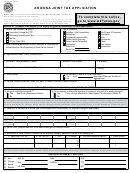

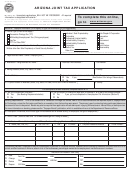

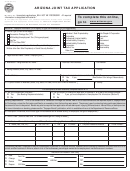

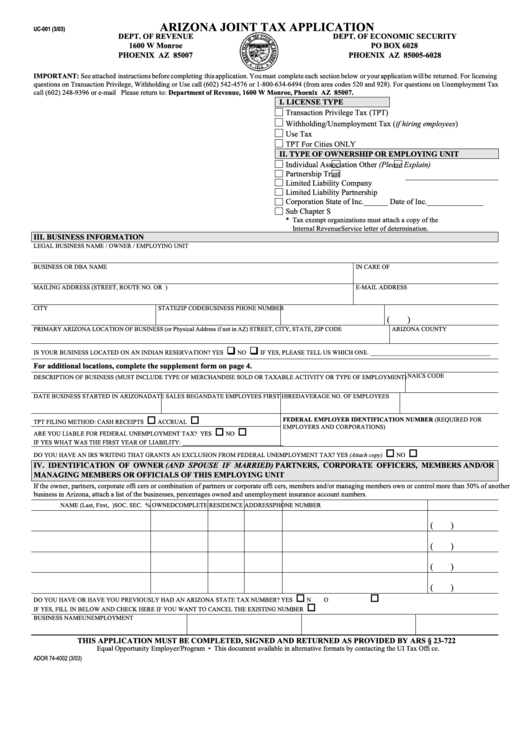

ARIZONA JOINT TAX APPLICATION

UC-001 (3/03)

DEPT. OF REVENUE

DEPT. OF ECONOMIC SECURITY

1600 W Monroe

PO BOX 6028

PHOENIX AZ 85007

PHOENIX AZ 85005-6028

IMPORTANT: See attached instructions before completing this application. You must complete each section below or your application will be returned. For licensing

questions on Transaction Privilege, Withholding or Use call (602) 542-4576 or 1-800-634-6494 (from area codes 520 and 928). For questions on Unemployment Tax

call (602) 248-9396 or e-mail uit.status@mail.de.state.az.us. Please return to: Department of Revenue, 1600 W Monroe, Phoenix AZ 85007.

I. LICENSE TYPE

Transaction Privilege Tax (TPT)

Withholding/Unemployment Tax (if hiring employees)

Use Tax

TPT For Cities ONLY

II. TYPE OF OWNERSHIP OR EMPLOYING UNIT

Individual

Association

Other (Please Explain)

Partnership

Trust

Limited Liability Company

Limited Liability Partnership

Corporation

State of Inc.______ Date of Inc.______________

Sub Chapter S

* Tax exempt organizations must attach a copy of the

Internal Revenue Service letter of determination.

III. BUSINESS INFORMATION

LEGAL BUSINESS NAME / OWNER / EMPLOYING UNIT

BUSINESS OR DBA NAME

IN CARE OF

MAILING ADDRESS (STREET, ROUTE NO. OR P.O. BOX)

E-MAIL ADDRESS

CITY

STATE

ZIP CODE

BUSINESS PHONE NUMBER

(

)

PRIMARY ARIZONA LOCATION OF BUSINESS (or Physical Address if not in AZ) STREET, CITY, STATE, ZIP CODE

ARIZONA COUNTY

IS YOUR BUSINESS LOCATED ON AN INDIAN RESERVATION?

YES

NO

IF YES, PLEASE TELL US WHICH ONE. ______________________________________

For additional locations, complete the supplement form on page 4.

NAICS CODE

DESCRIPTION OF BUSINESS (MUST INCLUDE TYPE OF MERCHANDISE SOLD OR TAXABLE ACTIVITY OR TYPE OF EMPLOYMENT)

DATE BUSINESS STARTED IN ARIZONA

DATE SALES BEGAN

DATE EMPLOYEES FIRST HIRED

AVERAGE NO. OF EMPLOYEES

FEDERAL EMPLOYER IDENTIFICATION NUMBER (REQUIRED FOR

TPT FILING METHOD:

CASH RECEIPTS

ACCRUAL

EMPLOYERS AND CORPORATIONS)

ARE YOU LIABLE FOR FEDERAL UNEMPLOYMENT TAX?

YES

NO

IF YES WHAT WAS THE FIRST YEAR OF LIABILITY: ________________________________

DO YOU HAVE AN IRS WRITING THAT GRANTS AN EXCLUSION FROM FEDERAL UNEMPLOYMENT TAX?

YES (Attach copy)

NO

IV. IDENTIFICATION OF OWNER (AND SPOUSE IF MARRIED) PARTNERS, CORPORATE OFFICERS, MEMBERS AND/OR

MANAGING MEMBERS OR OFFICIALS OF THIS EMPLOYING UNIT

If the owner, partners, corporate offi cers or combination of partners or corporate offi cers, members and/or managing members own or control more than 50% of another

business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers.

NAME (Last, First, M.I.)

SOC. SEC. NO.

TITLE

% OWNED

COMPLETE RESIDENCE ADDRESS

PHONE NUMBER

(

)

(

)

(

)

(

)

DO YOU HAVE OR HAVE YOU PREVIOUSLY HAD AN ARIZONA STATE TAX NUMBER? YES

NO

IF YES, FILL IN BELOW AND CHECK HERE IF YOU WANT TO CANCEL THE EXISTING NUMBER

BUSINESS NAME

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

THIS APPLICATION MUST BE COMPLETED, SIGNED AND RETURNED AS PROVIDED BY ARS § 23-722

Equal Opportunity Employer/Program • This document available in alternative formats by contacting the UI Tax Offi ce.

ADOR 74-4002 (3/03)

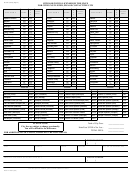

1

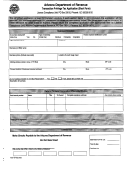

1 2

2 3

3 4

4