Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

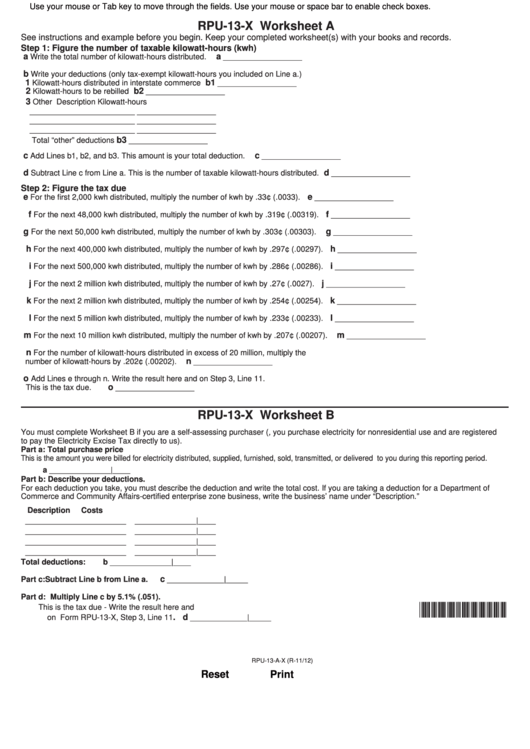

RPU-13-X Worksheet A

See instructions and example before you begin. Keep your completed worksheet(s) with your books and records.

Step 1: Figure the number of taxable kilowatt-hours (kwh)

a

a

Write the total number of kilowatt-hours distributed.

__________________

b

Write your deductions (only tax-exempt kilowatt-hours you included on Line a.)

1

b1

Kilowatt-hours distributed in interstate commerce

__________________

2

b2

Kilowatt-hours to be rebilled

__________________

3

Other

Description

Kilowatt-hours

________________________

__________________

________________________

__________________

________________________

__________________

b3

Total “other” deductions

__________________

c

c

Add Lines b1, b2, and b3. This amount is your total deduction.

__________________

d

d

Subtract Line c from Line a. This is the number of taxable kilowatt-hours distributed.

__________________

Step 2:

Figure the tax due

e

e

For the first 2,000 kwh distributed, multiply the number of kwh by .33¢ (.0033).

__________________

f

f

For the next 48,000 kwh distributed, multiply the number of kwh by .319¢ (.00319).

__________________

g

g

For the next 50,000 kwh distributed, multiply the number of kwh by .303¢ (.00303).

__________________

h

h

For the next 400,000 kwh distributed, multiply the number of kwh by .297¢ (.00297).

__________________

i

i

For the next 500,000 kwh distributed, multiply the number of kwh by .286¢ (.00286).

__________________

j

j

For the next 2 million kwh distributed, multiply the number of kwh by .27¢ (.0027).

__________________

k

k

For the next 2 million kwh distributed, multiply the number of kwh by .254¢ (.00254).

__________________

l

l

For the next 5 million kwh distributed, multiply the number of kwh by .233¢ (.00233).

__________________

m

m

For the next 10 million kwh distributed, multiply the number of kwh by .207¢ (.00207).

__________________

n

For the number of kilowatt-hours distributed in excess of 20 million, multiply the

n

number of kilowatt-hours by .202¢ (.00202).

__________________

o

Add Lines e through n. Write the result here and on Step 3, Line 11.

o

This is the tax due.

__________________

RPU-13-X Worksheet B

You must complete Worksheet B if you are a self-assessing purchaser (i.e., you purchase electricity for nonresidential use and are registered

to pay the Electricity Excise Tax directly to us).

Part a: Total purchase price

This is the amount you were billed for electricity distributed, supplied, furnished, sold, transmitted, or delivered to you during this reporting period.

a ______________|____

Part b: Describe your deductions.

For each deduction you take, you must describe the deduction and write the total cost. If you are taking a deduction for a Department of

Commerce and Community Affairs-certified enterprise zone business, write the business’ name under “Description.”

Description

Costs

_______________________

______________|____

_______________________

______________|____

_______________________

______________|____

_______________________

______________|____

Total deductions:

b ______________|____

c

Part c: Subtract Line b from Line a.

_____________|_____

Part d: Multiply Line c by 5.1% (.051).

*241301110*

This is the tax due - Write the result here and

.

d

on Form RPU-13-X, Step 3, Line 11

_____________|_____

RPU-13-A-X (R-11/12)

Reset

Print

1

1 2

2