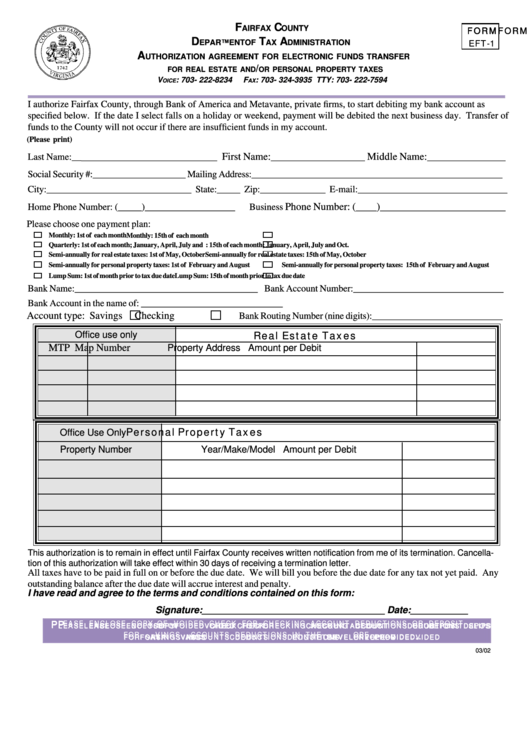

Form Eft-1 - Authorization Agreement For Electronic Funds Transfer For Real Estate And/or Personal Property Taxes

ADVERTISEMENT

F

C

FORM

FORM

FORM

FORM

FORM

AIRFAX

OUNTY

EFT-1

D

T

A

EPARTMENT OF

AX

DMINISTRATION

A

UTHORIZATION AGREEMENT FOR ELECTRONIC FUNDS TRANSFER

/

FOR REAL ESTATE AND

OR PERSONAL PROPERTY TAXES

V

: 703- 222-8234

F

: 703- 324-3935 TTY: 703- 222-7594

OICE

AX

I authorize Fairfax County, through Bank of America and Metavante, private firms, to start debiting my bank account as

specified below. If the date I select falls on a holiday or weekend, payment will be debited the next business day. Transfer of

funds to the County will not occur if there are insufficient funds in my account.

(Please print)

__________________________ First Name:__________________ Middle Name:_______________

Last Name:__

Social Security #:____________________ Mailing Address:______________________________________________________

City:_______________________________ State:_____ Zip:______________ E-mail:________________________________

Phone Number: (____)________________________

Home Phone Number: (_____)___________________

Business

Please choose one payment plan:

Monthly: 1st of each month

Monthly: 15th of each month

Quarterly: 1st of each month; January, April, July and Oct.

Quarterly: 15th of each month; January, April, July and Oct.

Semi-annually for real estate taxes: 1st of May, October

Semi-annually for real estate taxes: 15th of May, October

Semi-annually for personal property taxes: 1st of February and August

Semi-annually for personal property taxes: 15th of February and August

Lump Sum: 1st of month prior to tax due date

Lump Sum: 15th of month prior to tax due date

Bank Name:_______________________________________ Bank Account Number:________________________________

Bank Account in the name of: ______________________________

Account type: Savings

Checking

Bank Routing Number (nine digits):____________________________

Real Estate Taxes

Office use only

MTP

Map Number

Property Address

Amount per Debit

Personal Property Taxes

Office Use Only

Property Number

Year/Make/Model

Amount per Debit

This authorization is to remain in effect until Fairfax County receives written notification from me of its termination. Cancella-

tion of this authorization will take effect within 30 days of receiving a termination letter.

All taxes have to be paid in full on or before the due date. We will bill you before the due date for any tax not yet paid. Any

outstanding balance after the due date will accrue interest and penalty.

I have read and agree to the terms and conditions contained on this form:

Signature:___________________________________ Date:___________

P P P P P

LEASE

LEASE ENCLOSE

LEASE

ENCLOSE

ENCLOSE

ENCLOSE COPY

COPY

COPY

COPY OF

OF

OF

OF VOIDED

VOIDED

VOIDED

VOIDED CHECK

CHECK

CHECK

CHECK FOR

FOR

FOR CHECKING

FOR

CHECKING

CHECKING

CHECKING ACCOUNT

ACCOUNT

ACCOUNT DEDUCTIONS

ACCOUNT

DEDUCTIONS

DEDUCTIONS

DEDUCTIONS OR

OR

OR

OR DEPOSIT

DEPOSIT

DEPOSIT

DEPOSIT SLIP

SLIP

SLIP

SLIP

LEASE

LEASE

ENCLOSE

COPY

OF

VOIDED

CHECK

FOR

CHECKING

ACCOUNT

DEDUCTIONS

OR

DEPOSIT

SLIP

. . . . .

FOR

FOR

FOR

FOR

FOR SA

SA

SA

SA

SAVINGS

VINGS

VINGS

VINGS

VINGS A A A A A CCOUNTS

CCOUNTS

CCOUNTS

CCOUNTS

CCOUNTS DEDUCTIONS

DEDUCTIONS

DEDUCTIONS

DEDUCTIONS

DEDUCTIONS IN

IN

IN

IN

IN THE

THE

THE

THE ENVEL

THE

ENVEL

ENVEL

ENVEL

ENVELOPE

OPE

OPE

OPE

OPE PR

PR

PR

PR

PRO O O O O VIDED

VIDED

VIDED

VIDED

VIDED

03/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1