Form 540nr - Guidelines For Filing A Group 2001-2002

ADVERTISEMENT

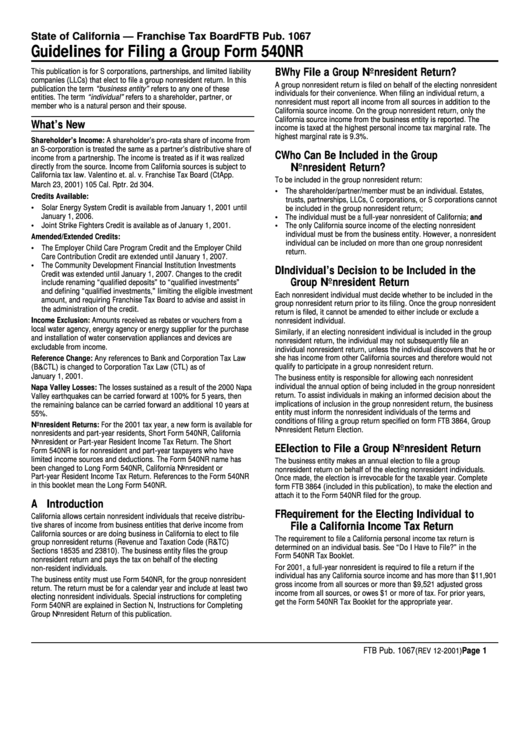

State of California — Franchise Tax Board

FTB Pub. 1067

Guidelines for Filing a Group Form 540NR

B Why File a Group Nonresident Return?

This publication is for S corporations, partnerships, and limited liability

companies (LLCs) that elect to file a group nonresident return. In this

A group nonresident return is filed on behalf of the electing nonresident

publication the term “business entity” refers to any one of these

individuals for their convenience. When filing an individual return, a

entities. The term “individual” refers to a shareholder, partner, or

nonresident must report all income from all sources in addition to the

member who is a natural person and their spouse.

California source income. On the group nonresident return, only the

California source income from the business entity is reported. The

What’s New

income is taxed at the highest personal income tax marginal rate. The

highest marginal rate is 9.3%.

Shareholder’s Income: A shareholder’s pro-rata share of income from

an S-corporation is treated the same as a partner’s distributive share of

C Who Can Be Included in the Group

income from a partnership. The income is treated as if it was realized

Nonresident Return?

directly from the source. Income from California sources is subject to

California tax law. Valentino et. al. v. Franchise Tax Board (CtApp.

To be included in the group nonresident return:

March 23, 2001) 105 Cal. Rptr. 2d 304.

• The shareholder/partner/member must be an individual. Estates,

Credits Available:

trusts, partnerships, LLCs, C corporations, or S corporations cannot

• Solar Energy System Credit is available from January 1, 2001 until

be included in the group nonresident return;

January 1, 2006.

• The individual must be a full-year nonresident of California; and

• Joint Strike Fighters Credit is available as of January 1, 2001.

• The only California source income of the electing nonresident

individual must be from the business entity. However, a nonresident

Amended/Extended Credits:

individual can be included on more than one group nonresident

• The Employer Child Care Program Credit and the Employer Child

return.

Care Contribution Credit are extended until January 1, 2007.

• The Community Development Financial Institution Investments

D Individual’s Decision to be Included in the

Credit was extended until January 1, 2007. Changes to the credit

Group Nonresident Return

include renaming “qualified deposits” to “qualified investments”

and defining “qualified investments,” limiting the eligible investment

Each nonresident individual must decide whether to be included in the

amount, and requiring Franchise Tax Board to advise and assist in

group nonresident return prior to its filing. Once the group nonresident

the administration of the credit.

return is filed, it cannot be amended to either include or exclude a

Income Exclusion: Amounts received as rebates or vouchers from a

nonresident individual.

local water agency, energy agency or energy supplier for the purchase

Similarly, if an electing nonresident individual is included in the group

and installation of water conservation appliances and devices are

nonresident return, the individual may not subsequently file an

excludable from income.

individual nonresident return, unless the individual discovers that he or

she has income from other California sources and therefore would not

Reference Change: Any references to Bank and Corporation Tax Law

qualify to participate in a group nonresident return.

(B&CTL) is changed to Corporation Tax Law (CTL) as of

January 1, 2001.

The business entity is responsible for allowing each nonresident

individual the annual option of being included in the group nonresident

Napa Valley Losses: The losses sustained as a result of the 2000 Napa

return. To assist individuals in making an informed decision about the

Valley earthquakes can be carried forward at 100% for 5 years, then

implications of inclusion in the group nonresident return, the business

the remaining balance can be carried forward an additional 10 years at

entity must inform the nonresident individuals of the terms and

55%.

conditions of filing a group return specified on form FTB 3864, Group

Nonresident Returns: For the 2001 tax year, a new form is available for

Nonresident Return Election.

nonresidents and part-year residents, Short Form 540NR, California

Nonresident or Part-year Resident Income Tax Return. The Short

E Election to File a Group Nonresident Return

Form 540NR is for nonresident and part-year taxpayers who have

limited income sources and deductions. The Form 540NR name has

The business entity makes an annual election to file a group

been changed to Long Form 540NR, California Nonresident or

nonresident return on behalf of the electing nonresident individuals.

Part-year Resident Income Tax Return. References to the Form 540NR

Once made, the election is irrevocable for the taxable year. Complete

in this booklet mean the Long Form 540NR.

form FTB 3864 (included in this publication), to make the election and

attach it to the Form 540NR filed for the group.

A Introduction

F Requirement for the Electing Individual to

California allows certain nonresident individuals that receive distribu-

File a California Income Tax Return

tive shares of income from business entities that derive income from

California sources or are doing business in California to elect to file

The requirement to file a California personal income tax return is

group nonresident returns (Revenue and Taxation Code (R&TC)

determined on an individual basis. See “Do I Have to File?” in the

Sections 18535 and 23810). The business entity files the group

Form 540NR Tax Booklet.

nonresident return and pays the tax on behalf of the electing

For 2001, a full-year nonresident is required to file a return if the

non-resident individuals.

individual has any California source income and has more than $11,901

The business entity must use Form 540NR, for the group nonresident

gross income from all sources or more than $9,521 adjusted gross

return. The return must be for a calendar year and include at least two

income from all sources, or owes $1 or more of tax. For prior years,

electing nonresident individuals. Special instructions for completing

get the Form 540NR Tax Booklet for the appropriate year.

Form 540NR are explained in Section N, Instructions for Completing

Group Nonresident Return of this publication.

FTB Pub. 1067

Page 1

(REV 12-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4