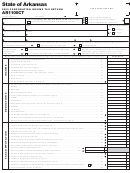

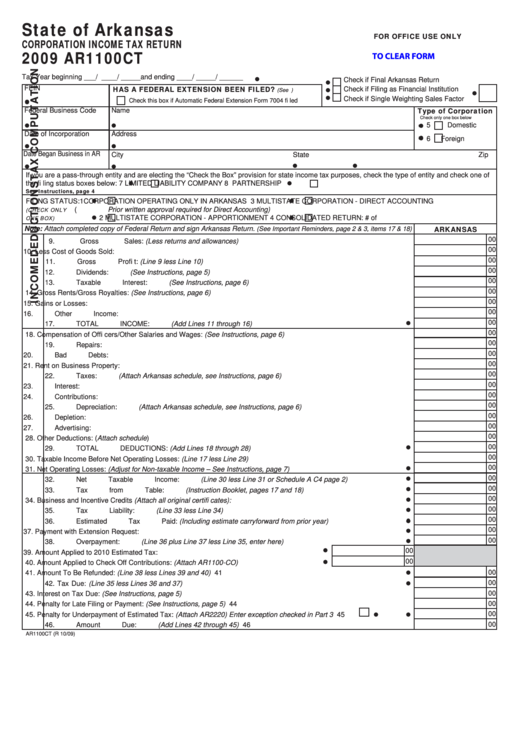

State of Arkansas

FOR OFFICE USE ONLY

CORPORATION INCOME TAX RETURN

2009 AR1100CT

CLICK HERE TO CLEAR FORM

Tax Year beginning ___ / ____ / _____ and ending ____ / _____ / ______

Check if Final Arkansas Return

HAS A FEDERAL EXTENSION BEEN FILED?

FEIN

Check if Filing as Financial Institution

(See Instr.page 4)

Check if Single Weighting Sales Factor

Check this box if Automatic Federal Extension Form 7004 fi led

Type of Corporation

Federal Business Code

Name

Check only one box below

5

Domestic

Date of Incorporation

Address

6

Foreign

Date Began Business in AR

City

State

Zip

Telephone Number

If you are a pass-through entity and are electing the “Check the Box” provision for state income tax purposes, check the type of entity and check one of

the fi ling status boxes below:

7

LIMITED LIABILITY COMPANY

8

PARTNERSHIP

See Instructions, page 4

FILING STATUS:

1

CORPORATION OPERATING ONLY IN ARKANSAS

3

MULTISTATE CORPORATION - DIRECT ACCOUNTING

(CHECK ONLY

(Prior written approval required for Direct Accounting)

ONE BOX)

2

MULTISTATE CORPORATION - APPORTIONMENT

4

CONSOLIDATED RETURN: # of corp.entities in AR __

ARKANSAS

Note: Attach completed copy of Federal Return and sign Arkansas Return.

(See Important Reminders, page 2 & 3, items 17 & 18)

00

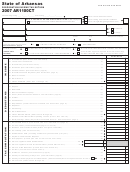

9. Gross Sales: (Less returns and allowances) ......................................................................................................... 9

00

10. Less Cost of Goods Sold: .................................................................................................................................... 10

00

11. Gross Profi t: (Line 9 less Line 10) .........................................................................................................................11

00

12. Dividends: (See Instructions, page 5) .................................................................................................................. 12

00

13. Taxable Interest: (See Instructions, page 6) ........................................................................................................ 13

00

14. Gross Rents/Gross Royalties: (See Instructions, page 6) ................................................................................... 14

00

15. Gains or Losses: .................................................................................................................................................. 15

00

16. Other Income: ...................................................................................................................................................... 16

00

17. TOTAL INCOME: (Add Lines 11 through 16) ....................................................................................................... 17

00

18. Compensation of Offi cers/Other Salaries and Wages: (See Instructions, page 6) .............................................. 18

00

19. Repairs: ................................................................................................................................................................ 19

00

20. Bad Debts: ........................................................................................................................................................... 20

00

21. Rent on Business Property: ................................................................................................................................. 21

00

22. Taxes: (Attach Arkansas schedule, see Instructions, page 6).............................................................................. 22

00

23. Interest: ................................................................................................................................................................ 23

00

24. Contributions: ....................................................................................................................................................... 24

00

25. Depreciation: (Attach Arkansas schedule, see Instructions, page 6) ................................................................... 25

00

26. Depletion: ............................................................................................................................................................. 26

00

27. Advertising: .......................................................................................................................................................... 27

00

28. Other Deductions: (Attach schedule) ................................................................................................................... 28

00

29. TOTAL DEDUCTIONS: (Add Lines 18 through 28) ............................................................................................. 29

00

30. Taxable Income Before Net Operating Losses: (Line 17 less Line 29) ................................................................ 30

00

31. Net Operating Losses: (Adjust for Non-taxable Income – See Instructions, page 7) ........................................... 31

00

32. Net Taxable Income: (Line 30 less Line 31 or Schedule A C4 page 2) ................................................................ 32

00

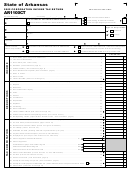

33. Tax from Table: (Instruction Booklet, pages 17 and 18) ....................................................................................... 33

00

34. Business and Incentive Credits (Attach all original certifi cates): ......................................................................... 34

00

35. Tax Liability: (Line 33 less Line 34) ...................................................................................................................... 35

00

36. Estimated Tax Paid: (Including estimate carryforward from prior year) ............................................................... 36

00

37. Payment with Extension Request: ....................................................................................................................... 37

00

38. Overpayment: (Line 36 plus Line 37 less Line 35, enter here) ............................................................................ 38

00

39. Amount Applied to 2010 Estimated Tax: ...................................................................39

00

40. Amount Applied to Check Off Contributions: (Attach AR1100-CO) ........................... 40

00

41. Amount To Be Refunded: (Line 38 less Lines 39 and 40) .....................................................................................41

00

42. Tax Due: (Line 35 less Lines 36 and 37) ...............................................................................................................42

00

43. Interest on Tax Due: (See Instructions, page 5) ................................................................................................... 43

00

44. Penalty for Late Filing or Payment: (See Instructions, page 5) ........................................................................... 44

00

45. Penalty for Underpayment of Estimated Tax: (Attach AR2220) Enter exception checked in Part 3 .................... 45

00

46. Amount Due: (Add Lines 42 through 45) ............................................................................................................. 46

AR1100CT (R 10/09)

1

1 2

2