FORM

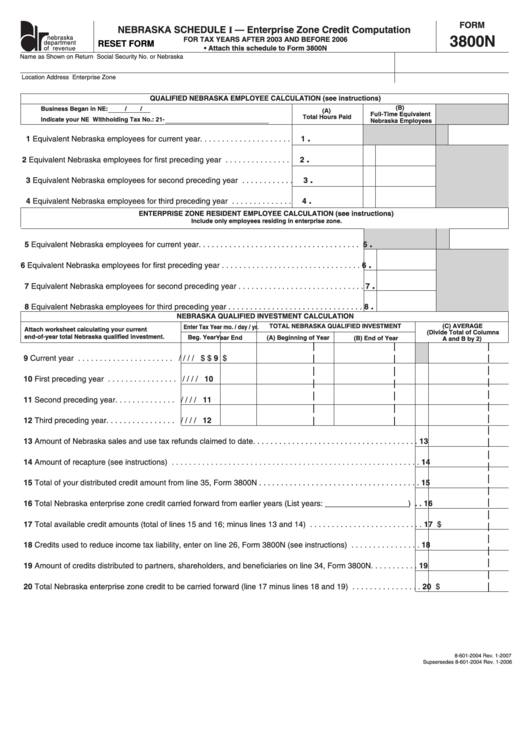

NEBRASKA SCHEDULE I — Enterprise Zone Credit Computation

3800N

nebraska

FOR TAX YEARS AFTER 2003 AND BEFORE 2006

department

RESET FORM

• Attach this schedule to Form 3800N

of revenue

Name as Shown on Return

Social Security No. or Nebraska I.D. No.

Location Address

Enterprise Zone

QUALIFIED NEBRASKA EMPLOYEE CALCULATION (see instructions)

(B)

Business Began in NE:

/

/

(A)

Full-Time Equivalent

Total Hours Paid

Indicate your NE Withholding Tax No.: 21-

Nebraska Employees

.

1 Equivalent Nebraska employees for current year . . . . . . . . . . . . . . . . . . . . .

1

.

2 Equivalent Nebraska employees for first preceding year . . . . . . . . . . . . . . .

2

.

3 Equivalent Nebraska employees for second preceding year . . . . . . . . . . . .

3

.

4 Equivalent Nebraska employees for third preceding year . . . . . . . . . . . . . .

4

ENTERPRISE ZONE RESIDENT EMPLOYEE CALCULATION (see instructions)

Include only employees residing in enterprise zone.

.

5 Equivalent Nebraska employees for current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

6 Equivalent Nebraska employees for first preceding year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

7 Equivalent Nebraska employees for second preceding year. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

8 Equivalent Nebraska employees for third preceding year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

NEBRASKA QUALIFIED INVESTMENT CALCULATION

(C) AVERAGE

TOTAL NEBRASKA QUALIFIED INVESTMENT

Enter Tax Year mo. / day / yr.

Attach worksheet calculating your current

(Divide Total of Columns

end-of-year total Nebraska qualified investment.

Beg. Year

Year End

(A) Beginning of Year

(B) End of Year

A and B by 2)

9 Current year . . . . . . . . . . . . . . . . . . . . . .

/

/

/

/

$

$

9 $

10 First preceding year . . . . . . . . . . . . . . . .

10

/

/

/

/

11 Second preceding year. . . . . . . . . . . . . .

/

/

/

/

11

12 Third preceding year. . . . . . . . . . . . . . . .

/

/

/

/

12

13 Amount of Nebraska sales and use tax refunds claimed to date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Amount of recapture (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Total of your distributed credit amount from line 35, Form 3800N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Total Nebraska enterprise zone credit carried forward from earlier years (List years: ___________________) . . 16

17 Total available credit amounts (total of lines 15 and 16; minus lines 13 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . 17 $

18 Credits used to reduce income tax liability, enter on line 26, Form 3800N (see instructions) . . . . . . . . . . . . . . . . 18

19 Amount of credits distributed to partners, shareholders, and beneficiaries on line 34, Form 3800N . . . . . . . . . . . 19

20 Total Nebraska enterprise zone credit to be carried forward (line 17 minus lines 18 and 19) . . . . . . . . . . . . . . . . 20 $

8-601-2004 Rev. 1-2007

Supsersedes 8-601-2004 Rev. 1-2006

1

1