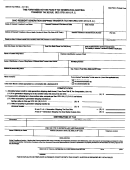

Form 22 - Certificate Of Estate Tax Payment And Real Property Disclosure For Dates Of Death On Or After November 8, 1990 (Section 5731.21 O.r.c.) Page 2

ADVERTISEMENT

Estate Tax Form 22

Instructions for Completion

Page 2

Estate Representative

The estate representative completes Section A in Parts I and II of this certificate.

The estate representative is required to sign Part I of the certificate. For dates of

death on or after November 8, 1990, this certificate is required to accompany one of

the following returns when it is filed with the probate court:

(a) Resident Ohio Estate Tax Return (ET Form 2)

(b) Nontaxable Return (ET Form 1-B or 2)

(c) Non-resident Estate Tax Return (ET Form 4)

(d) Amended Ohio Estate Tax Return (ET Form 2-X(i))

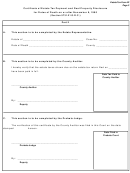

Probate Court

Upon receipt of one of the following returns for filing, the probate court date stamps

both the return and Part I of this certificate.

(a) Resident Ohio Estate Tax Return (ET Form 2)

(b) Nontaxable Return (ET Form 1-B or 2)

(c) Non-resident Estate Tax Return (ET Form 4)

(d) Amended Ohio Estate Tax Return (ET Form 2-X(i))

Part I is maintained in the court’ s public record file. Part II of this certificate is for-

warded to the County Auditor with the filed return or ET Form 5 for verification of

payment of tax.

After receipt of Part II of this certificate from the County Auditor, the probate court

signs and date stamps Section C. Part II is then filed with Part I in the public record

file.

County Auditor

If the estate taxes have been paid in full, the County Auditor completes Section B of

Part II of this certificate to verify that the taxes have been paid in full. The County

Auditor validates the date the return was filed. When the taxes are paid, the County

Auditor signs and date stamps Part II. After completion, Part II is returned to the

probate court. This same procedure is followed for nontaxable filings.

Part II of this certificate is maintained at the County Auditor’ s office until all taxes

shown to be due have been paid.

Note: This certificate does not take effect until verification of payment of tax is received from the County Auditor’ s

office. Any questions regarding this form should be directed to the Ohio Estate Tax Division at (614) 895-5710.

Continuation of Property Description

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4