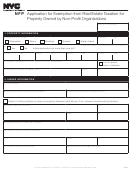

Form Tb2 - Non Profit Organizations Exemption Page 3

ADVERTISEMENT

Use of Technical Bulletins: A technical bulletin supplies general information to the public and does not replace

the need for competent legal advise. This technical bulletin supersedes all prior department pronouncements on

this subject.

For more information: Call Taxpayer Services at (802)828-2551; fax to (802)828-2720; or write to Business

Taxes Division, P.0. Box 547, Montpelier, VT 05601-0547.

Signed:

Gloria Hobson

Director, Business Taxes

Approved:

Betsy Anderson

Commissioner of Taxes

The Internal Revenue Code sections referenced in this technical bulletin are quoted below. These sections are

provided for your convenience and any questions concerning the sections should be directed to the Internal

Revenue Service. The text is from the Internal Revenue Code (Including all 1994 amendments), published by

CCH, Inc., December, 1994.

Internal Revenue Code 1986 Code Subtitle A, Ch. 1F, Part 1

Section 501. Exemption From Tax On Corporations, Certain Trusts, Etc.

501(c)(3) Corporations, and any community chest, fund, or foundation, organized and operated exclusively for

religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or

international amateur sports competition (but only if not part of its activities involve the provision of athletic

facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earning of

which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which

is carrying on propaganda, or otherwise attempting, to influence legislation, (except as otherwise provided in

subsection (h)), and which does not participate in, or intervene in (including the publishing or distributing of

statements), any political campaign on behalf of (or in opposition to) any candidate for public office.

Internal Revenue Code 1986 Code Subtitle A, Ch. 1F, Part II

Section 508. Special Rules With Respect To Section 501(c)(3) Organizations.

508(c) Exceptions. -

(1) Mandatory Exceptions. - Subsections (a) and (b) shall not apply to-

(A) churches, their integrated auxiliaries, and conventions or associations of churches, or

(B) any organization which is not a private foundation (as defined in section 509(a)) and the

gross receipts of which in each taxable year are normally not more than $5,000.

(2) Exceptions By Regulation. - The Secretary may be regulations exempt (to the extent and subject to such

conditions as may be prescribed in such regulations) from the provisions of subsection (a) or (b) or both -

(A) educational organizations described in section 170(b)(1)(A)(ii), and

(B) any other class of organizations with respect to which the Secretary determines that full

compliance with the provisions of subsections (a) and (b) is not necessary to the efficient

administration of the provisions of this title relating to private foundations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5