Tax On Gross Sales And Rentals Form - 2004

ADVERTISEMENT

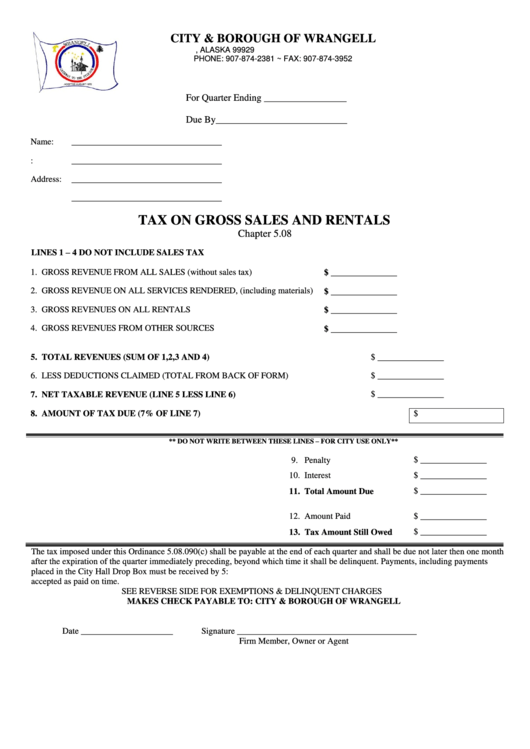

CITY & BOROUGH OF WRANGELL

P.O. BOX 531 WRANGELL, ALASKA 99929

PHONE: 907-874-2381 ~ FAX: 907-874-3952

For Quarter Ending _________________

Due By___________________________

Name:

__________________________________

D.B.A.:

__________________________________

Address:

__________________________________

__________________________________

TAX ON GROSS SALES AND RENTALS

Chapter 5.08

LINES 1 – 4 DO NOT INCLUDE SALES TAX

1. GROSS REVENUE FROM ALL SALES (without sales tax)

$ _______________

2. GROSS REVENUE ON ALL SERVICES RENDERED, (including materials)

$ _______________

3. GROSS REVENUES ON ALL RENTALS

$ _______________

4. GROSS REVENUES FROM OTHER SOURCES

$ _______________

$ _______________

5. TOTAL REVENUES (SUM OF 1,2,3 AND 4)

6. LESS DEDUCTIONS CLAIMED (TOTAL FROM BACK OF FORM)

$ _______________

$ _______________

7. NET TAXABLE REVENUE (LINE 5 LESS LINE 6)

$

8. AMOUNT OF TAX DUE (7% OF LINE 7)

** DO NOT WRITE BETWEEN THESE LINES – FOR CITY USE ONLY**

9. Penalty

$ _______________

10. Interest

$ _______________

11. Total Amount Due

$ _______________

12. Amount Paid

$ _______________

13. Tax Amount Still Owed

$ _______________

The tax imposed under this Ordinance 5.08.090(c) shall be payable at the end of each quarter and shall be due not later then one month

after the expiration of the quarter immediately preceding, beyond which time it shall be delinquent. Payments, including payments

placed in the City Hall Drop Box must be received by 5:00p.m. on the due date. Payments postmarked on the due date will be

accepted as paid on time.

SEE REVERSE SIDE FOR EXEMPTIONS & DELINQUENT CHARGES

MAKES CHECK PAYABLE TO: CITY & BOROUGH OF WRANGELL

Date _____________________

Signature _________________________________________

Firm Member, Owner or Agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2