APP/UC-001 (5/00) - REVERSE

DES

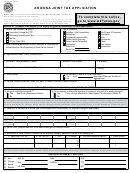

THIS BOX FOR AGENCY USE ONLY

DOR

DES

THIS BOX FOR AGENCY USE ONLY

DOR

TPT _______________________________________________________________

NEW

CHANGE

REVISE

REOPEN

SIC __________

ACCT NO ______________ CTY CD ___________ LIAB _________ TLAPSE__________

W H _______________________________________________________________

START ___________________________ LIAB EST _______________________________

CITIES ____________ ___________ ___________ ___________ ___________

REPORTS

S/E DATE

KP

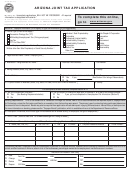

VI. Did you acquire all or part of an existing business?

Yes

No

If yes, indicate date ________________________________ and whether you acquired:

ALL business operations and locations in Arizona. You will receive the unemployment tax rate of the business you acquired

PART of the business. To apply for a portion of the prior owner's unemployment tax rate, call (602) 248-9101 to obtain an Application and Agreement for Severable

Portion Experience Rating Transfer (UC-247) and file within 180 days of acquisition.

PREVIOUS OWNER'S NAME (Last, First, M.I.)

PREVIOUS OWNER'S CURRENT ADDRESS

PREVIOUS OWNER'S CURRENT PHONE NUMBER

UNEMPLOYMENT NUMBER

WITHHOLDING NUMBER

TPT NUMBER

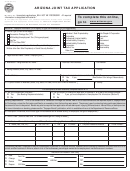

VII. EMPLOYMENT INFORMATION (complete only if applying for withholding/unemployment tax license)

Record of Arizona wages paid by calendar quarters for current and preceding calendar years.

YEAR

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

Weekly record of number of persons performing services in Arizona for current & preceding calendar year.

YEAR

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

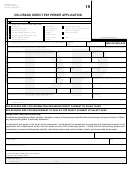

VIII. VOLUNTARY ELECTION OF UNEMPLOYMENT TAX COVERAGE

The undersigned, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment started if later, and continuing for

not less than two full calendar years to:

A. Become an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other employers and extend

unemployment tax coverage to my employees although not mandatory.

B. Extend coverage to all employees performing services excluded from coverage as shown in Section IX below.

AGENCY USE ONLY

SIGNATURE/TITLE

DATE

APPROVED/DATE

IX. ARE INDIVIDUALS PERFORMING SERVICES THAT ARE EXCLUDED FROM WITHHOLDING OR UNEMPLOYMENT TAX?

Yes

No

If yes, explain:

X. FEES FOR TRANSACTION PRIVILEGE TAX (no fee for withholding, use or unemployment)

State Fees (# loc. x $12.00):

City Fees (Total from Table):

Total Fees:

XI. SIGNATURE(S) BY INDIVIDUALS LEGALLY RESPONSIBLE FOR THE BUSINESS (REQUIRED)

This application must be signed by either a sole owner, two partners, two corporate officers, members and/or managing members, the trustee, receiver or personal representative of an estate.

UNDER PENALTY OF PERJURY I (WE) DECLARE THAT THE INFORMATION ON THIS DOCUMENT IS TRUE AND CORRECT.

TYPE OR PRINT NAME

TITLE

SIGNATURE

DATE

TYPE OR PRINT NAME

TITLE

SIGNATURE

DATE

ADOR 50-4002 (5/00)

1

1 2

2 3

3