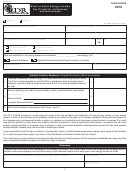

R-1086 (1/15)

FILING PERIOD

S o l a r E n e r g y I n c o m e Ta x

2014

Worksheet

PLEASE PRINT OR TYPE.

Name of Taxpayer/Entity claiming credit

Social Security No. /Entity Louisiana Revenue Account No.

Name of Taxpayer’s spouse

Spouse’s Social Security No.

(if joint individual income tax return)

(if joint individual income tax return)

Physical address of location where system installed

City

ZIP

State

LA

Solar Electric System

Solar Thermal System

Combination Solar Electric and Solar Thermal System

Date the installation of the energy system was completed

in a Louisiana residence.

(mm/dd/yyyy)

________________________________________

Contractor’s Name

Contractor’s Louisiana License Number

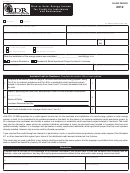

Computation of the Credit

1 Cost of new system equipment

1

2 Cost of new system Installation

2

3 Taxes associated with new system

3

4 Total

4

(Add Lines 1 through 3.)

Enter the smaller of $25,000 or the amount on Line 4. If the system is leased and its installation was

5

5

completed on or after July 1, 2013, skip Line 6 and go to Line 7. If not, go to Line 6.

6 Multiply Line 5 by 50% (.50). This is your credit.

6

7 Enter the sum of the nameplate kW of all of the photovoltaic panels in the system.

7

8 kW equivalent of solar collector panels. See instructions.

8

9 Total Power Rating of the System: Enter the sum of Lines 7 and 8.

9

10 Multiply Line 9 by 1,000.

10

11 Enter the smaller of 6,000 or the amount on Line 10.

11

If the system installation was completed during the period from 07/01/2013 to 06/30/2014 enter $4.50. If

12

12

the installation was completed during the period from 07/01/2014 to 06/30/2015 enter $3.50.

13 Multiply Line 11 by Line 12.

13

14 Enter the smaller of the amount on Line 13 or Line 5.

14

If the system installation was completed during the period from 07/01/2013 to 12/31/2013 enter 50% (.50).

15

15

If the installation was completed on or after 01/01/2014 enter 38% (.38).

16 Multiply Line 14 by Line 15. This is your credit.

16

Instructions for Line 8: To determine the kW equivalent for each panel, multiply the Solar Rating and Certification Corporation (SRCC)

efficiency rating by the gross area (in m²). The result is the kW equivalent for the panel. The efficiency rating is the first value in the

ISO Efficiency Equation for either SI units or IP Units (found in the “Technical Information” area of the collector’s SRCC certificate). For

example, if the equation is expressed as “η= 0.749 - 3.69060(P/G) - 0.00551(P²/G), the efficiency rating is 0.749. If this same collector’s

gross area (found in the “Collector Specifications” area of the certificate) is 2.993 m², then the kW equivalent of the collector would be

.749 x 2.993 = 2.242 kW. Enter the sum of the kW equivalents of all collector panels on line 8.

2

1

1 2

2 3

3 4

4 5

5