Meal Tax Form - Revenue Division Of Department Of Finance Of Town Of Herndon

ADVERTISEMENT

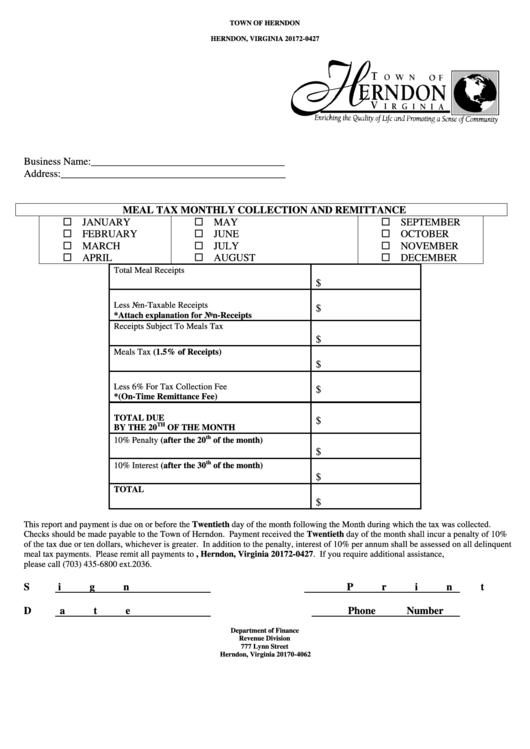

TOWN OF HERNDON

P.O. BOX 427

HERNDON, VIRGINIA 20172-0427

Business Name:_____________________________________

Address:___________________________________________

MEAL TAX MONTHLY COLLECTION AND REMITTANCE

JANUARY

MAY

SEPTEMBER

FEBRUARY

JUNE

OCTOBER

MARCH

JULY

NOVEMBER

APRIL

AUGUST

DECEMBER

Total Meal Receipts

$

Less Non-Taxable Receipts

$

*Attach explanation for Non-Receipts

Receipts Subject To Meals Tax

$

Meals Tax (1.5% of Receipts)

$

Less 6% For Tax Collection Fee

$

*(On-Time Remittance Fee)

TOTAL DUE

$

TH

BY THE 20

OF THE MONTH

th

10% Penalty (after the 20

of the month)

$

th

10% Interest (after the 30

of the month)

$

TOTAL

$

This report and payment is due on or before the Twentieth day of the month following the Month during which the tax was collected.

Checks should be made payable to the Town of Herndon. Payment received the Twentieth day of the month shall incur a penalty of 10%

of the tax due or ten dollars, whichever is greater. In addition to the penalty, interest of 10% per annum shall be assessed on all delinquent

meal tax payments. Please remit all payments to P.O. Box 427, Herndon, Virginia 20172-0427. If you require additional assistance,

please call (703) 435-6800 ext.2036.

Sign

Print Name

Date

Phone Number

Department of Finance

Revenue Division

777 Lynn Street

Herndon, Virginia 20170-4062

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1