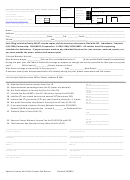

Whitley County, Kentucky Net Profit License Fee Return Form - 2016 Page 2

ADVERTISEMENT

2016

SECTION C

ALCOHOLIC BEVERAGE SALES DEDUCTION ( **ABSD**)

DIVIDE KENTUCKY ALCOHOLIC BEVERAGE SALES BY TOTAL SALES ( TOTAL SALES=GROSS RECEIPTS OF TOTAL SALES

WHETHER FROM ALCOHOLIC BEVERAGE OR OTHERWISE.)

Line 1a ALCOHOLIC BEVERAGE SALES__________________________________

Line 1 c =________________________%

Line 1b TOTAL SALES

___________________________________

Enter net profit from SECTION A LINE 6 _______________________X

Line 1d

Line 1 c =__________________________________

ENTER AMOUNT FROM LINE 1d ON SECTION A LINE 7

___________________________________________________________________________________________________________________

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE,

CORRECT, AND COMPLETE TO THE BEST OF MY KNOWLEDGE.

_______________________________________ _______________________________

____________________________

SIGNATURE OF TAXPAYER

TITLE

DATE

_______________________________________ _______________________________

PREPARER INFORMATION

DATE

YOU MUST ATTACH A COMPLETE COPY INCLUDING ALL ATTACHMENTS OF YOUR FEDERAL

AND STATE RETURN AS APPLICABLE (SEE INSTRUCTIONS).

THIS RETURN MUST BE FILED AND AMOUNT DUE PAID IN FULL ON OR BEFORE APRIL 15, OR WITHIN 105 DAYS

AFTER CLOSE OF FISCAL YEAR

EXTENSIONS –An extension of time for filing the Net Profits License Fee Return or a copy of the Federal Extension Request must be filed with this office

and will be granted for a period not to exceed six months.

The extension request must be a written request properly signed by the licensee or a duly authorized agent and received on or before the due date for filing.

If not penalty and interest will be charged.

A copy of the federal Form 4868, 8736, or 7004 for the same year may be used for the written request, provided that the licensee’s occupational license

fee reporting number and business name is plainly noted thereon.

An extension of time for filing the Net Profits License Fee Return does not extend the time for payment of the license fee. Full payment of the

estimated license fee liability must accompany the request for extension. Merely sending a tentative or estimated payment is not an acceptable

request for an extension, and the written request for the extension must be on a separate paper from the check by which the estimated payment is

made.

Interest at the rate of twelve (12) percent per annum simple interest shall apply to any unpaid license fee during the period of extension. No penalty

shall be assessed if the estimated tax paid is within ninety percent (90%) of the total tax owed as shown on the Net Profits License Fee Return and all

filing and payment requirements have been fulfilled and the final license fee and interest is paid with the filing of the Net Profits License Fee Return

within the period as extended. Any extension shall be granted with the understanding that all prior filing and payment requirements have been

fulfilled. However, if upon further examination it becomes evident that prior filing and payment requirements have not been fulfilled, interest and

penalty shall be assessed in full and in the same manner as though no extension had been granted.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2