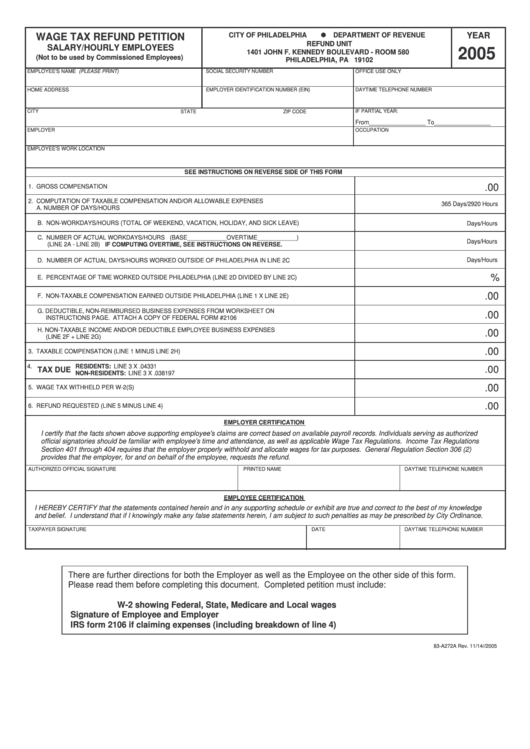

Form 83-A272a - Wage Tax Refund Petition Salary/hourly Employees - 2005

ADVERTISEMENT

YEAR

WAGE TAX REFUND PETITION

CITY OF PHILADELPHIA

DEPARTMENT OF REV ENUE

REFUND UNIT

SALARY/HOURLY EMPLOYEES

2005

1401 JOHN F. KE NNEDY BOULEV ARD - ROOM 580

(Not to be used by Commissioned Employees)

PHILADELPHI A, PA 19102

EMPLOYEE'S NAME (PLEA SE P RINT)

SOCIAL SECURITY NUMBER

OFFICE USE ONLY

HOME ADDRESS

EMPLOY ER IDENTIFICATIO N NUMBER (EIN)

DAYTIME TELEPHONE NUMBER

CITY

STATE

ZIP CODE

IF PA RTIAL Y EAR:

From__________ _______ To_____ ____________

EMPLOY ER

OCCUPATION

EMPLOY EE'S WO RK LO CATION

SEE INSTRUCTIONS ON REVERSE SIDE OF THIS FORM

.00

1. GROSS COMPENSA TION

2. COMPUTATION OF TAXABLE COMPENSATION AND/OR ALLOWABLE EXPENSES

365 Days/2920 Hours

A. NUMBER OF DAY S/HOURS

B. NON-WORKDAYS/HOURS (TOTAL OF WEEKEND, VACATION, HOLIDAY, AND SICK LEAVE)

Days/Hours

C. NUMBER OF ACTUAL WORKDAYS/HOURS (BASE___ ________ _OVERTIME___________ _)

Days/Hours

(LINE 2A - LINE 2B) IF COMPUTING OVERTIME, SEE INSTRUCTIONS ON REVERSE.

Days/Hours

D. NUMBER OF ACTUAL DAYS/HOURS WORKED OUTSIDE OF PHILADELPHIA IN LINE 2C

%

E. PERCENTAGE OF TIME WORKED OUTSIDE PHILADELPHIA (LINE 2D DIVIDED BY LINE 2C)

.00

F. NON-TAXABLE COMP ENSATION EARNED OUTSIDE PHILADELPHIA (LINE 1 X LINE 2E)

G. DEDUCTIBLE, NON-REIMBURSED BUSINESS EXPENSES FROM WORKSHEET ON

.00

INSTRUCTIONS PAGE. ATTACH A COPY OF FEDERAL FORM #2106

H. NON-TAXABLE INCOME AND/OR DEDUCTIBLE EMPLO YEE BUSINESS EXPENSES

.00

(LINE 2F + LINE 2G)

.00

3. TAXAB LE COMPENSATION (LINE 1 MINUS LINE 2H)

4.

RESIDENTS: LINE 3 X .04331

.00

TAX DUE

NON-RESIDENTS: LINE 3 X .038197

.00

5. WAGE TAX WITHHELD PER W-2(S)

.00

6. REFUND REQUESTED (LINE 5 MINUS LINE 4)

EMPLOYER CERTIFICATION

I certify that the facts shown ab ove supporting employee's claims are correct based on available payroll records. Individuals serving as authorized

official signatories should be familiar with employee's time and attendance, as well as applicable Wage Tax Regulations. Income Tax Regulations

Section 401 through 404 requires that the employer properly withhold and allocate wages for tax purposes. General Regulation Section 306 (2)

provides that the employer, for and on behalf of the employee, requests the refund.

PRINTED NAME

AUTHORIZED OFFICIAL SI GNATURE

DAYTIME TELEPHONE NUMBER

EMPLOYEE CERTIFICATION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge

and belief. I understand that if I knowingly make any false statements herein, I am subject to such penalties as may be prescribed by City Ordinance.

TAXPA YER SI GNATURE

DATE

DAYTIME TELEPHONE NUMBER

There are further directions for both the Employer as well as the Employee on the other side of this form.

Please read them before completing this document. Completed petition must include:

W-2 showing Federal, State, Medicare and Local wages

Signature of Employee and Employer

IRS form 2106 if claiming expenses (including breakdown of line 4)

83-A272A Rev. 11/14/ /2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1