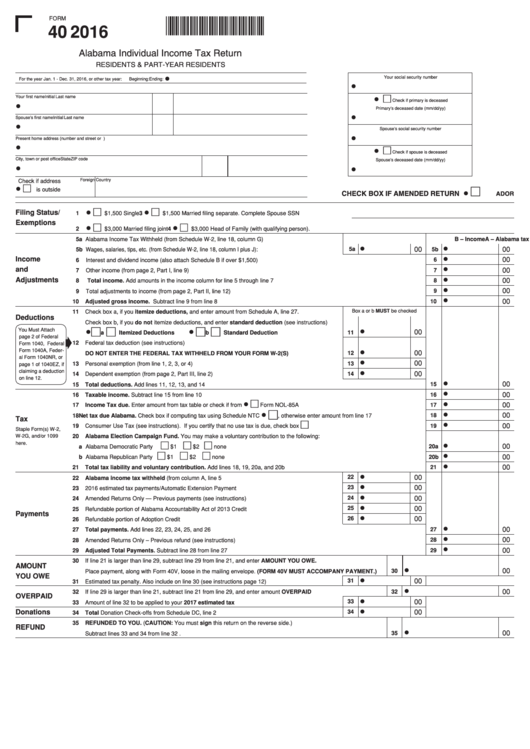

Form 40 - Individual Income Tax Return - 2016

ADVERTISEMENT

FORM

16000140

40

2016

Alabama Individual Income Tax Return

RESIDENTS & PART-YEAR RESIDENTS

•

Your social security number

For the year Jan. 1 - Dec. 31, 2016, or other tax year:

Beginning:

Ending:

•

Your first name

Initial

Last name

•

Check if primary is deceased

•

Primary’s deceased date (mm/dd/yy)

•

Spouse’s first name

Initial

Last name

•

Spouse’s social security number

•

Present home address (number and street or P.O. Box number)

•

•

Check if spouse is deceased

City, town or post office

State

ZIP code

Spouse’s deceased date (mm/dd/yy)

•

•

Check if address

Foreign Country

•

is outside U.S.

•

CHECK BOX IF AMENDED RETURN

ADOR

•

•

Filing Status/

1

$1,500 Single

3

$1,500 Married filing separate. Complete Spouse SSN

Exemptions

•

•

2

$3,000 Married filing joint

4

$3,000 Head of Family (with qualifying person).

5a Alabama Income Tax Withheld (from Schedule W-2, line 18, column G) . . . . . . . . . . . . . . . . . . . . . . . . . . .

A – Alabama tax withheld

B – Income

•

•

00

00

5a

5b

5b Wages, salaries, tips, etc. (from Schedule W-2, line 18, column I plus J): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

Income

00

6 Interest and dividend income (also attach Schedule B if over $1,500). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

and

00

7 Other income (from page 2, Part I, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

•

Adjustments

00

8 Total income. Add amounts in the income column for line 5 through line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

•

00

9 Total adjustments to income (from page 2, Part II, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

00

10

10 Adjusted gross income. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Box a or b MUST be checked

11 Check box a, if you itemize deductions, and enter amount from Schedule A, line 27.

Deductions

Check box b, if you do not itemize deductions, and enter standard deduction (see instructions)

You Must Attach

•

•

•

00

a

Itemized Deductions

b

Standard Deduction . . . . . . . . . . . . . . . . . . . . . . . . . .

11

page 2 of Federal

12 Federal tax deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 1040, Federal

Form 1040A, Feder-

•

00

12

DO NOT ENTER THE FEDERAL TAX WITHHELD FROM YOUR FORM W-2(S)

al Form 1040NR, or

•

00

13 Personal exemption (from line 1, 2, 3, or 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

page 1 of 1040EZ, if

claiming a deduction

•

00

14 Dependent exemption (from page 2, Part III, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

on line 12.

•

00

15 Total deductions. Add lines 11, 12, 13, and 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

•

00

16 Taxable income. Subtract line 15 from line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

•

00

17

17 Income Tax due. Enter amount from tax table or check if from

Form NOL-85A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

•

00

18 Net tax due Alabama. Check box if computing tax using Schedule NTC

, otherwise enter amount from line 17 . . . . . . . . . . . . . . .

18

Tax

•

00

19 Consumer Use Tax (see instructions). If you certify that no use tax is due, check box

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

Staple Form(s) W-2,

W-2G, and/or 1099

20 Alabama Election Campaign Fund. You may make a voluntary contribution to the following:

here.

•

00

a Alabama Democratic Party

$1

$2

none . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20a

•

00

20b

b Alabama Republican Party

$1

$2

none . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

21 Total tax liability and voluntary contribution. Add lines 18, 19, 20a, and 20b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

•

00

22

22 Alabama income tax withheld (from column A, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

23

00

23 2016 estimated tax payments/Automatic Extension Payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

24

24 Amended Returns Only — Previous payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

25

00

25 Refundable portion of Alabama Accountability Act of 2013 Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Payments

•

26

00

26 Refundable portion of Adoption Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

27

27 Total payments. Add lines 22, 23, 24, 25, and 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

28 Amended Returns Only – Previous refund (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

•

00

29 Adjusted Total Payments. Subtract line 28 from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 If line 21 is larger than line 29, subtract line 29 from line 21, and enter AMOUNT YOU OWE.

AMOUNT

•

00

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.)

30

YOU OWE

•

00

31

31 Estimated tax penalty. Also include on line 30 (see instructions page 12) . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

32 If line 29 is larger than line 21, subtract line 21 from line 29, and enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . .

32

OVERPAID

•

00

33

33 Amount of line 32 to be applied to your 2017 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

Donations

34

00

34 Total Donation Check-offs from Schedule DC, line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35 REFUNDED TO YOU. (CAUTION: You must sign this return on the reverse side.)

REFUND

•

00

35

Subtract lines 33 and 34 from line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2