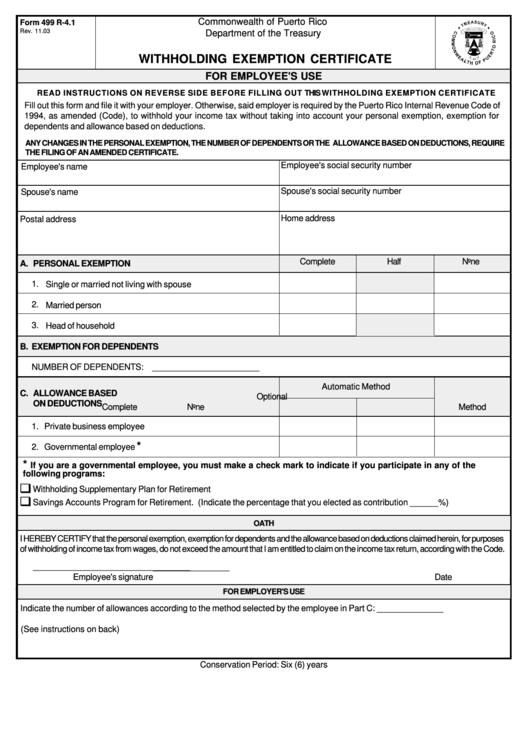

Form 499 R-4.1 - Withholding Exemption Certificate Form - Commonwealth Of Puerto Rico Department Of The Treasury

ADVERTISEMENT

Commonwealth of Puerto Rico

Form 499 R-4.1

Rev. 11.03

Department of the Treasury

WITHHOLDING EXEMPTION CERTIFICATE

FOR EMPLOYEE'S USE

READ INSTRUCTIONS ON REVERSE SIDE BEFORE FILLING OUT THIS WITHHOLDING EXEMPTION CERTIFICATE

Fill out this form and file it with your employer. Otherwise, said employer is required by the Puerto Rico Internal Revenue Code of

1994, as amended (Code), to withhold your income tax without taking into account your personal exemption, exemption for

dependents and allowance based on deductions.

ANY CHANGES IN THE PERSONAL EXEMPTION, THE NUMBER OF DEPENDENTS OR THE ALLOWANCE BASED ON DEDUCTIONS, REQUIRE

THE FILING OF AN AMENDED CERTIFICATE.

Employee's social security number

Employee's name

Spouse's social security number

Spouse's name

Home address

Postal address

Complete

Half

None

A.

PERSONAL EXEMPTION

1.

Single or married not living with spouse

2.

Married person

3.

Head of household

B.

EXEMPTION FOR DEPENDENTS

NUMBER OF DEPENDENTS: _______________________

Automatic Method

C.

ALLOWANCE BASED

Optional

ON DEDUCTIONS

Complete

None

Method

1.

Private business employee

*

2.

Governmental employee

*

If you are a governmental employee, you must make a check mark to indicate if you participate in any of the

following programs:

;

Withholding Supplementary Plan for Retirement

;

Savings Accounts Program for Retirement. (Indicate the percentage that you elected as contribution ______%)

OATH

I HEREBY CERTIFY that the personal exemption, exemption for dependents and the allowance based on deductions claimed herein, for purposes

of withholding of income tax from wages, do not exceed the amount that I am entitled to claim on the income tax return, according with the Code.

___________________________________

_________________

Employee's signature

Date

FOR EMPLOYER'S USE

Indicate the number of allowances according to the method selected by the employee in Part C: ______________

(See instructions on back)

Conservation Period: Six (6) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2