Form 85813.3 - Local Services Tax Employee Withholding Exemption Certificate - Lctcb/matcb

ADVERTISEMENT

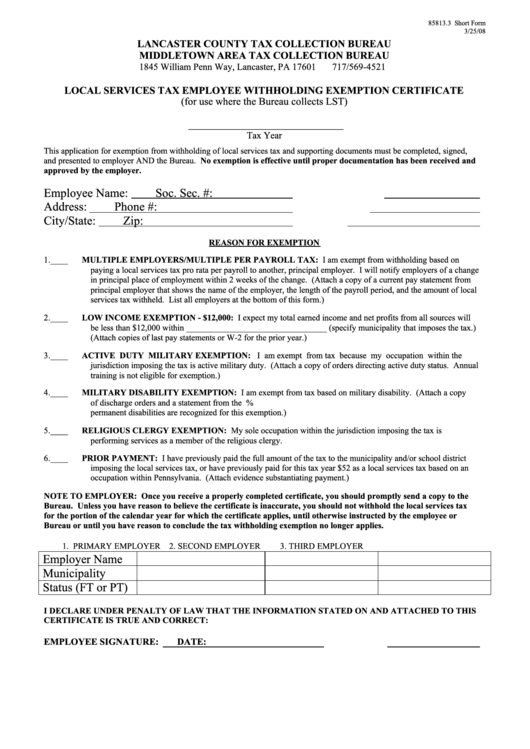

85813.3 Short Form

3/25/08

LANCASTER COUNTY TAX COLLECTION BUREAU

MIDDLETOWN AREA TAX COLLECTION BUREAU

1845 William Penn Way, Lancaster, PA 17601

717/569-4521

LOCAL SERVICES TAX EMPLOYEE WITHHOLDING EXEMPTION CERTIFICATE

(for use where the Bureau collects LST)

________________________________

Tax Year

This application for exemption from withholding of local services tax and supporting documents must be completed, signed,

and presented to employer AND the Bureau. No exemption is effective until proper documentation has been received and

approved by the employer.

Employee Name:

Soc. Sec. #:

Address:

Phone #:

City/State:

Zip:

REASON FOR EXEMPTION

1.

____

MULTIPLE EMPLOYERS/MULTIPLE PER PAYROLL TAX: I am exempt from withholding based on

paying a local services tax pro rata per payroll to another, principal employer. I will notify employers of a change

in principal place of employment within 2 weeks of the change. (Attach a copy of a current pay statement from

principal employer that shows the name of the employer, the length of the payroll period, and the amount of local

services tax withheld. List all employers at the bottom of this form.)

2.

____

LOW INCOME EXEMPTION - $12,000: I expect my total earned income and net profits from all sources will

be less than $12,000 within _________________________________ (specify municipality that imposes the tax.)

(Attach copies of last pay statements or W-2 for the prior year.)

3.

____

ACTIVE DUTY MILITARY EXEMPTION: I am exempt from tax because my occupation within the

jurisdiction imposing the tax is active military duty. (Attach a copy of orders directing active duty status. Annual

training is not eligible for exemption.)

4.

____

MILITARY DISABILITY EXEMPTION: I am exempt from tax based on military disability. (Attach a copy

of discharge orders and a statement from the U.S. Veterans Administrator documenting disability. Only 100%

permanent disabilities are recognized for this exemption.)

5.

____

RELIGIOUS CLERGY EXEMPTION:

My sole occupation within the jurisdiction imposing the tax is

performing services as a member of the religious clergy.

6.

____

PRIOR PAYMENT: I have previously paid the full amount of the tax to the municipality and/or school district

imposing the local services tax, or have previously paid for this tax year $52 as a local services tax based on an

occupation within Pennsylvania. (Attach evidence substantiating payment.)

NOTE TO EMPLOYER: Once you receive a properly completed certificate, you should promptly send a copy to the

Bureau. Unless you have reason to believe the certificate is inaccurate, you should not withhold the local services tax

for the portion of the calendar year for which the certificate applies, until otherwise instructed by the employee or

Bureau or until you have reason to conclude the tax withholding exemption no longer applies.

1. PRIMARY EMPLOYER

2. SECOND EMPLOYER

3. THIRD EMPLOYER

Employer Name

Municipality

Status (FT or PT)

I DECLARE UNDER PENALTY OF LAW THAT THE INFORMATION STATED ON AND ATTACHED TO THIS

CERTIFICATE IS TRUE AND CORRECT:

EMPLOYEE SIGNATURE:

DATE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1