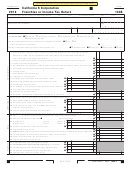

Schedule F Computation of Trade or Business Income. See instructions.

� a) Gross receipts or sales __________________________________________

00

b) Less returns and allowances ______________________________________ c) Balance . . . . . . . . . . . . . .

�c

00

2 Cost of goods sold from Schedule V, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Net gain (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Other income (loss). Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Total income (loss). Combine line 3 through line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Compensation of officers. Attach schedule. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Salaries and wages. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

00

�0 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�0

00

�� Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

��

00

�2 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�2

00

�3 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�3

�4 a) Depreciation __________________________

00

b) Less depreciation reported elsewhere on return ___________________________ c) Balance . . . . . . . .

�4c

00

�5 Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�5

00

�6 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�6

00

�7 Pension, profit-sharing plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�7

00

�8 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�8

�9 a) Total travel and entertainment __________________________________

00

b) Deductible amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�9b

00

20 Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

2� Total deductions. Add line 7 through line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2�

00

22 Ordinary income (loss) from trade or business. Subtract line 21 from line 6. Enter here and on Side 1, line 1 .

22

The corporation may not be required to complete Schedule L and Schedule M-�. See Schedule L and Schedule M-� instructions for reporting requirements.

Balance Sheet

Beginning of taxable year

End of taxable year

Schedule L

(a)

(b)

(c)

(d)

Assets

� Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 a Trade notes and accounts receivable . . . . . . .

b Less allowance for bad debts . . . . . . . . . . . .

(

)

(

)

3 Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Federal and state government obligations . . . . .

5 Other current assets. Attach schedule(s) . . . . . .

6 Loans to shareholders. Attach schedule(s) . . . .

7 Mortgage and real estate loans . . . . . . . . . . . . .

8 Other investments. Attach schedule(s). . . . . . . .

9 a Buildings and other fixed depreciable assets .

b Less accumulated depreciation . . . . . . . . . . .

(

)

(

)

�0 a Depletable assets. . . . . . . . . . . . . . . . . . . . . .

b Less accumulated depletion . . . . . . . . . . . . .

(

)

(

)

�� Land (net of any amortization) . . . . . . . . . . . . . .

�2 a Intangible assets (amortizable only) . . . . . . .

b Less accumulated amortization . . . . . . . . . . .

(

)

(

)

�3 Other assets. Attach schedule(s) . . . . . . . . . . . .

�4 Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Liabilities and shareholders’ equity

�5 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . .

�6 Mortgages, notes, bonds payable in less

than 1 year . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�7 Other current liabilities. Attach schedule(s) . . . .

�8 Loans from shareholders. Attach schedule(s) . .

�9 Mortgages, notes, bonds payable in

1 year or more . . . . . . . . . . . . . . . . . . . . . . . . . .

20 Other liabilities. Attach schedule(s) . . . . . . . . . .

2� Capital stock. . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Paid-in or capital surplus . . . . . . . . . . . . . . . . . .

23 Retained earnings . . . . . . . . . . . . . . . . . . . . . . .

24 Adjustments to shareholders’ equity.

Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . .

25 Less cost of treasury stock . . . . . . . . . . . . . . . .

(

)

(

)

26 Total liabilities and shareholders’ equity . . . .

Form 100S

2009 Side 3

3613093

C1

1

1 2

2 3

3 4

4 5

5