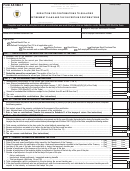

Form As 2920.1 - Certificate For Purchases Covered By A Qualified Contract - Department Of The Treasury Of Commonwealth Of Puerto Rico Page 3

ADVERTISEMENT

INSTRUCTIONS

Who must complete this form?

This form must be completed by:

1. An individual who purchases tangible personal property covered by lay away plans, that were granted before October 31,

2006; and

2. A merchant who purchases tangible personal property covered by a qualified contract, that was granted before October 31,

2006 or by bids that were awarded before October 31, 2006.

The purchaser must submit this form to the seller at the moment of the purchase.

Instructions to the Purchaser

In order to be valid, all parts of this certificate must be completed. If you are a merchant purchaser, this certificate must be signed by the owner,

partner, corporate official or other person duly authorized to represent the purchaser.

You must keep a copy of the qualified contract and all invoices, receipts or other evidence of purchases of tangible personal property made under said

contract. In addition, you must maintain a perpetual balance of the purchases made and the amount (number) of the taxable items remaining to be

acquired under each contract. For such purposes, you will use Schedule AS 2920.1.

If you intentionally issue a fraudulent Certificate for Purchases Covered by a Qualified Contract, you will be responsible for the payment of the sales

and use tax, and the applicable penalties.

Instructions to the Merchant Seller

If you are a seller registered in the Merchant’s Registry of the Department of the Treasury and accept a Certificate for Purchases Covered by a

Qualified Contract, you will be released from your obligation of collecting and remitting the sales and use tax. You are required to keep a copy of this

certificate in your files for a period of 6 years, counted from the filing date of the Sales and Use Tax Monthly Return, in which the excluded transaction

is reported. In addition, you must maintain documentation that shows the total sales of tangible personal property under each qualified contract.

Every merchant that accepts a Certificate for Purchases Covered by a Qualified Contract, must send a copy of all the certificates received during the

previous month to the Secretary of the Treasury, no later than the twentieth (20

) of each month. You must also send a copy of the qualified contract

th

to the Secretary of the Treasury, no later than the twentieth (20

) of the calendar month following the month in which the first purchase covered by the

th

qualified contract takes place. For these purposes, the merchant seller will use the following address:

Department of the Treasury

Sales and Use Tax Bureau

Qualified Contracts

P. O. Box 9024140

San Juan, PR 00902-4140

For your convenience, a space is provided in the upper right corner of this form so that the merchant seller can identify the invoice, receipt or

transaction number related to the transaction for which this certificate is issued

Schedule AS 2920.1

This schedule must only be completed by merchants that acquire tangible personal property covered by a qualified contract. Merchants must update

this schedule and include it in each transaction.

This schedule should not be completed by individuals who acquire tangible personal property covered by a lay away plan.

Additional Information

Sales of property acquired under a qualified contract which are not supported by a valid Certificate for Purchases Covered by a Qualified Contract will

be subject to the sales and use tax.

For additional information regarding this certificate, please contact the Department of the Treasury or visit any of the Taxpayer’s Service Centers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3