Credit Calculation Worksheet & Instructions For 2006 Income Tax Return (Form Ir) - City Of Forest Park, Ohio Tax Division

ADVERTISEMENT

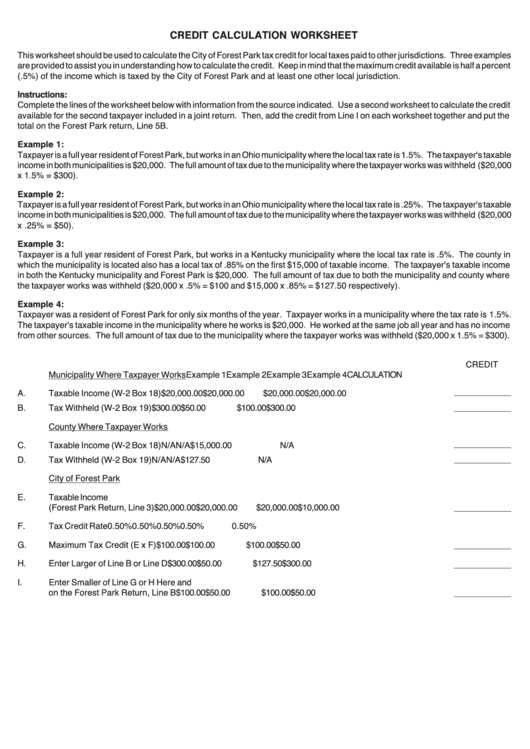

CREDIT CALCULATION WORKSHEET

This worksheet should be used to calculate the City of Forest Park tax credit for local taxes paid to other jurisdictions. Three examples

are provided to assist you in understanding how to calculate the credit. Keep in mind that the maximum credit available is half a percent

(.5%) of the income which is taxed by the City of Forest Park and at least one other local jurisdiction.

Instructions:

Complete the lines of the worksheet below with information from the source indicated. Use a second worksheet to calculate the credit

available for the second taxpayer included in a joint return. Then, add the credit from Line I on each worksheet together and put the

total on the Forest Park return, Line 5B.

Example 1:

Taxpayer is a full year resident of Forest Park, but works in an Ohio municipality where the local tax rate is 1.5%. The taxpayer's taxable

income in both municipalities is $20,000. The full amount of tax due to the municipality where the taxpayer works was withheld ($20,000

x 1.5% = $300).

Example 2:

Taxpayer is a full year resident of Forest Park, but works in an Ohio municipality where the local tax rate is .25%. The taxpayer's taxable

income in both municipalities is $20,000. The full amount of tax due to the municipality where the taxpayer works was withheld ($20,000

x .25% = $50).

Example 3:

Taxpayer is a full year resident of Forest Park, but works in a Kentucky municipality where the local tax rate is .5%. The county in

which the municipality is located also has a local tax of .85% on the first $15,000 of taxable income. The taxpayer's taxable income

in both the Kentucky municipality and Forest Park is $20,000. The full amount of tax due to both the municipality and county where

the taxpayer works was withheld ($20,000 x .5% = $100 and $15,000 x .85% = $127.50 respectively).

Example 4:

Taxpayer was a resident of Forest Park for only six months of the year. Taxpayer works in a municipality where the tax rate is 1.5%.

The taxpayer's taxable income in the municipality where he works is $20,000. He worked at the same job all year and has no income

from other sources. The full amount of tax due to the municipality where the taxpayer works was withheld ($20,000 x 1.5% = $300).

CREDIT

Municipality Where Taxpayer Works

Example 1

Example 2

Example 3

Example 4

CALCULATION

A.

Taxable Income (W-2 Box 18)

$20,000.00

$20,000.00

$20,000.00

$20,000.00

B.

Tax Withheld (W-2 Box 19)

$300.00

$50.00

$100.00

$300.00

County Where Taxpayer Works

C.

Taxable Income (W-2 Box 18)

N/A

N/A

$15,000.00

N/A

D.

Tax Withheld (W-2 Box 19)

N/A

N/A

$127.50

N/A

City of Forest Park

E.

Taxable Income

(Forest Park Return, Line 3)

$20,000.00

$20,000.00

$20,000.00

$10,000.00

F.

Tax Credit Rate

0.50%

0.50%

0.50%

0.50%

0.50%

G.

Maximum Tax Credit (E x F)

$100.00

$100.00

$100.00

$50.00

H.

Enter Larger of Line B or Line D

$300.00

$50.00

$127.50

$300.00

I.

Enter Smaller of Line G or H Here and

on the Forest Park Return, Line B

$100.00

$50.00

$100.00

$50.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3