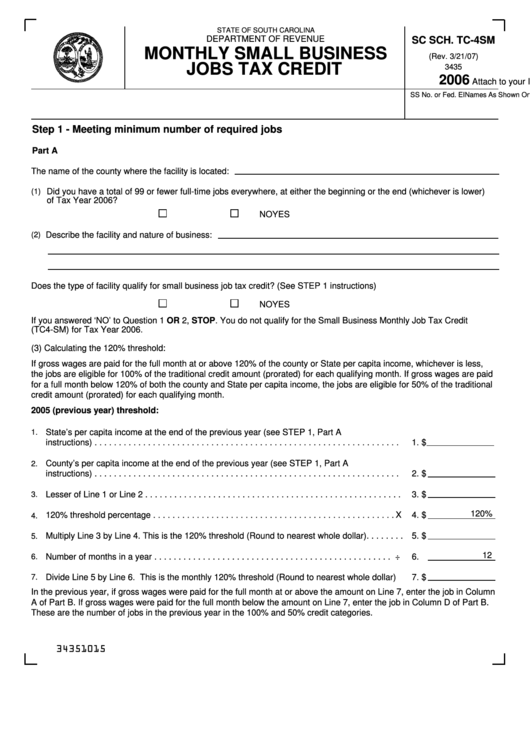

Monthly Small Business Jobs Tax Credit Form - 2006

ADVERTISEMENT

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC SCH. TC-4SM

MONTHLY SMALL BUSINESS

(Rev. 3/21/07)

JOBS TAX CREDIT

3435

2006

Attach to your Income Tax Return

Names As Shown On Tax Return

SS No. or Fed. EI

Step 1 - Meeting minimum number of required jobs

Part A

The name of the county where the facility is located:

(1)

Did you have a total of 99 or fewer full-time jobs everywhere, at either the beginning or the end (whichever is lower)

of Tax Year 2006?

YES

NO

Describe the facility and nature of business:

(2)

Does the type of facility qualify for small business job tax credit? (See STEP 1 instructions)

YES

NO

If you answered ‘NO’ to Question 1 OR 2, STOP. You do not qualify for the Small Business Monthly Job Tax Credit

(TC4-SM) for Tax Year 2006.

(3) Calculating the 120% threshold:

If gross wages are paid for the full month at or above 120% of the county or State per capita income, whichever is less,

the jobs are eligible for 100% of the traditional credit amount (prorated) for each qualifying month. If gross wages are paid

for a full month below 120% of both the county and State per capita income, the jobs are eligible for 50% of the traditional

credit amount (prorated) for each qualifying month.

2005 (previous year) threshold:

1.

State’s per capita income at the end of the previous year (see STEP 1, Part A

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

$

County’s per capita income at the end of the previous year (see STEP 1, Part A

2.

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

$

3.

Lesser of Line 1 or Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

$

120%

120% threshold percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

4.

$

4.

Multiply Line 3 by Line 4. This is the 120% threshold (Round to nearest whole dollar). . . . . . . .

5.

$

5.

12

6.

Number of months in a year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ÷

6.

7.

Divide Line 5 by Line 6. This is the monthly 120% threshold (Round to nearest whole dollar)

7.

$

In the previous year, if gross wages were paid for the full month at or above the amount on Line 7, enter the job in Column

A of Part B. If gross wages were paid for the full month below the amount on Line 7, enter the job in Column D of Part B.

These are the number of jobs in the previous year in the 100% and 50% credit categories.

34351015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7