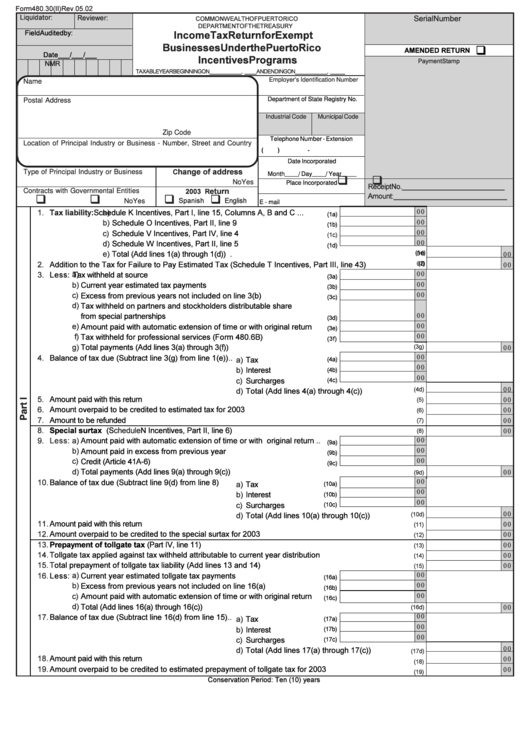

Form 480.30(Ii) - Income Tax Return For Exempt Business Under The Puerto Rico Incentives Programs

ADVERTISEMENT

Form 480.30(II) Rev. 05.02

Liquidator:

Reviewer:

Serial Number

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field Audited by:

Income Tax Return for Exempt

Businesses Under the Puerto Rico

q

AMENDED RETURN

Date ___/ ___/ ___

Incentives Programs

Payment Stamp

R

M

N

TAXABLE YEAR BEGINNING ON ___________, ____ AND ENDING ON ___________, _____

Employer's Identification Number

Name

Department of State Registry No.

Postal Address

Industrial Code

Municipal Code

Zip Code

Telephone Number - Extension

Location of Principal Industry or Business - Number, Street and Country

(

)

-

Date Incorporated

hange of address

C

Type of Principal Industry or Business

Month____/ Day____/ Year ____

q

q

Yes

No

Place Incorporated

Receipt No. ___________________________

eturn

2003 R

Contracts with Governmental Entities

Amount: ______________________________

q

q

q

q

Spanish

English

Yes

No

E - mail

0 0

1.

Tax liability:

a)

Schedule K Incentives, Part I, line 15, Columns A, B and C ...

(1a)

0 0

b)

Schedule O Incentives, Part II, line 9 ...........................................

(1b)

0 0

c)

Schedule V Incentives, Part IV, line 4 ...........................................

(1c)

0 0

d)

Schedule W Incentives, Part II, line 5 ...........................................

(1d)

(1e)

0 0

e)

Total (Add lines 1(a) through 1(d)) ............................................................................................

0 0

0 0

(2)

2.

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Incentives, Part III, line 43) .......................

0 0

a)

0 0

3.

Less:

Tax withheld at source ...................................................................................

(3a)

b)

0 0

Current year estimated tax payments ..........................................................

(3b)

c)

0 0

Excess from previous years not included on line 3(b) .............................

(3c)

d)

Tax withheld on partners and stockholders distributable share

0 0

from special partnerships .............................................................................

(3d)

e)

0 0

Amount paid with automatic extension of time or with original return

(3e)

f)

0 0

Tax withheld for professional services (Form 480.6B) ............................

(3f)

g)

Total payments (Add lines 3(a) through 3(f)) .........................................................................................

(3g)

0 0

0 0

4.

Balance of tax due (Subtract line 3(g) from line 1(e))..

a)

Tax .................................

(4a)

0 0

b)

Interest .........................

(4b)

0 0

c)

Surcharges ..................

(4c)

0 0

(4d)

d)

Total (Add lines 4(a) through 4(c)) ......................

5.

Amount paid with this return ......................................................................................................................................

0 0

(5)

6.

Amount overpaid to be credited to estimated tax for 2003 ...................................................................................

0 0

(6)

7.

Amount to be refunded ................................................................................................................................................

0 0

(7)

8.

Special surtax

(Schedule

N Incentives, Part II, line 6) .......................................................................................

0 0

(8)

a)

0 0

9.

Less:

Amount paid with automatic extension of time or with original return ..

(9a)

b)

0 0

Amount paid in excess from previous year ................................................

(9b)

c)

0 0

Credit (Article 41A-6) .......................................................................................

(9c)

d)

Total payments (Add lines 9(a) through 9(c)) .........................................................................................

0 0

(9d)

0 0

10.

Balance of tax due (Subtract line 9(d) from line 8)......

a)

Tax .................................

(10a)

0 0

b)

Interest .........................

(10b)

0 0

c)

Surcharges ..................

(10c)

0 0

(10d)

d)

Total (Add lines 10(a) through 10(c)) ....................

11.

Amount paid with this return ......................................................................................................................................

0 0

(11)

12.

Amount overpaid to be credited to the special surtax for 2003 ...........................................................................

0 0

(12)

13.

Prepayment of tollgate tax (Part IV, line 11) .........................................................................................................

0 0

(13)

14.

Tollgate tax applied against tax withheld attributable to current year distribution ...........................................

0 0

(14)

15.

Total prepayment of tollgate tax liability (Add lines 13 and 14) ....................................

0 0

(15)

a)

0 0

16.

Less:

Current year estimated tollgate tax payments .........................................

(16a)

b)

0 0

Excess from previous years not included on line 16(a) ........................

(16b)

0 0

c)

Amount paid with automatic extension of time or with original return

(16c)

d)

Total (Add lines 16(a) through 16(c)) ......................................................................................................

0 0

(16d)

0 0

17.

Balance of tax due (Subtract line 16(d) from line 15)..

a)

Tax ...............................

(17a)

0 0

b)

Interest .......................

(17b)

0 0

c)

Surcharges ................

(17c)

0 0

d)

Total (Add lines 17(a) through 17(c)) ..................

(17d)

18.

Amount paid with this return ......................................................................................................................................

0 0

(18)

19.

Amount overpaid to be credited to estimated prepayment of tollgate tax for 2003 .........................................

0 0

(19)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4