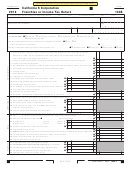

36 Franchise or income tax due. If line 30 is more than line 35, subtract line 35 from line 30. Go to line 39 . . . .

36

00

00

37 Overpayment. If line 35 is more than line 30, subtract line 30 from line 35. . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

00

38 Amount of line 37 to be credited to 2010 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

00

39 Use Tax. This is not a total line. See instructions. . . . . . . . . . . . . . . .

39

00

40 Refund. If the sum of line 38 and line 39 is less than 37, then subtract the result from line 37. . . . . . . . . . . . .

40

__

See instructions to have the refund directly deposited.

a Routing number . . . . . . . . . . . . . . . . .

40a

__

b Type: Checking

Savings

c Account number . . . . . . . . . . . . . . . . . . . . . . . . . . .

40c

4� a Penalties and interest. b

Check if estimate penalty computed using Exception B or C.

00

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4�a

00

42 Total amount due. Add line 36, line 38, line 39, and line 41a, then subtract line 37 from the result . . . . . . . . .

42

Schedule Q Questions (continued from Side 1)

B �. For this taxable year, was there a change in control or

G Maximum number of shareholders in the S corporation

majority ownership for this S corporation or any of its

at any time during the year:

________________________________

subsidiaries that owned or (under certain

H Date business began in California or date income was first derived

circumstances) leased real property in California? . . .

Yes

No

from California sources:

________/________/________

2. For this taxable year, did this S corporation or any of its

I Is the S corporation under audit by the IRS or has

subsidiaries acquire control or majority ownership of

it been audited in a prior year? . . . . . . . . . . . . . . . . . . . .

Yes

No

any other legal entity that owned or (under certain

circumstances) leased real property in California? . . .

Yes

No

J Effective date of federal S election:

________/________/________

3. If this S corporation or any of its subsidiaries owned or

L Accounting method:

(1)

Cash (2)

Accrual (3)

Other

(under certain circumstances) leased real property in

M Location of principal

California, has more than 50% of the voting stock of

accounting records: ___________________________________________

any one of them cumulatively transferred in one or

more transactions since March 1, 1975, which was

N “Doing business as’’ name. (See instructions):

_____________________

not reported on a previous year’s tax return? . . . . . .

Yes

No

__________________________________________________________

(Penalties may apply – see instructions.)

O Have all required information returns (e.g., federal

C Principal business activity code.

Form 1099, 8300 and state Forms 592, 592-B etc.)

(Do not leave blank): . . . . . . . . . . . . . . . . . . . . . .

been filed with the Franchise Tax Board? . . . . . . .

N/A

Yes

No

Business activity _____________________________________________

P Is this S corporation apportioning income to California

Product or service ___________________________________________

using Schedule R? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

D Is this S corporation filing on a water’s-edge basis

Q Has the S corporation included a reportable transaction

pursuant to R&TC Sections 25110 and 25113 for

or listed transaction within this return?

the current taxable year?. . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(See instructions for definitions). . . . . . . . . . . . . . . . . . .

Yes

No

E Does this tax return include Qualified

If “Yes,” complete and attach federal Form 8886, for each transaction.

Subchapter S Subsidiaries? . . . . . . . . . . . . . . . . . . . . . .

Yes

No

R Did this S corporation file the federal

F Date incorporated:________/________/________

Schedule M-3(Form 1120S)? . . . . . . . . . . . . . . . . . . . . .

Yes

No

Where:

State

Country________________________________

Schedule J Add-On Taxes and Recapture of Tax Credits. See instructions.

� LIFO recapture due to S corporation election (IRC Section 1363(d)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

deferral: $__________________________)

�

00

2 Interest computed under the look-back method for completed long-term contracts (attach form FTB 3834)

2

00

3 Interest on tax attributable to installment: a) Sales of certain timeshares and residential lots. . . . . . . . . . . .

3a

00

b) Method for nondealer installment obligations . . . . . . . . . . . . .

3b

00

4 IRC Section 197(f)(9)(B)(ii) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Credit recapture name:________________________________________________________________ . .

5

00

6 Combine line 1 through line 5. Revise the amount on line 36 or line 37 above, whichever applies,

by this amount. Write “Schedule J’’ to the left of line 36 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

Sign

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Title

Date

Telephone

Signature

of officer

(

)

Date

Preparer’s SSN/PTIN

Check if self-

Preparer’s

employed

Paid

signature

Preparer’s

FEIN

-

Firm’s name (or yours,

Use Only

if self-employed)

and address

Telephone

(

)

Yes No

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . . .

Side 2 Form 100S

2009

3612093

C1

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4 5

5