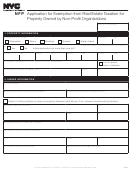

Form Tb2 - Non Profit Organizations Exemption Page 4

ADVERTISEMENT

August 18, 1995

TO: 501(c)(3) Non Profit Organizations

RE: Sales and Use Tax

FOR MORE INFORMATION: Call 802 828 2551 Fax 802 828 2720

Write Vermont Department of Taxes

P.0. Box 547

Montpelier, VT 05601-0547

The amendment of the law governing sales and use tax exemption for 501(c)(3) non profit organizations by the

1995 Legislature may affect your organization. The enclosed technical bulletin describes the new criteria for

exemption.

Under the new law, you may now be required to collect tax on your sales. If your sales are taxable, you will

need to register with the Department for a sales tax account number. A registration form for 501(c)(3)

organizations accompanies this mailing for your convenience.

Please contact the Business Taxes Division if you need further information.

encl.

REPLY TO:

Vermont Department of Taxes

P.O. Box 547

Montpelier, VT 05601-0547

REGISTRATION FOR SALES TAX ACCOUNT

FOR 501(c)(3) ORGANIZATION

Vt. Account No. _______________________ Federal ID No. _____________________

Organization Name ______________________________________________________

Mailing Address _________________________________________________________

________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5