Form Rpu-13 - Instructions And Example

ADVERTISEMENT

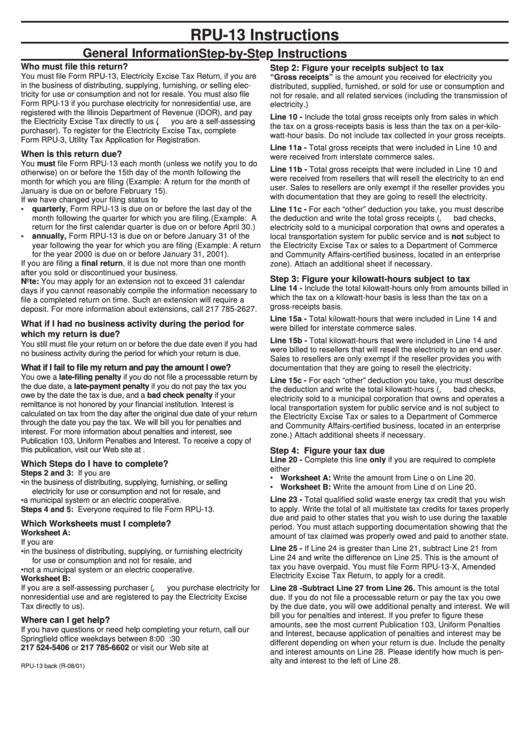

RPU-13 Instructions

General Information

Step-by-Step Instructions

Who must file this return?

Step 2: Figure your receipts subject to tax

You must file Form RPU-13, Electricity Excise Tax Return, if you are

“Gross receipts” is the amount you received for electricity you

in the business of distributing, supplying, furnishing, or selling elec-

distributed, supplied, furnished, or sold for use or consumption and

tricity for use or consumption and not for resale. You must also file

not for resale, and all related services (including the transmission of

Form RPU-13 if you purchase electricity for nonresidential use, are

electricity.)

registered with the Illinois Department of Revenue (IDOR), and pay

Line 10 - Include the total gross receipts only from sales in which

the Electricity Excise Tax directly to us ( i.e., you are a self-assessing

the tax on a gross-receipts basis is less than the tax on a per-kilo-

purchaser). To register for the Electricity Excise Tax, complete

watt-hour basis. Do not include tax collected in your gross receipts.

Form RPU-3, Utility Tax Application for Registration.

Line 11a - Total gross receipts that were included in Line 10 and

When is this return due?

were received from interstate commerce sales.

You must file Form RPU-13 each month (unless we notify you to do

Line 11b - Total gross receipts that were included in Line 10 and

otherwise) on or before the 15th day of the month following the

were received from resellers that will resell the electricity to an end

month for which you are filing (Example: A return for the month of

user. Sales to resellers are only exempt if the reseller provides you

January is due on or before February 15).

with documentation that they are going to resell the electricity.

If we have changed your filing status to

•

quarterly, Form RPU-13 is due on or before the last day of the

Line 11c - For each “other” deduction you take, you must describe

month following the quarter for which you are filing.(Example: A

the deduction and write the total gross receipts ( i.e., bad checks,

return for the first calendar quarter is due on or before April 30.)

electricity sold to a municipal corporation that owns and operates a

•

annually, Form RPU-13 is due on or before January 31 of the

local transportation system for public service and is not subject to

year following the year for which you are filing (Example: A return

the Electricity Excise Tax or sales to a Department of Commerce

for the year 2000 is due on or before January 31, 2001).

and Community Affairs-certified business, located in an enterprise

If you are filing a final return, it is due not more than one month

zone). Attach an additional sheet if necessary.

after you sold or discontinued your business.

Step 3: Figure your kilowatt-hours subject to tax

Note: You may apply for an extension not to exceed 31 calendar

Line 14 - Include the total kilowatt-hours only from amounts billed in

days if you cannot reasonably compile the information necessary to

which the tax on a kilowatt-hour basis is less than the tax on a

file a completed return on time. Such an extension will require a

gross-receipts basis.

deposit. For more information about extensions, call 217 785-2627.

Line 15a - Total kilowatt-hours that were included in Line 14 and

What if I had no business activity during the period for

were billed for interstate commerce sales.

which my return is due?

Line 15b - Total kilowatt-hours that were included in Line 14 and

You still must file your return on or before the due date even if you had

were billed to resellers that will resell the electricity to an end user.

no business activity during the period for which your return is due.

Sales to resellers are only exempt if the reseller provides you with

What if I fail to file my return and pay the amount I owe?

documentation that they are going to resell the electricity.

You owe a late-filing penalty if you do not file a processable return by

Line 15c - For each “other” deduction you take, you must describe

the due date, a late-payment penalty if you do not pay the tax you

the deduction and write the total kilowatt-hours ( i.e., bad checks,

owe by the date the tax is due, and a bad check penalty if your

electricity sold to a municipal corporation that owns and operates a

remittance is not honored by your financial institution. Interest is

local transportation system for public service and is not subject to

calculated on tax from the day after the original due date of your return

the Electricity Excise Tax or sales to a Department of Commerce

through the date you pay the tax. We will bill you for penalties and

and Community Affairs-certified business, located in an enterprise

interest. For more information about penalties and interest, see

zone.) Attach additional sheets if necessary.

Publication 103, Uniform Penalties and Interest. To receive a copy of

this publication, visit our Web site at

Step 4: Figure your tax due

Line 20 - Complete this line only if you are required to complete

Which Steps do I have to complete?

either

Steps 2 and 3: If you are

• Worksheet A: Write the amount from Line o on Line 20.

• in the business of distributing, supplying, furnishing, or selling

• Worksheet B: Write the amount from Line d on Line 20.

electricity for use or consumption and not for resale, and

Line 23 - Total qualified solid waste energy tax credit that you wish

• a municipal system or an electric cooperative.

to apply. Write the total of all multistate tax credits for taxes properly

Steps 4 and 5: Everyone required to file Form RPU-13.

due and paid to other states that you wish to use during the taxable

Which Worksheets must I complete?

period. You must attach supporting documentation showing that the

Worksheet A:

amount of tax claimed was properly owed and paid to another state.

If you are

Line 25 - If Line 24 is greater than Line 21, subtract Line 21 from

• in the business of distributing, supplying, or furnishing electricity

Line 24 and write the difference on Line 25. This is the amount of

for use or consumption and not for resale, and

tax you have overpaid. You must file Form RPU-13-X, Amended

• not a municipal system or an electric cooperative.

Electricity Excise Tax Return, to apply for a credit.

Worksheet B:

If you are a self-assessing purchaser ( i.e., you purchase electricity for

Line 28 - Subtract Line 27 from Line 26. This amount is the total

nonresidential use and are registered to pay the Electricity Excise

due. If you do not file a processable return or pay the tax you owe

Tax directly to us).

by the due date, you will owe additional penalty and interest. We will

bill you for penalties and interest. If you prefer to figure these

Where can I get help?

amounts, see the most current Publication 103, Uniform Penalties

If you have questions or need help completing your return, call our

and Interest, because application of penalties and interest may be

Springfield office weekdays between 8:00 a.m. and 4:30 p.m. at

different depending on when your return is due. Include the penalty

217 524-5406 or 217 785-6602 or visit our Web site at

and interest amounts on Line 28. Please identify how much is pen-

alty and interest to the left of Line 28.

RPU-13 back (R-08/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2