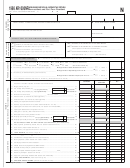

FORM 740-NP (2007)

Page 2

REFUND/TAX PAYMENT SUMMARY

00

29 Enter amount from page 1, line 28. This is your

Total Tax Liability

.......................................................................................................................

29

30 (a) Enter Kentucky income tax withheld as shown on attached

•

00

2007 Form W-2(s) and other supporting statements ..........................................................

30(a)

•

00

30(b)

(b) Enter 2007 Kentucky estimated tax payments ........................................................................

(c) Enter refundable Kentucky corporation tax credit (KRS 141.420(3)(c))

•

00

as shown on attached Kentucky Schedule(s) K-1 or Form(s) 725 ............................

30(c)

00

31 Add lines 30(a) through 30(c) ..........................................................................................................................................................................................

31

00

32 If line 31 is larger than line 29, enter AMOUNT OVERPAID (see instructions) .............................................................................................

32

See instructions for a detailed description of funds.

(Enter amount(s) checked)

•

00

33 Nature and Wildlife Fund Contribution

$10

$25

$50

Other

33

•

00

34

Child Victims' Trust Fund Contribution

$10

$25

$50

Other

34

•

00

35 Veterans' Program Trust Fund Contribution ..................................................................................................................

35

•

00

36 Breast Cancer Research and Education Trust Fund Contribution ........................................................................

36

00

37 Add lines 33 through 36 ......................................................................................................................................................................................................

37

•

38 Amount of line 32 to be CREDITED TO YOUR 2008 ESTIMATED TAX ...........................................................................................................

00

38

•

00

39 Subtract lines 37 and 38 from line 32. Amount to be REFUNDED TO YOU ...................................................................

39

REFUND

•

00

40 If line 29 is larger than line 31, enter ADDITIONAL TAX DUE ............................................................................................................................

40

41 (a) Estimated tax penalty

(c) Late payment penalty

(d) Late filing penalty

Check if Form 2210-K attached

•

00

(b) Interest

(e) Add lines 41(a) through 41(d). Enter here ................................

41(e)

00

OWE

42 Add lines 40 and 41(e) and enter here. This is the AMOUNT YOU OWE ..................................................................................

42

Make check payable to Kentucky State Treasurer.

Write your Social Security number and "KY Income Tax-2007" on the check.

A copy of pages 1 and 2 of your federal income tax return and all supporting schedules must be attached to Kentucky Form 740-NP.

I, the undersigned, declare under penalties of perjury that I have examined this return, including all accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. I also understand and agree that our election to file a combined return under the provisions of Regulation 103

KAR 17:020 will result in refunds being made payable to us jointly and in each of us being jointly and severally liable for all taxes accruing under this return.

(

)

Your Signature (If joint return, both must sign.)

Spouse's Signature

Date Signed

Telephone Number (daytime)

Typed or Printed Name of Preparer Other than Taxpayer

I.D. Number of Preparer

Date

Mail to:

Kentucky Department of Revenue, Frankfort, KY 40618-0006.

REFUNDS

Kentucky Department of Revenue, Frankfort, KY 40619-0008.

PAYMENTS

Official Use Only

EST

CF

NT

P B F

R

1

1 2

2 3

3 4

4