Income Tax Return Form Page 2

ADVERTISEMENT

SCHEDULE X Reconciliation with Federal Income Tax Return (See Instructions Below)

ITEMS NOT TAXABLE

DEDUCT

ITEMS NOT DEDUCTIBLE

N.

Capital Gains .................................................. $ ______________

A.

CAPITAL LOSSES (Excluding ordinary losses)........ $ _____________

B.

EXPENSES APPLICABLE TO NON-TAXABLE

RE: Form 4797 (excluding ordinary gains)

O.

Interest ............................................................ $ ______________

INCOME (at least 5% of Line Z) ............................... $ _____________

P.

Dividends......................................................... $ ______________

C.

TAXES BASED ON INCOME ................................... $ _____________

Q.

LOSS CARRY FORWARD (Attach Schedule) $ ______________

D.

SICK PAY NOT INCLUDED

R.

OTHER (Explain) SEE INSTRUCTIONS ........ $ ______________

ON PAGE 1............................................................... $ _____________

E.

PAYMENTS TO PARTNERS.................................... $ _____________

................................................................................. $ ______________

................................................................................. $ ______________

F.

CONTRIBUTIONS .................................................... $ _____________

................................................................................. $ ______________

G.

IRA OR KEOGH PAYMENTS, ETC.......................... $ _____________

................................................................................. $ ______________

H.

ALIMONY.................................................................. $ _____________

TOTAL DEDUCTION .................. $ ______________

I.

OTHER EXPENSES NOT DEDUCTIBLE (Explain) . $ _____________

J.

TOTAL ADDITIONS (Enter under Line Z)................. $ _____________

Total Additions (From Line J) ...... $ ______________

TOTAL SCHEDULE X (Enter as Line 3 - on front side) ........... ........................................................................................................ $ ______________

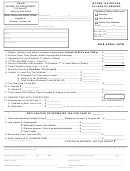

SCHEDULE Y Business Allocation Formula (See Instructions Below)

A. Located

B. Located

C. Percentage

(B ÷ A)

Everywhere

in the Municipality

Step 1. Average value of real and tangible personal property .................................... $ _______________

$ ______________

______________ %

Gross annual rentals multiplied by 8................................................................ $ _______________

$ ______________

______________ %

Total step 1. ..................................................................................................... $ _______________

$ ______________

______________ %

Step 2. Gross receipts from sales and work or services performed (See instr.) .......... $ _______________

$ ______________

______________ %

Step 3. Total wages, salaries, commissions, and other compensation paid ................ $ _______________

$ ______________

______________ %

Step 4. Total percentages ............................................................................................................................................................................. ______________ %

Step 5. Average percentage (Divide Total percentage by number of percentages used - enter on Line 5) ................................................. ______________ %

SCHEDULE Z Partner’s Distributive Shares of Net Income (From Federal Schedule 1065K and 1099) (See Instructions Below)

2

3

4

5

6

Distributive Shares

Resident

of Partners

Other

Taxable

Amount

1. Name and Address of Each Partner

Yes

No

Percent

Amount

Payments

Percentage

Taxable

(a)

% $

$

% $

(b)

% $

$

% $

(c)

% $

$

% $

(d)

% $

$

% $

7. Totals

100% $

$

% $

GENERAL TAX INFORMATION MUST BE COMPLETED

Business Allociation Formula

1.

Date Business or Trust created _____________________________________

SCHEDULE Y

A business allocation formula consisting of the average of property, gross

2.

Did you file a return last year?

Yes

No

receipts and wages paid, may be used by business entities not required to pay tax on entire

net profits, by reason of doing business both inside and outside the Municipality limits. How-

3.

Did you have employees during the past year?

Yes

No

ever, if the books and records of the taxpayer shall disclose with reasonable accuracy the net

profit attributable to the Municipality, then only this portion shall be considered as having a

4.

On what basis are your records kept?

Cash

Accrual

taxable status in the Municipality.

Completed Contract

Other ___________________________

SPECIAL NOTE: Sales and gross receipts in the Municipality (Step 2) mean:

5.

Has your Federal Tax Liability for any prior year been changed in the year cov-

1.

All sales and tangible personal property which is shipped from the Village to

ered by this return as a result of an examination by the Internal Revenue Service?

purchasers outside the Village regardless of where title passes if the taxpayer is

not, through its own employees, regularly engaged in the solicitation or promo-

Yes

No

tion of sales at the place where delivery is made.

2.

All sales of tangible personal property which is delivered within the Municipality

If Business terminated complete the following: Date Business terminated: _____________

regardless of where title passes, even though transported from a point outside

the Municipality, if the taxpayer is regularly engaged through its own employees

If you sold your business, give name and address of purchaser:

in the solicitation and the sales result from such solicitation or promotion.

Name: __________________________________________________________________

3.

All sales of tangible personal property which is delivered within the Municipality,

Address: ________________________________________________________________

regardless of where title passes, if shipped or delivered from a stock of goods

within the Municipality.

If Business Entity changed during past year, mark appropriate blocks:

FROM:

Individual

Partnership

Corporation

Partnership Distributive Share of Net Income

TO:

Individual

Partnership

Corporation

SCHEDULE Z

Must be completed by all partners and associations filing returns. Amount

shown in this schedule must correspond with amount reported on your Federal Partnership

SCHEDULE INSTRUCTIONS

Form. Attach a schedule 1065.

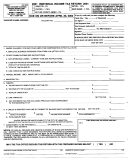

Reconciliation with Federal Income Tax Return

SCHEDULE X

is used for the purpose of making adjustments when total income (Line 2) includes income

not taxable and/or items not deductible for municipal purposes. Enter the amounts of any such items in

Schedule X and carry total (Line J and Line Z) respectively to Line 3. Line A, Capital Losses from the sale,

exchange or other disposition of property shall not be taken into consideration in arriving at net profits earned,

Line B. If you have deducted non-taxable income (Line Z) expenses attributable to this non-taxable income

shall not be allowed as a deduction from the remaining taxable income. Line C would include federal, state,

local and other taxes based on income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2