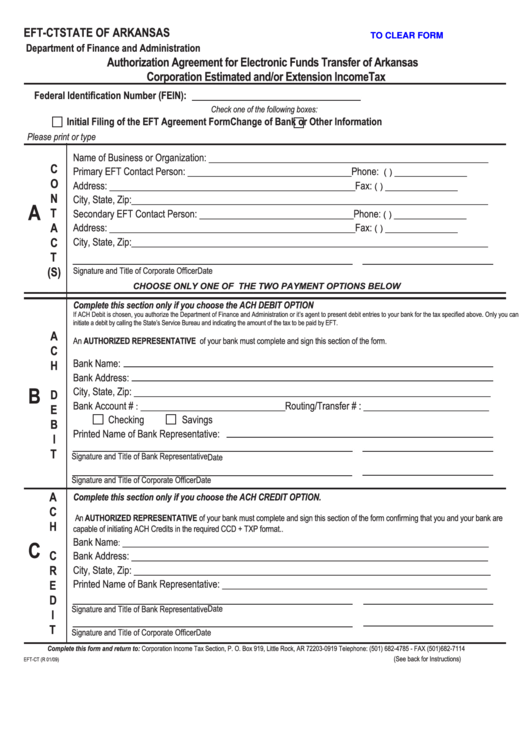

EFT-CT

STATE OF ARKANSAS

CLICK HERE TO CLEAR FORM

Department of Finance and Administration

Authorization Agreement for Electronic Funds Transfer of Arkansas

Corporation Estimated and/or Extension IncomeTax

Federal Identification Number (FEIN):

Check one of the following boxes:

Initial Filing of the EFT Agreement Form

Change of Bank or Other Information

Please print or type

Name of Business or Organization:

__________________________________________________________

C

Primary EFT Contact Person:

Phone:

__________________________________

(

) _______________

O

Address:

Fax:

___________________________________________________

(

) _______________

N

City, State, Zip:

__________________________________________________________________________

A

T

Secondary EFT Contact Person:

Phone:

________________________________

(

) _______________

A

Address:

Fax:

___________________________________________________

(

) _______________

C

City, State, Zip:

__________________________________________________________________________

T

(S)

Signature and Title of Corporate Officer

Date

CHOOSE ONLY ONE OF THE TWO PAYMENT OPTIONS BELOW

CHO

OSE ONLY ONE OF THE TWO PAYMENT OPTIONS BELOW

Complete this section only if you choose the ACH DEBIT OPTION

If ACH Debit is chosen, you authorize the Department of Finance and Administration or it’s agent to present debit entries to your bank for the tax specified above. Only you can

initiate a debit by calling the State’s Service Bureau and indicating the amount of the tax to be paid by EFT.

A

An AUTHORIZED REPRESENTATIVE of your bank must complete and sign this section of the form.

C

Bank Name:

H

Bank Address:

B

City, State, Zip:

D

__________________________________________________________________________

Bank Account #

Routing/Transfer # :

E

: ______________________________

__________________________

Checking

Savings

B

Printed Name of Bank Representative:

I

T

Signature and Title of Bank Representative

Date

Signature and Title of Corporate Officer

Date

A

Complete this section only if you choose the ACH CREDIT OPTION.

C

An AUTHORIZED REPRESENTATIVE of your bank must complete and sign this section of the form confirming that you and your bank are

H

capable of initiating ACH Credits in the required CCD + TXP format..

Bank Name

C

: ____________________________________________________________________________

C

Bank Address:

__________________________________________________________________________

R

City, State, Zip:

__________________________________________________________________________

E

Printed Name of Bank Representative:

_______________________________________________________

D

Date

Signature and Title of Bank Representative

I

T

Signature and Title of Corporate Officer

Date

Complete this form and return to: Corporation Income Tax Section, P. O. Box 919, Little Rock, AR 72203-0919 Telephone: (501) 682-4785 - FAX (501)682-7114

(See back for Instructions)

EFT-CT (R 01/09)

1

1