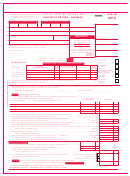

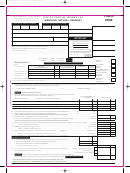

Form P1040 (R) - Individual Return - Resident - 2005 Page 2

ADVERTISEMENT

IMPORTANT

- DETAILED SUPPORTING SCHEDULES MUST BE ATTACHED WHERE INDICATED BELOW. FAILURE TO ATTACH SCHEDULES

OR ATTACHING INCOMPLETE SCHEDULES CAN RESULT IN DEDUCTIONS AND LOSSES BEING DISALLOWED OR DELAY THE PROCESSING

OF YOUR RETURN UNTIL ACCEPTABLE SCHEDULES ARE OBTAINED.

ADDITIONAL INCOME TO BE INCLUDED:

PROFIT OR LOSS FROM BUSINESS OR PROFESSION

ONLY USE LINES 16, 17 OR 18 BELOW, IF YOU FILED A SCHEDULE C WITH YOUR FEDERAL RETURN, AND A COPY IS ATTACHED TO THIS RETURN.

16. Net profit (or loss) from business or professi

16.

.00

17.

17.

.00

18.

18.

.00

19.

.00

19.

SALES OR EXCHANGES OF PROPERTY

ATTACH A COPY OF YOUR FEDERAL SCHEDULE D AND FORM 4797 (IF APPLICABLE).

20a.

20a.

.00

20b.

20b.

.00

RENTS AND ROYALTIES

21. Net income (or loss) from rents and royalties. Copies of ALL federal schedules must be attached

21.

.00

OTHER INCOME

22.

All other income not previously discussed is reported here. This includes partnerships, estates, trusts, alimony received, distributions from profit

sharing plans, distributions from IRAs, capital gains, gambling winnings from lotteries, casinos, racetracks, bingo halls, or any other source.

Received from

Kind of Income

Federal Identification

Number

a.

a.

.00

b.

b.

.00

c.

c.

.00

d.

d.

.00

22.

.00

23. TOTAL

23.

.00

DEDUCTIONS ALLOWED:

You must attach a copy of your Federal form(s) to support entries on Line 24.

24.

.00

.00

.00

.00

25. TOTAL DEDUCTIONS - enter on page 1 line 8

25.

.00

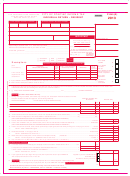

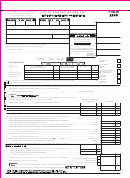

CREDITS ALLOWED:

26. MULTIPLE TAXING CITY CREDIT (see instructions for limitations. Attach other City's 1040 income tax form)

a. Income earned in other city before exemptions

a.

.00

b.

.00

.00

c.

d.

.005

.00

e.

f. Credit for taxes paid by Partnership on behalf of partner (provide Partnership name(s) and

.00

f.

g.

.00

Line 26

.00

I declare that I have examined this return (including accompanying schedule and statements and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than the taxpayer, his declaration is based on all information of which he has any knowledge.

X

X

(

)

Signature

Date

Daytime Phone #

Signature of preparer other than taxpayer

DATE

X

(

)

Signature

Date

Daytime Phone #

Firm name and address

MAIL RETURNS WITH PAYMENTS FOR BALANCE

MAIL ALL OTHER RETURNS

DUE (INCLUDE SS# ON CHECK OR MONEY ORDER)

City, State and Zip.

TO:

CITY TREASURER

TO:

INCOME TAX DIVISION

TELEPHONE # (248) 758-3236

CITY OF PONTIAC

CITY OF PONTIAC

If you have any questions regarding

P. O. BOX 430779

47450 WOODWARD AVE

City of Pontiac Income Tax.

PONTIAC, MI 48343-0779

PONTIAC, MI 48342

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2