Schedule It-40nol Template - Individual Income Tax Net Operating Loss Computation

ADVERTISEMENT

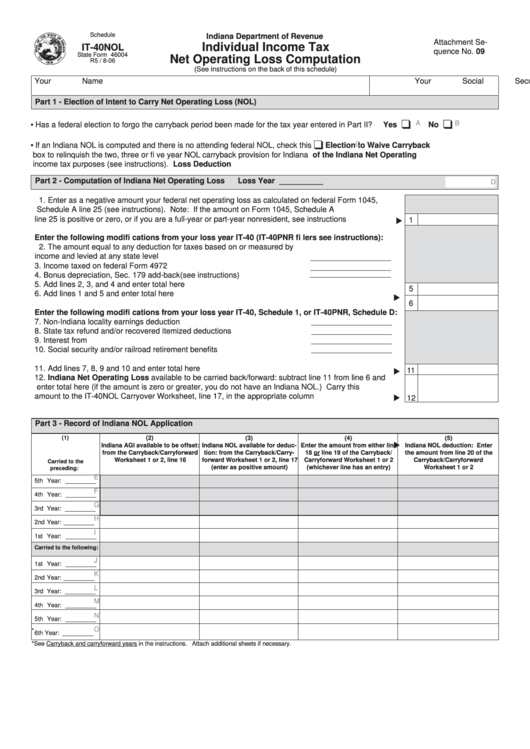

Schedule

Indiana Department of Revenue

Attachment Se-

Individual Income Tax

IT-40NOL

quence No. 09

State Form 46004

Net Operating Loss Computation

R5 / 8-06

(See instructions on the back of this schedule)

Your Name

Your Social Security Number

Part 1 - Election of Intent to Carry Net Operating Loss (NOL)

A

B

• Has a federal election to forgo the carryback period been made for the tax year entered in Part II?

Yes

No

C

• If an Indiana NOL is computed and there is no attending federal NOL, check this

Election to Waive Carryback

box to relinquish the two, three or fi ve year NOL carryback provision for Indiana

of the Indiana Net Operating

income tax purposes (see instructions).

Loss Deduction

Part 2 - Computation of Indiana Net Operating Loss

Loss Year __________

D

1. Enter as a negative amount your federal net operating loss as calculated on federal Form 1045,

Schedule A line 25 (see instructions). Note: If the amount on Form 1045, Schedule A

line 25 is positive or zero, or if you are a full-year or part-year nonresident, see instructions ..............

1

Enter the following modifi cations from your loss year IT-40 (IT-40PNR fi lers see instructions):

2. The amount equal to any deduction for taxes based on or measured by

income and levied at any state level ........................................................

2

3. Income taxed on federal Form 4972 ........................................................

3

4. Bonus depreciation, Sec. 179 add-back(see instructions) .......................

4

5. Add lines 2, 3, and 4 and enter total here .............................................................................................

5

6. Add lines 1 and 5 and enter total here ..................................................................................................

6

Enter the following modifi cations from your loss year IT-40, Schedule 1, or IT-40PNR, Schedule D:

7. Non-Indiana locality earnings deduction ..................................................

7

8. State tax refund and/or recovered itemized deductions ..........................

8

9. Interest from U.S. government obligations ...............................................

9

10. Social security and/or railroad retirement benefi ts ................................... 10

11. Add lines 7, 8, 9 and 10 and enter total here ........................................................................................

11

12. Indiana Net Operating Loss available to be carried back/forward: subtract line 11 from line 6 and

enter total here (if the amount is zero or greater, you do not have an Indiana NOL.) Carry this

amount to the IT-40NOL Carryover Worksheet, line 17, in the appropriate column .............................

12

Part 3 - Record of Indiana NOL Application

(1)

(2)

(3)

(4)

(5)

Indiana AGI available to be offset:

Indiana NOL available for deduc-

Enter the amount from either line

Indiana NOL deduction: Enter

from the Carryback/Carryforward

tion: from the Carryback/Carry-

18 or line 19 of the Carryback/

the amount from line 20 of the

Worksheet 1 or 2, line 16

forward Worksheet 1 or 2, line 17

Carryforward Worksheet 1 or 2

Carryback/Carryforward

Carried to the

(enter as positive amount)

(whichever line has an entry)

Worksheet 1 or 2

preceding:

E

5th Year: _________

F

4th Year: _________

G

3rd Year: _________

H

2nd Year: _________

I

1st Year: _________

Carried to the following:

J

1st Year: _________

K

2nd Year: _________

L

3rd Year: _________

M

4th Year: _________

N

5th Year: _________

O

*

6th Year: _________

*See Carryback and carryforward years in the instructions. Attach additional sheets if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1