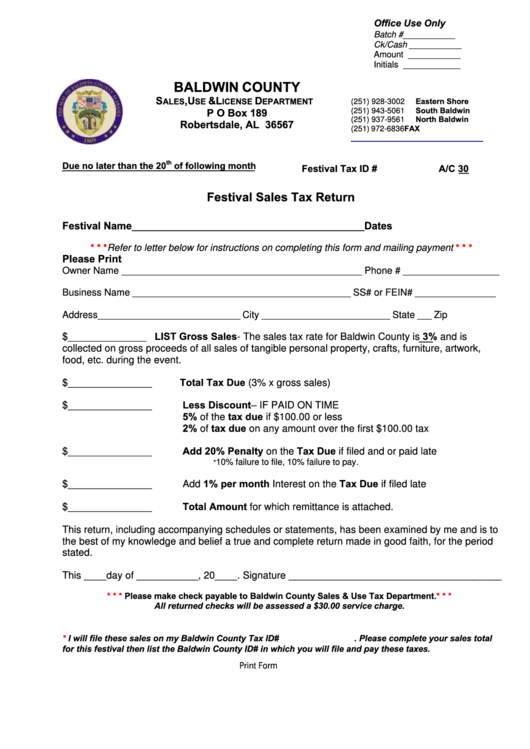

Office Use Only

Batch # ___________

Ck/Cash ___________

Amount ___________

Initials ____________

BALDWIN COUNTY

S

, U

& L

D

ALES

SE

ICENSE

EPARTMENT

Eastern Shore

(251) 928-3002

South Baldwin

P O Box 189

(251) 943-5061

North Baldwin

(251) 937-9561

Robertsdale, AL 36567

FAX

(251) 972-6836

salesandusetax@baldwincountyal.gov

th

Due no later than the 20

of following month

Festival Tax ID #

A/C 30

Festival Sales Tax Return

Festival Name

Dates

_________________________________________________

* * *

* * *

Refer to letter below for instructions on completing this form and mailing payment

Please Print

Owner Name _____________________________________________ Phone # __________________

Business Name

SS# or FEIN#

______________________________________________

_________________

Address

City

State

Zip

______________________________

___________________________

___

$______________ LIST Gross Sales- The sales tax rate for Baldwin County is 3% and is

collected on gross proceeds of all sales of tangible personal property, crafts, furniture, artwork,

food, etc. during the event.

Total Tax Due (3% x gross sales)

$_______________

Less Discount – IF PAID ON TIME

$_______________

5% of the tax due if $100.00 or less

2% of tax due on any amount over the first $100.00 tax

Add 20% Penalty on the Tax Due if filed and or paid late

$_______________

10% failure to file, 10% failure to pay.

*

Add 1% per month Interest on the Tax Due if filed late

$_______________

Total Amount for which remittance is attached.

$_______________

This return, including accompanying schedules or statements, has been examined by me and is to

the best of my knowledge and belief a true and complete return made in good faith, for the period

stated.

This ____day of ___________, 20____. Signature ______________________________________

* * *

Please make check payable to Baldwin County Sales & Use Tax

Department.* * *

All returned checks will be assessed a $30.00 service charge.

*

I will file these sales on my Baldwin County Tax ID#

. Please complete your sales total

for this festival then list the Baldwin County ID# in which you will file and pay these taxes.

Print Form

1

1