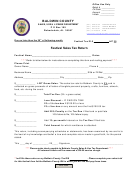

Instructions for Filing Baldwin County Tax Return

Column A

Enter gross sales (both cash/credit, nontaxable/ taxable).

Column B

Enter total deductions from standard deductions summary table below.

Column C

Enter net taxable – Column A (gross receipts) less Column B (total deductions).

Column D

Enter tax due for EACH tax type due by multiplying tax rate by Column C (net taxable).

Column E

Enter discount 5% of first $100 tax due or less and 2% for any tax over $100. Only allowable if return is timely

filed AND paid. Maximum discount is 400. ONLY ALLOWED ON SALES TAX.

Column F

(Use only if return is late). Enter 10% of tax due or $50, whichever is greater for failure to timely file.

Column G

(Use only if return is late). Enter 10% of tax due for failure to timely pay.

Column H

(Use only if return is late). Enter 1% per month for interest for each month delinquent.

(1) Total tax due – Add all amounts in Column 1 (total tax due) minus Column E (discount)or if tax is not timely filed, add

Column F and/or if not timely paid, add Column G plus 1% interest Column H for each month delinquent.

(2) Number of autos withdrawn – Enter number of autos x $7.50.

(3) Credit voucher – Enter any credit amount that has been approved by Baldwin County. Must have received a voucher.

(4) Total amount due – Enter the total amount that is due.

Standard Deduction Summary Table

(Summary below must be completed to correspond with total deductions on front of the tax report)

Type of Tax

Wholesale

Auto/Mach

Labor/Non

Sales/Deliv.

Sales to

Sales

Other

Total

Sales

Trade-Ins

Taxable

Outside

Gov’t or

of Gas

Allowable

Deductions

Service

Jurisdiction/

Agencies

or

Deductions

Rental

Lube

Oils

SALES TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

SELLERS USE TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

CONSUMER USE TAX:

General 3%

Amusement 3%

Vending 3%

Automotive 1.25%

Farm 1.25%

Machine 1.25%

RENTAL TAX:

General 4%

Automotive 1.75%

INSTRUCTIONS & INFORMATION CONCERNING THE COMPLETION OF THIS REPORT

th

To avoid the application of penalties and/or interest, the return must be filed on or before the 20

of the month following the period for which the

return is submitted. Cancellation postmark will determine timely filing. If ANY information changes on your account, please contact our office for an

updated form. Any credit for prior overpayment must have been approved by this Department. This report must be filed monthly unless you have

requested and been approved by this Department for a change in filing status.

Submit by Email

Print Form

1

1 2

2