Clear Form

W

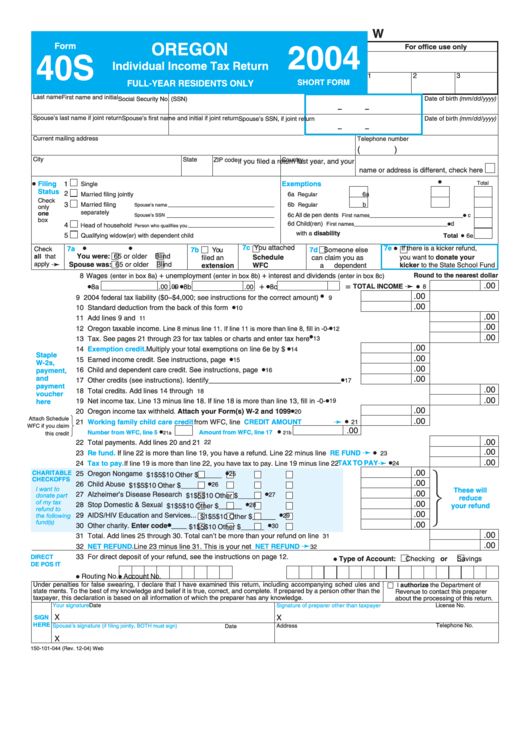

Form

OREGON

For office use only

2004

40S

Individual Income Tax Return

1

2

3

SHORT FORM

FULL-YEAR RESIDENTS ONLY

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

–

–

Date of birth (mm/dd/yyyy)

Spouse’s last name if joint return

Spouse’s first name and initial if joint return

Spouse’s SSN, if joint return

–

–

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you filed a return last year, and your

name or address is different, check here

•

•

Exemptions

Total

Filing

1

Single

Status

2

6a Yourself......

6a

Married filing jointly

Regular

........ Severely disabled

.........

Check

3

6b Spouse ......

b

Married filing

Regular

........ Severely disabled

...........

Spouse’s name

only

separately

one

•

6c All de pen dents

c

Spouse’s SSN

First names ________________________________

box

4

•

Head of household

6d Child(ren)

d

Person who qualifies you

First names ________________________________

with a disability

•

5

Qualifying widow(er) with dependent child

6e

Total

•

•

7a

•

Check

7c

You attached

7b

You

7d

Someone else

7e

If there is a kicker refund,

You were:

65 or older

Blind

all that

Schedule

filed an

can claim you as

you want to donate your

➛

apply

Spouse was:

65 or older

Blind

kicker to the State School Fund

extension

a dependent

WFC

+

+

Round to the nearest dollar

8 Wages

)

unemployment

interest and dividends

(enter in box 8a

(enter in box 8b)

(enter in box 8c)

➛

.00

•

+

•

+

•

=

•

TOTAL INCOME

8a

.00

8b

.00

8c

.00

8

•

.00

9 2004 federal tax liability ($0–$4,000; see instructions for the correct amount) ...........

9

.00

•

10 Standard deduction from the back of this form ...........................................................

10

.00

11 Add lines 9 and 10...............................................................................................................................................

11

.00

•

12 Oregon taxable income.

...........................................

Line 8 minus line 11. If line 11 is more than line 8, fill in -0-

12

•

.00

13 Tax. See pages 21 through 23 for tax tables or charts and enter tax here ....................................................

13

.00

•

14

Exemption credit.

Multiply your total exemptions on line 6e by $151 .......................

14

Staple

.00

•

15 Earned income credit. See instructions, page 10........................................................

15

W-2s,

.00

•

16 Child and dependent care credit. See instructions, page 10.......................................

payment,

16

and

.00

•

17 Other credits (see instructions). Identify __________________________________

17

payment

.00

18 Total credits. Add lines 14 through 17 .................................................................................................................

18

voucher

•

.00

19 Net income tax. Line 13 minus line 18. If line 18 is more than line 13, fill in -0- ..............................................

19

here

.00

•

20 Oregon income tax withheld. Attach your Form(s) W-2 and 1099 ...........................

20

Attach Schedule

➛

.00

•

21

Working family child care credit

from WFC, line

19.............CREDIT AMOUNT

21

WFC if you claim

.00

•

•

Number from WFC, line 5

Amount from WFC, line 17

21a

21b

this credit

.00

22 Total payments. Add lines 20 and 21 ..................................................................................................................

22

➛

.00

•

23

Re fund.

If line 22 is more than line 19, you have a refund. Line 22 minus line 19 ...................

RE FUND

23

➛

•

.00

.............TAX TO PAY

24

Tax to pay.

If line 19 is more than line 22 , you have tax to pay. Line 19 minus line 22

24

.00

•

CHARITABLE

25 Oregon Nongame Wildlife ...............

$1 ......

$5 .....

$10 .....

25

Other $______

CHECKOFFS

.00

•

26 Child Abuse Prevention...................

$1 ......

$5 .....

$10 .....

26

Other $______

I want to

These will

.00

•

donate part

27 Alzheimer’s Disease Research .......

$1 ......

$5 .....

$10 .....

27

Other $______

reduce

of my tax

.00

•

28 Stop Domestic & Sexual Violence...

$1 ......

$5 .....

$10 .....

28

Other $______

your refund

refund to

.00

the following

•

29 AIDS/HIV Education and Services ...

$1 ......

$5 .....

$10 .....

29

Other $______

fund(s)

•

.00

•

30 Other charity. Enter code

____ ....

$1 ......

$5 .....

$10 .....

30

Other $______

.00

31 Total. Add lines 25 through 30. Total can’t be more than your refund on line 23.................................................

31

➛

.00

32

NET REFUND.

Line 23 minus line 31. This is your net refund.............................................

NET REFUND

32

33 For direct deposit of your refund, see the instructions on page 12.

DIRECT

•

Type of Account:

Checking or

Savings

DE POS IT

•

•

Routing No.

Account No.

Under penalties for false swearing, I declare that I have examined this return, including accompanying sched ules and

I authorize the Department of

state ments. To the best of my knowledge and belief it is true, correct, and complete. If prepared by a person other than the

Revenue to contact this preparer

taxpayer, this declaration is based on all information of which the preparer has any knowledge.

about the processing of this return.

Your signature

Date

Signature of preparer other than taxpayer

License No.

X

X

SIGN

HERE

Address

Telephone No.

Spouse’s signature

(if filing jointly, BOTH must sign)

Date

X

150-101-044 (Rev. 12-04) Web

1

1 2

2