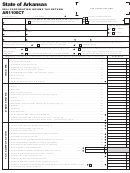

SCHEDULE A – Apportionment of Income for Multistate Corporation

FEIN:

A. INCOME TO APPORTION:

1. Income per Federal Return: (Federal Form 1120, Line 28) .........................................................................................

00

00

2. Add Adjustments: (Attach schedule) ..............................................................................

3. Deduct Adjustments: (Attach schedule) .........................................................................

00

4. TOTAL APPORTIONABLE INCOME: ..........................................................................................................................

00

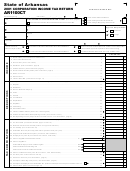

NOTE:

If all factors in Section B are 100%, do not complete Columns (A), (B), or (C). The return should be fi led as a status 1, CORPORATION

OPERATING ONLY IN ARKANSAS and complete all appropriate lines of page 1 of Form AR1100CT.

B. APPORTIONMENT FACTOR:

(A)

(B)

(C)

÷

1. Property Used in Business:

Amounts in Arkansas

Total Amounts

Percentage (A)

(B)

a. Tangible Assets Used in Business and Inventories

Less Construction in Progress:

(Calculate to 6 places to

1. Amount Beginning of Year: ...................................

00

00

the right of the decimal.

00

00

2. Amount End of Year: .............................................

Fill in all spaces.)

00

00

3. Total: (Add Lines a1 and a2) .................................

÷

4. Average Tangible Assets: (Line 3

2) .................

00

00

00

00

999.999999

b. Rental Property: (8 times annual rent) .......................

%

(EXAMPLE)

c. Average Value of Intangible Property:

(For Financial Institutions Only - Attach schedule)

00

00

00

00

%

d. TOTAL PROPERTY: (Add Lines a4, b, and c) .......

2. Salaries, Wages, Commissions and Other Compensation

Related to the Production of Business Income:

a. TOTAL: ...................................................................

00

00

%

3. Sales/Receipts:

00

a. Destination Shipped From Within Arkansas: ..............

00

b. Destination Shipped From Without Arkansas: ...........

c. Origin Shipped From Within Arkansas to U.S. Govt: .

00

d. Origin Shipped From Within Arkansas to

00

Other Non-taxable Jurisdictions: ................................

e. Other Gross Receipts: (Attach schedule) ..................

00

f. TOTAL SALES / RECEIPTS:

(Add Lines 3a through 3e) .....................................

00

00

%

g. DOUBLE WEIGHTED: (Applies to tax years beginning on or after January 1, 1995)

%

(Financial Institutions must use Single Weighted Factor) (Column C, Line 3f X 2) ................................................

4. Sum of Percentages:(Single Weighted: Add Column C, Lines 1d, 2a and 3f)

%

(Double Weighted: Add Column C, Lines 1d, 2a and 3g). ...........................................................

%

*5. Percentage Attributable to Arkansas: ...................Line 4

Divided By*

=

*For Part B, Line 5, Divide Line 4 by number of entries other than zero which you make on Part B, Column B, Lines (1d), (2a), and (3f).

NOTE: An entry other than zero in Part B, Column B, Line (3f), counts as two (2) entries unless using Single Weighted Factor.

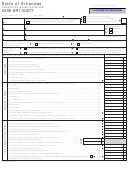

C. ARKANSAS TAXABLE INCOME:

00

1. Income Apportioned to Arkansas: (Part A, Line 4) x (Part B, Line 5,Column C) ..........................................................

2. Add: Direct Income Allocated to Arkansas: (Attach schedule) ....................................................................................

00

3. Less: Apportioned NOL to Arkansas: (See NOL Instructions, page 7) .......................................................................

00

4. TOTAL INCOME TAXABLE TO ARKANSAS: (Enter here and on Line 32, page 1) ....................................................

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, statements and documents, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

SIGNATURE OF OFFICER

DATE

TITLE

FOR OFFICE USE ONLY

PREPARER’S SIGNATURE

DATE

PREPARER’S FEIN/PIN

A

B

PREPARER’S PRINTED NAME

May the Arkansas Revenue Agency

C

discuss this return with the preparer

shown above?

D

AREA CODE AND TELEPHONE NUMBER OF PREPARER

Yes

No

E

Mail completed form to: Corporation Income Tax, P. O. Box 919, Little Rock, AR 72203-0919

F

AR1100CT Back (R 10/08)

CLICK HERE TO CLEAR FORM

1

1 2

2