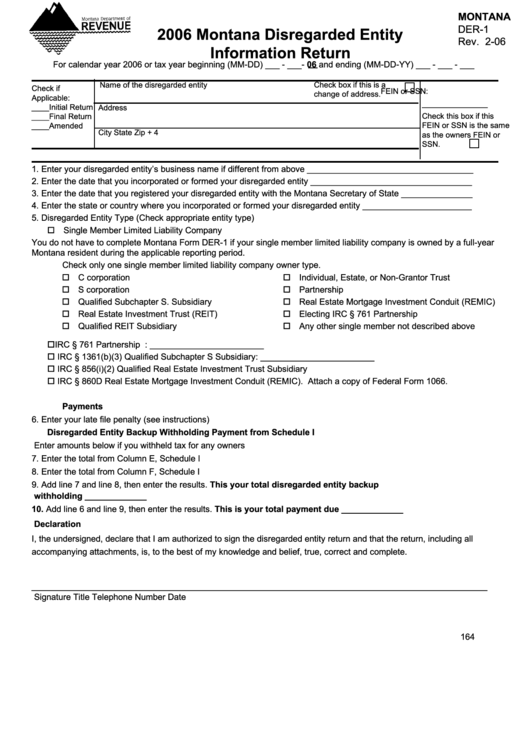

Form Der-1 - Montana Disregarded Entity Information Return - State Of Montana 2006

ADVERTISEMENT

MONTANA

DER-1

2006 Montana Disregarded Entity

Rev. 2-06

Information Return

For calendar year 2006 or tax year beginning (MM-DD) ___ - ___- 06 and ending (MM-DD-YY) ___ - ___ - ___

Check box if this is a

Name of the disregarded entity

Check if

FEIN or SSN:

change of address.

Applicable:

_______________

____Initial Return

Address

____Final Return

Check this box if this

FEIN or SSN is the same

____Amended

City

State

Zip + 4

as the owners FEIN or

SSN.

1. Enter your disregarded entity’s business name if different from above ___________________________________

2. Enter the date that you incorporated or formed your disregarded entity __________________________________

3. Enter the date that you registered your disregarded entity with the Montana Secretary of State _______________

4. Enter the state or country where you incorporated or formed your disregarded entity _______________________

5. Disregarded Entity Type (Check appropriate entity type)

Single Member Limited Liability Company

You do not have to complete Montana Form DER-1 if your single member limited liability company is owned by a full-year

Montana resident during the applicable reporting period.

Check only one single member limited liability company owner type.

C corporation

Individual, Estate, or Non-Grantor Trust

S corporation

Partnership

Qualified Subchapter S. Subsidiary

Real Estate Mortgage Investment Conduit (REMIC)

Real Estate Investment Trust (REIT)

Electing IRC § 761 Partnership

Qualified REIT Subsidiary

Any other single member not described above

IRC § 761 Partnership ...................................................... Enter date of election: ________________________

IRC § 1361(b)(3) Qualified Subchapter S Subsidiary ....... Enter date of election: ________________________

IRC § 856(i)(2) Qualified Real Estate Investment Trust Subsidiary

IRC § 860D Real Estate Mortgage Investment Conduit (REMIC). Attach a copy of Federal Form 1066.

Payments

6. Enter your late file penalty (see instructions) .................................................................................... 6. _____________

Disregarded Entity Backup Withholding Payment from Schedule I

Enter amounts below if you withheld tax for any owners

7. Enter the total from Column E, Schedule I ........................................................................................ 7. _____________

8. Enter the total from Column F, Schedule I ........................................................................................ 8. _____________

9. Add line 7 and line 8, then enter the results. This your total disregarded entity backup

withholding ...................................................................................................................................... 9. _____________

10. Add line 6 and line 9, then enter the results. This is your total payment due .............................. 10. _____________

Declaration

I, the undersigned, declare that I am authorized to sign the disregarded entity return and that the return, including all

accompanying attachments, is, to the best of my knowledge and belief, true, correct and complete.

________________________________________________________________________________________________

Signature

Title

Telephone Number

Date

164

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3