Quarterly Liquor License Tax Return Form

ADVERTISEMENT

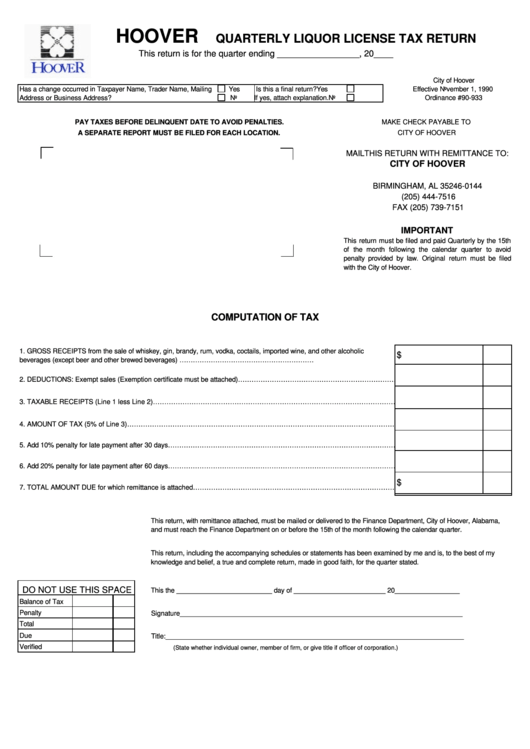

HOOVER

QUARTERLY LIQUOR LICENSE TAX RETURN

This return is for the quarter ending _________________, 20____

City of Hoover

Has a change occurred in Taxpayer Name, Trader Name, Mailing

Yes

Is this a final return?

Yes

Effective November 1, 1990

Address or Business Address?

No

If yes, attach explanation.

No

Ordinance #90-933

PAY TAXES BEFORE DELINQUENT DATE TO AVOID PENALTIES.

MAKE CHECK PAYABLE TO

A SEPARATE REPORT MUST BE FILED FOR EACH LOCATION.

CITY OF HOOVER

MAILTHIS RETURN WITH REMITTANCE TO:

CITY OF HOOVER

P.O. BOX 11407

BIRMINGHAM, AL 35246-0144

(205) 444-7516

FAX (205) 739-7151

IMPORTANT

This return must be filed and paid Quarterly by the 15th

of the month following the calendar quarter to avoid

penalty provided by law. Original return must be filed

with the City of Hoover.

COMPUTATION OF TAX

1. GROSS RECEIPTS from the sale of whiskey, gin, brandy, rum, vodka, coctails, imported wine, and other alcoholic

$

beverages (except beer and other brewed beverages) ……………………………………………………

2. DEDUCTIONS: Exempt sales (Exemption certificate must be attached)………………………………………………………………………………………………..

3. TAXABLE RECEIPTS (Line 1 less Line 2)………………………………………………………………………………………………………………..…………..

4. AMOUNT OF TAX (5% of Line 3)……………………………………………………………………………….………………………………………………….

5. Add 10% penalty for late payment after 30 days……………………………………………………………………………………………………

6. Add 20% penalty for late payment after 60 days………………………………………………………………………………………………..

$

7. TOTAL AMOUNT DUE for which remittance is attached…………………………………………………………………………………………………………………

This return, with remittance attached, must be mailed or delivered to the Finance Department, City of Hoover, Alabama,

and must reach the Finance Department on or before the 15th of the month following the calendar quarter.

This return, including the accompanying schedules or statements has been examined by me and is, to the best of my

knowledge and belief, a true and complete return, made in good faith, for the quarter stated.

DO NOT USE THIS SPACE

This the _________________________ day of ________________________ 20_________________

Balance of Tax

Penalty

Signature__________________________________________________________________________

Total

Due

Title:______________________________________________________________________________

Verified

(State whether individual owner, member of firm, or give title if officer of corporation.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1