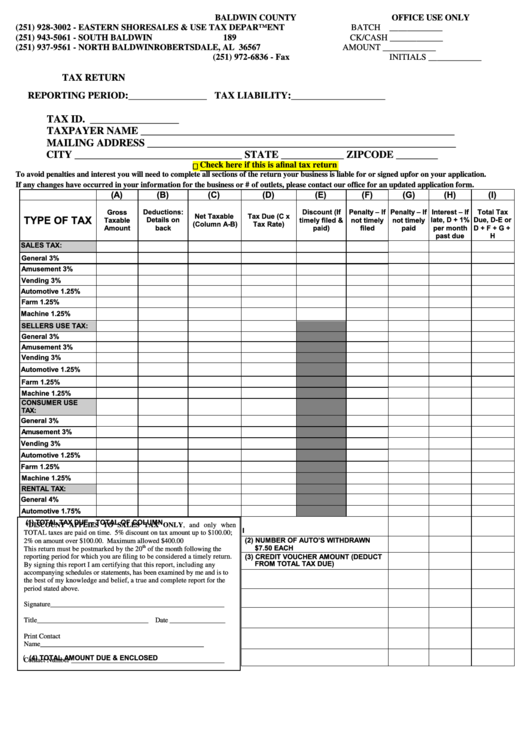

BALDWIN COUNTY

OFFICE USE ONLY

(251) 928-3002 - EASTERN SHORE

SALES & USE TAX DEPARTMENT

BATCH ____________

(251) 943-5061 - SOUTH BALDWIN

P.O. BOX 189

CK/CASH ____________

(251) 937-9561 - NORTH BALDWIN

ROBERTSDALE, AL 36567

AMOUNT ____________

(251) 972-6836 - Fax

INITIALS ____________

TAX RETURN

:_______________

:__________________

REPORTING PERIOD

TAX LIABILITY

TAX ID. _________________

TAXPAYER NAME ____________________________________________________________

MAILING ADDRESS ___________________________________________________________

CITY ________________________________ STATE ____________ ZIPCODE ________

Check here if this is a final tax return

To avoid penalties and interest you will need to complete all sections of the return your business is liable for or signed up for on your application.

If any changes have occurred in your information for the business or # of outlets, please contact our office for an updated application form.

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

Deductions:

Interest – If

Total Tax

Gross

Discount (If

Penalty – If

Penalty – If

Net Taxable

Tax Due (C x

TYPE OF TAX

Taxable

Details on

timely filed &

not timely

not timely

late, D + 1%

Due, D-E or

(Column A-B)

Tax Rate)

Amount

back

paid)

filed

paid

per month

D + F + G +

past due

H

SALES TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

SELLERS USE TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

CONSUMER USE

TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

RENTAL TAX:

General 4%

Automotive 1.75%

(1) TOTAL TAX DUE – TOTAL OF COLUMN

*DISCOUNT APPLIES TO SALES TAX ONLY, and only when

I

TOTAL taxes are paid on time. 5% discount on tax amount up to $100.00;

(2) NUMBER OF AUTO’S WITHDRAWN

2% on amount over $100.00. Maximum allowed $400.00

$7.50 EACH

th

This return must be postmarked by the 20

of the month following the

(3) CREDIT VOUCHER AMOUNT (DEDUCT

reporting period for which you are filing to be considered a timely return.

FROM TOTAL TAX DUE)

By signing this report I am certifying that this report, including any

accompanying schedules or statements, has been examined by me and is to

the best of my knowledge and belief, a true and complete report for the

period stated above.

Signature__________________________________________________

Title________________________________ Date ________________

Print Contact

Name_______________________________________________

(4) TOTAL AMOUNT DUE & ENCLOSED

(

Contact Number ____________________________________________

1

1 2

2