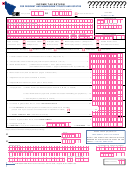

Form It-141qft - For Resident And Nonresident Qualified Funeral Trusts Page 2

ADVERTISEMENT

SCHEDULE NR

IT-141 Rev. 11/99

PART I - NONRESIDENT INCOME AND ALLOCATION

(To be completed by nonresident qualified funeral trusts only)

COLUMN I

COLUMN II

INCOME

REPORTED ON

ALLOCATED TO

FEDERAL RETURN

WEST VIRGINIA

1

1

1. Interest Income ..............................................................................................................

2

2

2. Dividends .......................................................................................................................

3

3

3. Capital gain or (loss) .....................................................................................................

4

4

4. Other Income (state nature of income)

5

5

5. Total Income (add lines 1 through 4) .............................................................................

COLUMN I

COLUMN II

DEDUCTIONS

REPORTED ON

ALLOCATED TO

WEST VIRGINIA

FEDERAL RETURN

6

6

6. Taxes .............................................................................................................................

7

7

7. Trustee Fees ..................................................................................................................

8

8

8. Attorney, accountant, and return preparer fees ............................................................

9

9

9. Other Deductions not subject to the 2% floor ...............................................................

10

10

10. Allowable miscellaneous itemized deductions subject to 2% floor ..............................

11

11

11. Total deductions (sum of lines 6 through 10) ...............................................................

12

12

12. Taxable income (line 5 minus line 11) ...........................................................................

PART II - CALCULATION OF WEST VIRGINIA TAX

13. West Virginia Taxable Income (page 1, line 6) ....................

14. Tentative Tax (Apply rate schedule

Note: The federal income used in the calculation of

to the amount on line 13) ....................................................

the income percentage (line 15) must be increased

15. Income Percentage (carry to four decimal places)

by the amount of any gain (reduced by any deduc-

WV income (line 12, col.II)

•

tions) upon which tax is imposed under section 644

=

Federal income (line 12, col.I)

of the Internal Revenue Code.

16. West Virginia Tax (Line 14 times line 15)

(Enter here and on page 1, line 7) .......................................

Check box on line 7, page 1 for Schedule NR.

INSTRUCTIONS FOR NONRESIDENT QUALIFIED FUNERAL TRUST

GENERAL INSTRUCTIONS

Schedule NR must be completed for all nonresident qualified funeral trusts

Virginia sources. Because of the conformity of all amounts in column I of

having items of income, gain or deduction derived from West Virginia sources.

Schedule NR to the federal return, the instructions for the federal return are

Schedule NR is designed to conform to the federal qualified funeral trust

equally applicable here. The specific instructions below relate only to column

return. Column I must be completed regardless of the source of income, gain

II, to be used by nonresident qualified funeral trusts for allocation of income

or deduction. These figures are taken directly from Federal Form 1041-QFT.

and deductions to West Virginia and West Virginia taxable income.

In column II, enter the amount which is attributable to or connected with West

SPECIFIC INSTRUCTIONS FOR SCHEDULE NR (Column II)

Enter that amount which is attributable to West Virginia only.

Lines 1 and 2 - Interest and dividends: Interest and dividends should

administering the trust during the tax year that are connected to West Virginia.

Note: Trustee fees deducted on Federal Form 706 cannot be deducted on

be allocated to West Virginia only to the extent that such income is from

property employed in a business, trade, profession or occupation carried on

this form.

in this State.

Line 8 - Attorney, accountant, and return preparer fees: Enter

Line 3 - Capital gain or (loss): Enter the net amount of gains or (losses)

the deductible fees paid by the trust during the tax year that are connected with

from capital assets. The net gains or (losses) allocable to West Virginia are

West Virginia.

those from the sale or exchange of property having a situs within the State.

Line 9 - Other deductions not subject to the 2 percent floor:

Line 4 - Other income: Enter the total amount of other income which is

Enter the total amount of all other expenses authorized by law and allocated

allocated to West Virginia and not specifically mentioned above.

to West Virginia. These expenses must be connected with income previously

allocated to West Virginia.

Line 6 - Taxes: Enter the amount of taxes allocated to West Virginia.

Line 10 - Allowable miscellaneous deductions subject to the

Taxes are allocated to the extent such are connected with the operation of a

2 percent floor:

business or property having a situs within the State.

Enter the amount of the allowable miscellaneous

deductions subject to the 2 percent floor.

These deductions must be

Line 7 - Trustee fees: Enter the deductible fees paid to the trustee for

connected with income previously allocated to West Virginia.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2