicate if you made payments for the preparation of your return:

Yes

No. If you answered "Yes", require the Specialist's signature and registration number.

Retention period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3