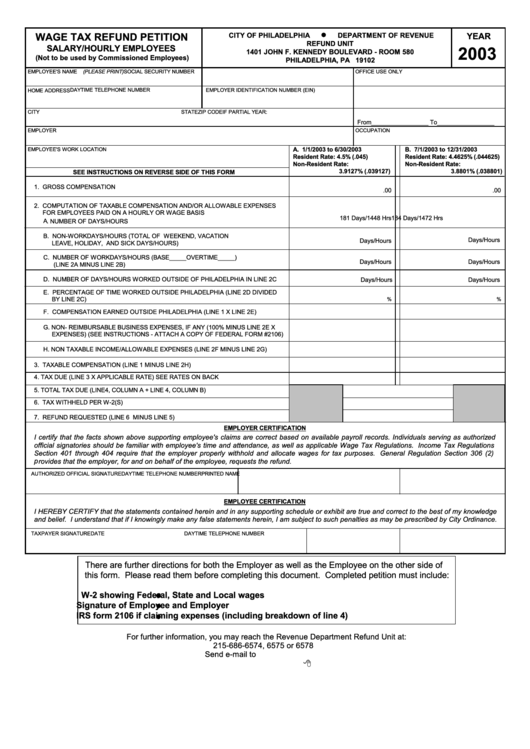

Wage Tax Refund Petition Salary/hourly Employees Form - Department Of Revenue - 2003

ADVERTISEMENT

WAGE TAX REFUND PETITION

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

YEAR

REFUND UNIT

SALARY/HOURLY EMPLOYEES

2003

1401 JOHN F. KENNEDY BOULEVARD - ROOM 580

(Not to be used by Commissioned Employees)

PHILADELPHIA, PA 19102

EMPLOYEE'S NAME (PLEASE PRINT)

SOCIAL SECURITY NUMBER

OFFICE USE ONLY

EMPLOYER IDENTIFICATION NUMBER (EIN)

DAYTIME TELEPHONE NUMBER

HOME ADDRESS

CITY

STATE

ZIP CODE

IF PARTIAL YEAR:

From_________________ To_________________

EMPLOYER

OCCUPATION

EMPLOYEE'S WORK LOCATION

A. 1/1/2003 to 6/30/2003

B. 7/1/2003 to 12/31/2003

Resident Rate: 4.5% (.045)

Resident Rate: 4.4625% (.044625)

Non-Resident Rate:

Non-Resident Rate:

3.9127% (.039127)

3.8801% (.038801)

SEE INSTRUCTIONS ON REVERSE SIDE OF THIS FORM

1. GROSS COMPENSATION

.00

.00

2. COMPUTATION OF TAXABLE COMPENSATION AND/OR ALLOWABLE EXPENSES

FOR EMPLOYEES PAID ON A HOURLY OR WAGE BASIS

181 Days/1448 Hrs

184 Days/1472 Hrs

A. NUMBER OF DAYS/HOURS

B. NON-WORKDAYS/HOURS (TOTAL OF WEEKEND, VACATION

Days/Hours

Days/Hours

LEAVE, HOLIDAY, AND SICK DAYS/HOURS)

C. NUMBER OF WORKDAYS/HOURS (BASE_____OVERTIME_____)

Days/Hours

Days/Hours

(LINE 2A MINUS LINE 2B)

D. NUMBER OF DAYS/HOURS WORKED OUTSIDE OF PHILADELPHIA IN LINE 2C

Days/Hours

Days/Hours

E. PERCENTAGE OF TIME WORKED OUTSIDE PHILADELPHIA (LINE 2D DIVIDED

BY LINE 2C)

%

%

F. COMPENSATION EARNED OUTSIDE PHILADELPHIA (LINE 1 X LINE 2E)

G. NON- REIMBURSABLE BUSINESS EXPENSES, IF ANY (100% MINUS LINE 2E X

EXPENSES) (SEE INSTRUCTIONS - ATTACH A COPY OF FEDERAL FORM #2106)

H. NON TAXABLE INCOME/ALLOWABLE EXPENSES (LINE 2F MINUS LINE 2G)

3. TAXABLE COMPENSATION (LINE 1 MINUS LINE 2H)

4. TAX DUE (LINE 3 X APPLICABLE RATE) SEE RATES ON BACK

5. TOTAL TAX DUE (LINE4, COLUMN A + LINE 4, COLUMN B)

6. TAX WITHHELD PER W-2(S)

7. REFUND REQUESTED (LINE 6 MINUS LINE 5)

EMPLOYER CERTIFICATION

I certify that the facts shown above supporting employee's claims are correct based on available payroll records. Individuals serving as authorized

official signatories should be familiar with employee's time and attendance, as well as applicable Wage Tax Regulations. Income Tax Regulations

Section 401 through 404 require that the employer properly withhold and allocate wages for tax purposes. General Regulation Section 306 (2)

provides that the employer, for and on behalf of the employee, requests the refund.

AUTHORIZED OFFICIAL SIGNATURE

PRINTED NAME

DAYTIME TELEPHONE NUMBER

EMPLOYEE CERTIFICATION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge

and belief. I understand that if I knowingly make any false statements herein, I am subject to such penalties as may be prescribed by City Ordinance.

DAYTIME TELEPHONE NUMBER

TAXPAYER SIGNATURE

DATE

There are further directions for both the Employer as well as the Employee on the other side of

this form. Please read them before completing this document. Completed petition must include:

W-2 showing Federal, State and Local wages

Signature of Employee and Employer

IRS form 2106 if claiming expenses (including breakdown of line 4)

For further information, you may reach the Revenue Department Refund Unit at:

215-686-6574, 6575 or 6578

Send e-mail to revenue@phila.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1