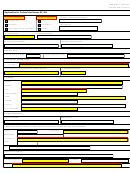

Form Cd-418 - Cooperative Or Mutual Association - 2016 Page 3

ADVERTISEMENT

Page 3,

Legal Name

FEIN

CD-418 Web, 8-16

Federal Taxable Income Before NOL Deduction

Adjustments to Federal Taxable Income

B

C

Complete this schedule if you do not attach a copy of your federal income tax return.

.

.

1. Additions:

00

00

1. a. Gross receipts or sales

.

.

a. Taxes based on net income

00

00

b. Returns and allowances

b. Contributions

.

.

c. Dividends paid on capital stock

00

00

c. Balance

(Line 1a minus Line 1b)

.

(From Schedule D, Line 1)

.

d. Nonpatronage income allocated to patrons

00

00

2. Cost of goods sold

(Attach schedule)

.

(From Schedule D, Line 2)

.

e. Expenses attributable to income not

00

00

3. Gross Profit

(Line 1c minus Line 2)

taxed

(See instructions for Form CD-405)

.

.

f. Domestic production activities deduction

00

00

.

4. Dividends

(Attach schedule)

(Schedule B, Line 22 minus Schedule D, Line 4)

.

00

.

g. Bonus depreciation

5. a. Interest on obligations of the

00

00

.

United States and its instrumentalities

.

h. Section 179 expense deduction

00

00

.

i. Other

(Attach schedule)

b. Other interest

.

00

00

2. Total Additions

(Add Lines 1a-1i)

6. Gross rents and royalties

.

.

3. Deductions

00

00

7. Capital gain net income

(Attach schedule)

.

.

a. U.S. obligation interest

(net of expenses)

00

00

.

b. Other deductible dividends

8. Net gain (loss)

(Attach schedule)

.

00

.

c. State net loss

00

9. Other income

(Attach schedule)

00

.

.

d. Bonus depreciation

10. Total Income

00

00

.

Add Lines 3 through 9

e. Section 179 expense deduction

.

00

11. Compensation of officers

f. Other

.

(Attach schedule)

00

(Attach schedule)

00

.

4. Total Deductions

(Add Lines 3a-3f)

12. Salaries and wages

00

.

(Less employment credits)

5. Adjustments to Federal

Taxable Income

.

00

13. Bad debts

.

Line 2 minus Line 4, enter amount

00

here and on Schedule A, Line 2

00

14. Rents

.

§

00

Deductions and Adjustments Under IRC

1382

D

15. Taxes and licenses

.

.

00

16. Interest

1.

.

Dividends paid on capital stock

00

(Internal Revenue Code § 521 cooperatives only)

00

.

17. Charitable contributions

2.

Nonpatronage income allocated to patrons

00

(Internal Revenue Code § 521 cooperatives only)

18. a. Depreciation

.

3. Patronage dividends:

b. Depreciation included

00

.

a. Money

.

in cost of goods sold

00

00

b. Qualified written notices of allocation

c. Balance

(Line 18a minus Line 18b)

.

.

c. Other property

(except nonqualified

00

00

19. Advertising

.

written notices of allocation)

00

d. Money or other property

.

(except written

20. Pension, profit-sharing,and similar plans

.

in redemption of

notices of allocation)

00

nonqualified written notices of allocation

00

21. Employee benefit programs

.

.

4. Domestic production activities deduction

(

00

)

00

22. Domestic production activities deduction

allocated to patrons

.

.

00

5. Total - Add Lines 1 through 4; enter

23. Other deductions

(Attach schedule)

.

00

amount here and on Schedule B, Line 26a

00

24. Total Deductions

(Add Lines 11-23)

Contributions

E

.

25. Taxable Income before IRC § 1382,

.

NOL, and Special Deductions

1. Enter total contributions to donees other

00

00

Line 10 minus Line 24

than those listed in Line 4, below

.

2. Multiply the amount shown on Schedule

.

26.

a. Deductions and adjustments under

A, Line 3 by 5% if Line 3 is greater than

00

00

.

IRC § 1382

zero. Otherwise, enter zero here.

(From Schedule D, Line 5)

.

00

3. Enter the lesser of Line 1 or Line 2

b. Special Deductions

.

00

(From Federal Form 1120-C, Line 26c)

4. Enter total contributions to the State

00

of N.C. and its political subdivisions

.

5. Amount Deductible

.

27. Federal Taxable Income Before NOL

00

Add Lines 3 and 4; enter total here and on

Line 25 minus Lines 26a and 26b; enter

00

amount here and on Schedule A, Line 1

Schedule A, Line 4

Note: The letters F through K are not used to designate schedules.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4