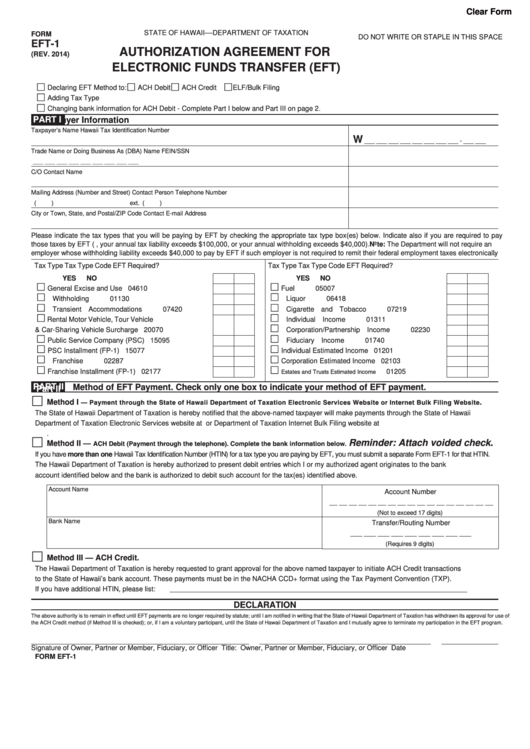

Clear Form

FORM

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII––DEPARTMENT OF TAXATION

EFT-1

AUTHORIZATION AGREEMENT FOR

(REV. 2014)

ELECTRONIC FUNDS TRANSFER (EFT)

Declaring EFT Method to:

ACH Debit

ACH Credit

ELF/Bulk Filing

Adding Tax Type

Changing bank information for ACH Debit - Complete Part I below and Part III on page 2.

PART I

Taxpayer Information

Taxpayer’s Name

Hawaii Tax Identification Number

W

___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

Trade Name or Doing Business As (DBA) Name

FEIN/SSN

___ ___ ___ ___ ___ ___ ___ ___ ___

C/O

Contact Name

Mailing Address (Number and Street)

Contact Person Telephone Number

(

)

ext. (

)

City or Town, State, and Postal/ZIP Code

Contact E-mail Address

Please indicate the tax types that you will be paying by EFT by checking the appropriate tax type box(es) below. Indicate also if you are required to pay

those taxes by EFT (i.e., your annual tax liability exceeds $100,000, or your annual withholding exceeds $40,000). Note: The Department will not require an

employer whose withholding liability exceeds $40,000 to pay by EFT if such employer is not required to remit their federal employment taxes electronically.

Tax Type

Tax Type Code

EFT Required?

Tax Type

Tax Type Code

EFT Required?

YES

NO

YES

NO

General Excise and Use

04610

Fuel

05007

Withholding

01130

Liquor

06418

Transient Accommodations

07420

Cigarette and Tobacco

07219

Rental Motor Vehicle, Tour Vehicle

Individual Income

01311

& Car-Sharing Vehicle Surcharge

20070

Corporation/Partnership Income

02230

Public Service Company (PSC)

15095

Fiduciary Income

01740

PSC Installment (FP-1)

15077

Individual Estimated Income

01201

Franchise

02287

Corporation Estimated Income

02103

Estates and Trusts Estimated Income

Franchise Installment (FP-1)

02177

01205

PART II

Method of EFT Payment. Check only one box to indicate your method of EFT payment.

Part II

Method I — Payment through the State of Hawaii Department of Taxation Electronic Services Website or Internet Bulk Filing Website.

The State of Hawaii Department of Taxation is hereby notified that the above-named taxpayer will make payments through the State of Hawaii

Department of Taxation Electronic Services website at tax.hawaii.gov/eservices/ or Department of Taxation Internet Bulk Filing website at

dotax.ehawaii.gov/bulktax.

Method II — ACH Debit (Payment through the telephone). Complete the bank information below.

Reminder: Attach voided check.

If you have more than one Hawaii Tax Identification Number (HTIN) for a tax type you are paying by EFT, you must submit a separate Form EFT-1 for that HTIN.

The Hawaii Department of Taxation is hereby authorized to present debit entries which I or my authorized agent originates to the bank

account identified below and the bank is authorized to debit such account for the tax(es) identified above.

Account Name

Account Number

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

(Not to exceed 17 digits)

Bank Name

Transfer/Routing Number

___ ___ ___ ___ ___ ___ ___ ___ ___

(Requires 9 digits)

Method III — ACH Credit.

The Hawaii Department of Taxation is hereby requested to grant approval for the above named taxpayer to initiate ACH Credit transactions

to the State of Hawaii’s bank account. These payments must be in the NACHA CCD+ format using the Tax Payment Convention (TXP).

If you have additional HTIN, please list:

DECLARATION

The above authority is to remain in effect until EFT payments are no longer required by statute; until I am notified in writing that the State of Hawaii Department of Taxation has withdrawn its approval for use of

the ACH Credit method (if Method III is checked); or, if I am a voluntary participant, until the State of Hawaii Department of Taxation and I mutually agree to terminate my participation in the EFT program.

Signature of Owner, Partner or Member, Fiduciary, or Officer

Title: Owner, Partner or Member, Fiduciary, or Officer

Date

FORM EFT-1

1

1 2

2